The global haptic technology market is one of the rapidly emerging industries driven by adoption across automotive and non-automotive industrial applications. The report presents trends, drivers, challenges companies, and forecasts of tactile and force haptic technologies across consumer electronics, automotive, healthcare, and other industry applications to 2030.

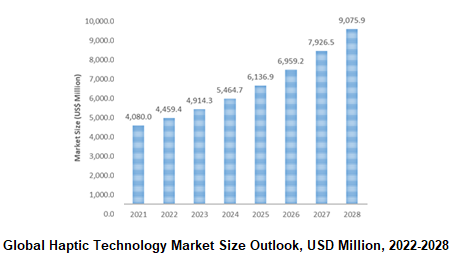

Haptic Technology market is diverse and one of the potential growth markets with over 12.1% growth (CAGR) anticipated over the forecast period. Increasing launch of innovative products with new applications, R&D activities supporting wider applications, rapid penetration in developing markets, and wider availability are shaping the market outlook.

The global Haptic Technology market is valued at around USD 4.5 Billion in 2022 and is characterized by strong demand from the consumer electronics industry. Despite strong competition from voice-based and other interactive technologies, the demand for Haptic Technology continues to remain strong over the forecast period. We estimate around 12.1% Compounded Annual Growth Rate to be registered in the industry between 2021 and 2028. However, regional disparities do exist and the growth rates of different types also vary significantly based on geography.

Steady growth in consumer segments, the launch of new products, R&D initiatives supporting wide applications, trade growth, and economic recovery will be the major contributing factors.

Strategies of key players vary based on the applications for which the technology is being marketed. Companies marketing Haptic Technology to smartphones, tablets, and other consumer electronics devices focus more on supply-chain optimization, quality, costs, consistency, and other strategies. On the other hand, companies supplying to automotive, healthcare, industrial, and other sectors focus more on efficiency, multi-functionality, and other aspects.

Based on the feedback type obtained in devices deploying haptic technology, the tactile type holds the lion’s share of the market in value terms. Over the forecast period, interest in different types of Haptic Technology is poised to increase as vendors promote the use of force type across applications. During 2022, the Tactile type accounted for 65.8% market share and is also the fastest-growing type worldwide.

Deployment of automation and control and sensing systems across end-user industries including manufacturing, utilities, transportation and other industries encourage user interactive features, including haptic technologies.

Among applications, consumer electronics remain the largest user of haptic technology, predominantly driven by its use in smartphones, tablets, gaming consoles, and others. A large portion of the demand originates from the Asian markets, due to the manufacturing activities across countries. During 2020, the consumer electronics segment accounted for the dominant share of the total haptic technology market size. Further, automotive manufacturing companies are also rapidly embracing haptic technology. Other key end users of haptic technology include healthcare, commercial and industrial applications, education, and other sectors.

The global haptic technology market is dominated by Asia Pacific, in particular, China, due to the large-scale consumer electronics and automotive manufacturing activities. Driven by low-cost advantages, availability of labor, and proximity to major consuming markets, several global players are setting up their production units in China, India, South East Asia, and other markets.

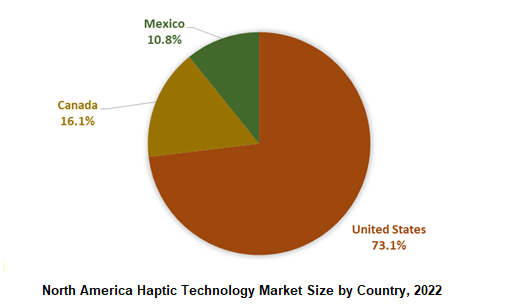

The US dominated the North American haptic technology market size in 2022. Key consumer electronics such as video games consoles, TV sets, PCs and smartphones drive the market potential for haptic technologies. Launch of game consoles by Sony, Microsoft, Apple and other players support the haptics. Consumer electronics companies are increasingly forming collaborations with software companies for technological advancements in haptics.

Technologically advanced products gain wide penetration in the country, encouraging new product launches across end user industries. Further, saturation in smartphones, PCs and TV sets is encouraging manufacturers to opt for advanced technologies such as haptics. Smart watches and fitness trackers, smart assistant devices, and automotive industry are the main market drivers.

The semiconductor manufacturing industry continues to grow in the US coupled with the presence of leading haptics technology providers such as Texas Instruments, Microchip Technology, and others strengthen the industry.

Type

Tactile

Force

Applications

Consumer Electronics

Automotive

Healthcare

Other Industries

Companies

Texas Instruments

Johnson Electric

AAC Technologies

TDK Electronics

Microchip Technology

Immersion

On Semiconductor

Precision Microdrives

Synaptics

Ultraleap

Chapter 1- Global Haptic Technology Industry

Executive Summary

Haptic Technology Industry Outlook, 2020 – 2028

Abbreviations

Market Scope and Deliverables

Research Methodology

Chapter 2- MACROECONOMIC & DEMOGRAPHIC OUTLOOK

GDP Outlook, 2010 – 2030

Population Outlook of Select Countries, 2010 – 2030

Chapter 3- OVERVIEW OF THE HAPTIC TECHNOLOGY MARKET, 2022

Haptic Technology Industry Panorama, 2022

Companies Profiled in the Report

Market Trends and Drivers Facing the Haptic Technology Companies

Market Obstacles

Regional Analysis

Chapter 4- MARKET TRENDS IN HAPTIC TECHNOLOGY TYPES

Largest Haptic Technology Types in 2022

Tactile based Haptic Technology Market Analysis and Outlook to 2030

Force based Haptic Technology Market Analysis and Outlook to 2030

Chapter 5- MARKET TRENDS IN HAPTIC TECHNOLOGY APPLICATIONS

Haptic Technology Market Share by Applications in 2022

Consumer Electronics- Haptic Technology Market Size Forecast to 2030

Automotive- Haptic Technology Market Size Forecast to 2030

Healthcare- Haptic Technology Market Size Forecast to 2030

Other Applications- Haptic Technology Market Size Forecast to 2030

Chapter 6- HAPTIC TECHNOLOGY MARKET OUTLOOK IN POST-PANDEMIC PERIOD

Low Growth Scenario

Reference Case Scenario

High Growth Case Scenario

Chapter 7- NORTH AMERICA HAPTIC TECHNOLOGY MARKET OUTLOOK AND OPPORTUNITIES

North America Haptic Technology Market Forecasts to 2030

Tactile Type dominates the North American Haptic Technology Market

Consumer Electronics are the leading users in North America

The US dominates the North American Haptic Technology Market

United States Haptic Technology Market Size Forecast to 2030

Canada Haptic Technology Market Size Forecast to 2030

Mexico Haptic Technology Market Size Forecast to 2030

Chapter 8- EUROPE HAPTIC TECHNOLOGY MARKET OUTLOOK AND OPPORTUNITIES

Europe Haptic Technology Market Size Outlook to 2030

Tactile Type Based Haptic Technology dominates the European Market

Consumer Electronics are the leading application types in Europe

Germany dominates the European Haptic Technology Market

Germany Haptic Technology Market Size Forecast to 2030

United Kingdom Haptic Technology Market Size Forecast to 2030

France Haptic Technology Market Size Forecast to 2030

Spain Haptic Technology Market Size Forecast to 2030

Other Europe Haptic Technology Market Size Forecast to 2030

Chapter 9- ASIA PACIFIC HAPTIC TECHNOLOGY MARKET OUTLOOK AND OPPORTUNITIES

Asia Pacific Haptic Technology Market Size Outlook to 2030

Tactile Type dominates the Asia Pacific Market

Consumer Electronics are the leading types in the Asia Pacific

China dominates the Asia Pacific Haptic Technology Market

China Haptic Technology Market Size Forecast to 2030

South Korea Haptic Technology Market Size Forecast to 2030

Japan Haptic Technology Market Size Forecast to 2030

Other Asia Pacific Haptic Technology Market Size Forecast to 2030

Chapter 10- LATIN AMERICA HAPTIC TECHNOLOGY MARKET OUTLOOK AND OPPORTUNITIES

Latin America Haptic Technology Market Size Outlook to 2030

Tactile Type dominate the Latin American Market

Consumer Electronics is the leading user type in Latin America

Brazil dominates the Latin America Haptic Technology Market

Brazil Haptic Technology Market Size Forecast to 2030

Rest of Latin America Haptic Technology Market Size Forecast to 2030

Chapter 11- MIDDLE EAST AND AFRICA HAPTIC TECHNOLOGY MARKET OUTLOOK AND OPPORTUNITIES

Middle East and Africa Haptic Technology Market Size Outlook to 2030

Tactile Type dominates the Middle East and Africa Market

Consumer Electronics is the leading types in the Middle East and Africa

Middle East dominates the MEA Haptic Technology slices Market

Middle East Haptic Technology Market Size Forecast to 2030

Africa Haptic Technology Market Size Forecast to 2030

Chapter 12- HAPTIC TECHNOLOGY COMPANIES AND BUSINESS PROFILES

Texas Instruments

Johnson Electric

AAC Technologies

TDK Electronics

Microchip Technology

Immersion

On Semiconductor

Precision Microdrives

Synaptics

Ultraleap

Chapter 13- APPENDIX

Type

Tactile

Force

Applications

Consumer Electronics

Automotive

Healthcare

Other Industries