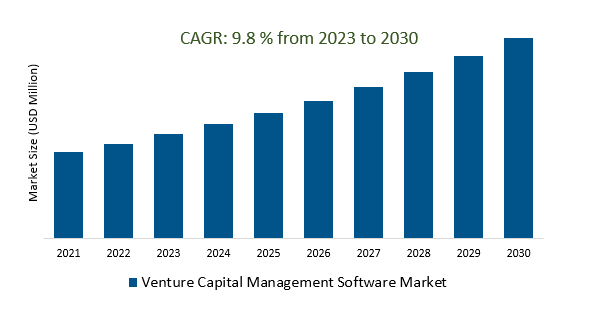

The Global Venture Capital Management Software Market Size is estimated to register 9.8% growth over the forecast period from 2023 to 2030.

The market growth is driven by increasing Venture capital firms that are increasingly adopting software solutions to automate various aspects of their operations, such as deal sourcing, due diligence, and portfolio management. Leading Companies focusing on Expanding Venture Capital Ecosystem, Rising Investments in Technology Startups, Data-Driven Decision-Making, Integration of Emerging Technologies, Customization and Scalability, and others to boost market shares in the industry.

The Venture Capital Management Software Market offers specialized software solutions designed to assist venture capital and private equity firms in managing investments in startups and high-growth companies, with key features encompassing deal sourcing, due diligence, investment management, investor relations, data analytics, and compliance. The market is growing steadily, driven by the expansion of the startup ecosystem and increasing interest in technology investments, with future prospects tied to the industry's growth, customization, and emerging technology integration.

Venture capital management software integration with Customer Relationship Management (CRM) systems has emerged as a pivotal advancement in the industry, effectively streamlining workflows and enhancing data visibility for venture capital (VC) firms. By seamlessly connecting these two essential components, VC professionals can efficiently track and manage relationships with founders, limited partners, and other stakeholders. This integration not only facilitates comprehensive insights into investor interactions and preferences but also enables VCs to capture and leverage crucial data, optimizing deal sourcing and portfolio management processes.

Venture capital firms are increasingly adopting venture capital management software with fundraising management capabilities to streamline fundraising processes, track investor commitments, and enhance investor relations. This software provides a centralized platform for communication and reporting, helping VC firms efficiently manage their fundraising campaigns and build stronger relationships with limited partners and stakeholders in the competitive venture capital landscape.

The globalization of venture capital is spurring demand for venture capital management software that can effectively support cross-border investments and navigate the complexities of global deal structures. As venture capital firms extend their reach to international markets, the need for software capable of streamlining due diligence, compliance, and portfolio management while addressing diverse regulatory requirements has grown significantly. Such software not only facilitates global investment strategies but also enhances efficiency and reporting, providing a competitive advantage in the increasingly intricate global venture capital landscape.

The Global Venture Capital Management Software Market is analyzed across Special Purpose Vehicle Management, Customer Relationship Management, Fund Management, Investor & Investment Management, Portfolio Monitoring, and others. Special Purpose Vehicle Management is poised to register the fastest growth. Special Purpose Vehicle (SPV) management is a pivotal component of Venture Capital Management Software, allowing venture capital firms to efficiently handle fund pooling and administration for specific investments. This feature streamlines fund allocation, reporting, and compliance, enhancing overall operational efficiency. As the venture capital industry evolves, the integration of SPV management within this software is essential for optimizing investment processes and portfolio management.

The Global Venture Capital Management Software Market is analyzed across various Organizations including SMEs, Large Enterprises, and others. Of these, SMEs held a significant market share in 2023. Small and Medium-sized Enterprises (SMEs) constitute a significant segment of the Venture Capital Management Software market, utilizing these software solutions to streamline venture capital investments. These tools provide cost-effective and efficient means for SMEs to manage deal sourcing, due diligence, and investment tracking, facilitating informed investment decisions in the competitive venture capital landscape. As venture capital investment in SMEs continues to grow, the adoption of this software is on the rise, enabling SMEs to compete effectively in the venture capital sector.

By Type

By Organisation

By Deployment Mode

By Region

*List not exhaustive

Venture Capital Management Software Market Outlook 2023

1 Market Overview

1.1 Introduction to the Venture Capital Management Software Market

1.2 Scope of the Study

1.3 Research Objective

1.3.1 Key Market Scope and Segments

1.3.2 Players Covered

1.3.3 Years Considered

2 Executive Summary

2.1 2023 Venture Capital Management Software Industry- Market Statistics

3 Market Dynamics

3.1 Market Drivers

3.2 Market Challenges

3.3 Market Opportunities

3.4 Market Trends

4 Market Factor Analysis

4.1 Porter’s Five Forces

4.2 Market Entropy

4.2.1 Global Venture Capital Management Software Market Companies with Area Served

4.2.2 Products Offerings Global Venture Capital Management Software Market

5 COVID-19 Impact Analysis and Outlook Scenarios

5.1.1 Covid-19 Impact Analysis

5.1.2 Post-COVID-19 Scenario- Low Growth Case

5.1.3 Post-COVID-19 Scenario- Reference Growth Case

5.1.4 Post-COVID-19 Scenario- Low Growth Case

6 Global Venture Capital Management Software Market Trends

6.1 Global Venture Capital Management Software Revenue (USD Million) and CAGR (%) by Type (2018-2030)

6.2 Global Venture Capital Management Software Revenue (USD Million) and CAGR (%) by Applications (2018-2030)

6.3 Global Venture Capital Management Software Revenue (USD Million) and CAGR (%) by Regions (2018-2030)

7 Global Venture Capital Management Software Market Revenue (USD Million) by Type, and Applications (2018-2022)

7.1 Global Venture Capital Management Software Revenue (USD Million) by Type (2018-2022)

7.1.1 Global Venture Capital Management Software Revenue (USD Million), Market Share (%) by Type (2018-2022)

7.2 Global Venture Capital Management Software Revenue (USD Million) by Applications (2018-2022)

7.2.1 Global Venture Capital Management Software Revenue (USD Million), Market Share (%) by Applications (2018-2022)

8 Global Venture Capital Management Software Development Regional Status and Outlook

8.1 Global Venture Capital Management Software Revenue (USD Million) By Regions (2018-2022)

8.2 North America Venture Capital Management Software Revenue (USD Million) by Type, and Application (2018-2022)

8.2.1 North America Venture Capital Management Software Revenue (USD Million) by Country (2018-2022)

8.2.2 North America Venture Capital Management Software Revenue (USD Million) by Type (2018-2022)

8.2.3 North America Venture Capital Management Software Revenue (USD Million) by Applications (2018-2022)

8.3 Europe Venture Capital Management Software Revenue (USD Million), by Type, and Applications (USD Million) (2018-2022)

8.3.1 Europe Venture Capital Management Software Revenue (USD Million), by Country (2018-2022)

8.3.2 Europe Venture Capital Management Software Revenue (USD Million) by Type (2018-2022)

8.3.3 Europe Venture Capital Management Software Revenue (USD Million) by Applications (2018-2022)

8.4 Asia Pacific Venture Capital Management Software Revenue (USD Million), and Revenue (USD Million) by Type, and Applications (2018-2022)

8.4.1 Asia Pacific Venture Capital Management Software Revenue (USD Million) by Country (2018-2022)

8.4.2 Asia Pacific Venture Capital Management Software Revenue (USD Million) by Type (2018-2022)

8.4.3 Asia Pacific Venture Capital Management Software Revenue (USD Million) by Applications (2018-2022)

8.5 South America Venture Capital Management Software Revenue (USD Million), by Type, and Applications (2018-2022)

8.5.1 South America Venture Capital Management Software Revenue (USD Million), by Country (2018-2022)

8.5.2 South America Venture Capital Management Software Revenue (USD Million) by Type (2018-2022)

8.5.3 South America Venture Capital Management Software Revenue (USD Million) by Applications (2018-2022)

8.6 Middle East and Africa Venture Capital Management Software Revenue (USD Million), by Type, Technology, Application, Thickness (2018-2022)

8.6.1 Middle East and Africa Venture Capital Management Software Revenue (USD Million) by Country (2018-2022)

8.6.2 Middle East and Africa Venture Capital Management Software Revenue (USD Million) by Type (2018-2022)

8.6.3 Middle East and Africa Venture Capital Management Software Revenue (USD Million) by Applications (2018-2022)

9 Company Profiles

10 Global Venture Capital Management Software Market Revenue (USD Million), by Type, and Applications (2023-2030)

10.1 Global Venture Capital Management Software Revenue (USD Million) and Market Share (%) by Type (2023-2030)

10.1.1 Global Venture Capital Management Software Revenue (USD Million), and Market Share (%) by Type (2023-2030)

10.2 Global Venture Capital Management Software Revenue (USD Million) and Market Share (%) by Applications (2023-2030)

10.2.1 Global Venture Capital Management Software Revenue (USD Million), and Market Share (%) by Applications (2023-2030)

11 Global Venture Capital Management Software Development Regional Status and Outlook Forecast

11.1 Global Venture Capital Management Software Revenue (USD Million) By Regions (2023-2030)

11.2 North America Venture Capital Management Software Revenue (USD Million) by Type, and Applications (2023-2030)

11.2.1 North America Venture Capital Management Software Revenue (USD) Million by Country (2023-2030)

11.2.2 North America Venture Capital Management Software Revenue (USD Million), by Type (2023-2030)

11.2.3 North America Venture Capital Management Software Revenue (USD Million), Market Share (%) by Applications (2023-2030)

11.3 Europe Venture Capital Management Software Revenue (USD Million), by Type, and Applications (2023-2030)

11.3.1 Europe Venture Capital Management Software Revenue (USD Million), by Country (2023-2030)

11.3.2 Europe Venture Capital Management Software Revenue (USD Million), by Type (2023-2030)

11.3.3 Europe Venture Capital Management Software Revenue (USD Million), by Applications (2023-2030)

11.4 Asia Pacific Venture Capital Management Software Revenue (USD Million) by Type, and Applications (2023-2030)

11.4.1 Asia Pacific Venture Capital Management Software Revenue (USD Million), by Country (2023-2030)

11.4.2 Asia Pacific Venture Capital Management Software Revenue (USD Million), by Type (2023-2030)

11.4.3 Asia Pacific Venture Capital Management Software Revenue (USD Million), by Applications (2023-2030)

11.5 South America Venture Capital Management Software Revenue (USD Million), by Type, and Applications (2023-2030)

11.5.1 South America Venture Capital Management Software Revenue (USD Million), by Country (2023-2030)

11.5.2 South America Venture Capital Management Software Revenue (USD Million), by Type (2023-2030)

11.5.3 South America Venture Capital Management Software Revenue (USD Million), by Applications (2023-2030)

11.6 Middle East and Africa Venture Capital Management Software Revenue (USD Million), by Type, and Applications (2023-2030)

11.6.1 Middle East and Africa Venture Capital Management Software Revenue (USD Million), by Region (2023-2030)

11.6.2 Middle East and Africa Venture Capital Management Software Revenue (USD Million), by Type (2023-2030)

11.6.3 Middle East and Africa Venture Capital Management Software Revenue (USD Million), by Applications (2023-2030)

12 Methodology and Data Sources

12.1 Methodology/Research Approach

12.1.1 Research Programs/Design

12.1.2 Market Size Estimation

12.1.3 Market Breakdown and Data Triangulation

12.2 Data Sources

12.2.1 Secondary Sources

12.2.2 Primary Sources

12.3 Disclaimer

List of Tables

Table 1 Market Segmentation Analysis

Table 2 Global Venture Capital Management Software Market Companies with Areas Served

Table 3 Products Offerings Global Venture Capital Management Software Market

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Venture Capital Management Software Revenue (USD Million) And CAGR (%) By Type (2018-2030)

Table 8 Global Venture Capital Management Software Revenue (USD Million) And CAGR (%) By Applications (2018-2030)

Table 9 Global Venture Capital Management Software Revenue (USD Million) And CAGR (%) By Regions (2018-2030)

Table 10 Global Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Table 11 Global Venture Capital Management Software Revenue Market Share (%) By Type (2018-2022)

Table 12 Global Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Table 13 Global Venture Capital Management Software Revenue Market Share (%) By Applications (2018-2022)

Table 14 Global Venture Capital Management Software Market Revenue (USD Million) By Regions (2018-2022)

Table 15 Global Venture Capital Management Software Market Share (%) By Regions (2018-2022)

Table 16 North America Venture Capital Management Software Revenue (USD Million) By Country (2018-2022)

Table 17 North America Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Table 18 North America Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Table 19 Europe Venture Capital Management Software Revenue (USD Million) By Country (2018-2022)

Table 20 Europe Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Table 21 Europe Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Table 22 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Country (2018-2022)

Table 23 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Table 24 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Table 25 South America Venture Capital Management Software Revenue (USD Million) By Country (2018-2022)

Table 26 South America Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Table 27 South America Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Table 28 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Region (2018-2022)

Table 29 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Table 30 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Table 31 Financial Analysis

Table 32 Global Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Table 33 Global Venture Capital Management Software Revenue Market Share (%) By Type (2023-2030)

Table 34 Global Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Table 35 Global Venture Capital Management Software Revenue Market Share (%) By Applications (2023-2030)

Table 36 Global Venture Capital Management Software Market Revenue (USD Million), And Revenue (USD Million) By Regions (2023-2030)

Table 37 North America Venture Capital Management Software Revenue (USD)By Country (2023-2030)

Table 38 North America Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Table 39 North America Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Table 40 Europe Venture Capital Management Software Revenue (USD Million) By Country (2023-2030)

Table 41 Europe Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Table 42 Europe Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Table 43 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Country (2023-2030)

Table 44 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Table 45 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Table 46 South America Venture Capital Management Software Revenue (USD Million) By Country (2023-2030)

Table 47 South America Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Table 48 South America Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Table 49 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Region (2023-2030)

Table 50 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Region (2023-2030)

Table 51 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Table 52 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Table 53 Research Programs/Design for This Report

Table 54 Key Data Information from Secondary Sources

Table 55 Key Data Information from Primary Sources

List of Figures

Figure 1 Market Scope

Figure 2 Porter’s Five Forces

Figure 3 Global Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Figure 4 Global Venture Capital Management Software Revenue Market Share (%) By Type (2022)

Figure 5 Global Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Figure 6 Global Venture Capital Management Software Revenue Market Share (%) By Applications (2022)

Figure 7 Global Venture Capital Management Software Market Revenue (USD Million) By Regions (2018-2022)

Figure 8 Global Venture Capital Management Software Market Share (%) By Regions (2022)

Figure 9 North America Venture Capital Management Software Revenue (USD Million) By Country (2018-2022)

Figure 10 North America Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Figure 11 North America Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Figure 12 Europe Venture Capital Management Software Revenue (USD Million) By Country (2018-2022)

Figure 13 Europe Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Figure 14 Europe Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Figure 15 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Country (2018-2022)

Figure 16 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Figure 17 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Figure 18 South America Venture Capital Management Software Revenue (USD Million) By Country (2018-2022)

Figure 19 South America Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Figure 20 South America Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Figure 21 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Region (2018-2022)

Figure 22 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Type (2018-2022)

Figure 23 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Applications (2018-2022)

Figure 24 Global Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Figure 25 Global Venture Capital Management Software Revenue Market Share (%) By Type (2030)

Figure 26 Global Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Figure 27 Global Venture Capital Management Software Revenue Market Share (%) By Applications (2030)

Figure 28 Global Venture Capital Management Software Market Revenue (USD Million) By Regions (2023-2030)

Figure 29 North America Venture Capital Management Software Revenue (USD Million) By Country (2023-2030)

Figure 30 North America Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Figure 31 North America Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Figure 32 Europe Venture Capital Management Software Revenue (USD Million) By Country (2023-2030)

Figure 33 Europe Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Figure 34 Europe Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Figure 35 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Country (2023-2030)

Figure 36 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Figure 37 Asia Pacific Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Figure 38 South America Venture Capital Management Software Revenue (USD Million) By Country (2023-2030)

Figure 39 South America Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Figure 40 South America Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Figure 41 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Region (2023-2030)

Figure 42 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Region (2023-2030)

Figure 43 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Type (2023-2030)

Figure 44 Middle East and Africa Venture Capital Management Software Revenue (USD Million) By Applications (2023-2030)

Figure 45 Bottom-Up and Top-Down Approaches For This Report

Figure 46 Data Triangulation

By Type

By Organisation

By Deployment Mode

By Region