The Women's Health Diagnostics Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Application (Cancer, Infectious diseases, Osteoporosis, Pregnancy & fertility, Prenatal), By End-User (Hospitals, Laboratory, Home care, Others).

Women's Health Diagnostics encompasses a wide range of medical tests, screening tools, and diagnostic procedures used to assess and monitor women's reproductive health, gynecological conditions, and gender-specific health concerns throughout the lifespan. Women's health diagnostics include screenings for cervical cancer (Pap smears, HPV testing), breast cancer (mammography, breast ultrasound), ovarian cancer (CA-125 blood test, pelvic ultrasound), sexually transmitted infections (STI testing), hormonal imbalances (hormone assays), pregnancy-related conditions (pregnancy tests, prenatal screening), menopause-related changes (bone density scans, hormone levels), and reproductive health issues (ovulation monitoring, fertility testing). These diagnostics help detect early signs of disease, guide treatment decisions, and promote preventive health measures tailored to women's unique healthcare needs. Women's health diagnostics also play a critical role in maternal-fetal medicine, obstetrics, and reproductive endocrinology, supporting preconception counseling, prenatal care, and fertility treatments. With advancements in diagnostic imaging, molecular testing, and personalized medicine, women's health diagnostics continue to evolve, offering improved accuracy, sensitivity, and specificity in detecting and managing women's health conditions. Comprehensive women's health diagnostics contribute to early detection of gynecological cancers, reduction of maternal and infant mortality rates, optimization of reproductive outcomes, and promotion of women's overall health and well-being across the lifespan.

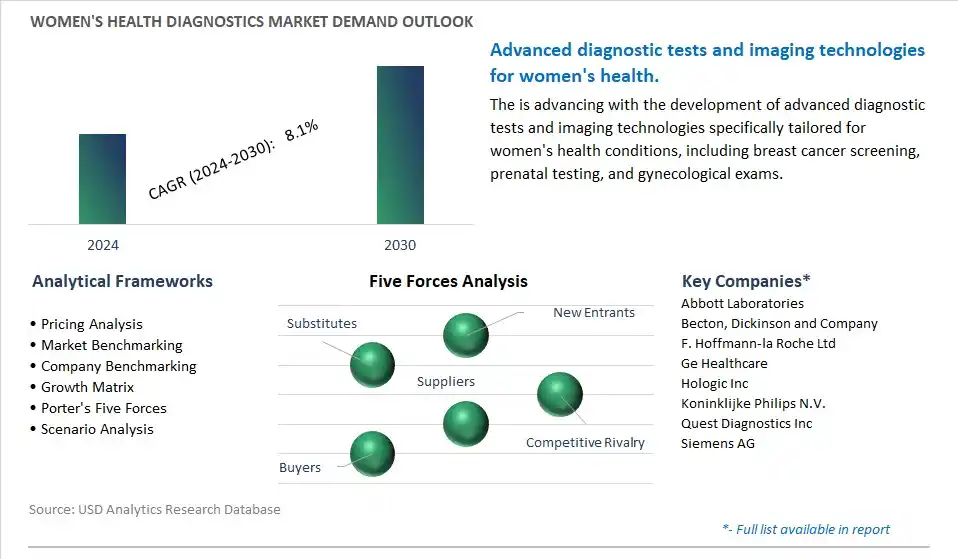

The most prominent trend in the Women's Health Diagnostics market is the shift towards personalized and comprehensive diagnostic solutions. This trend involves the development of diagnostics tailored specifically for women's health conditions, including reproductive health, breast cancer screening, hormonal imbalances, and gynecological disorders. The emphasis is on providing accurate, sensitive, and non-invasive diagnostic tests that address the unique healthcare needs of women across different age groups and demographics.

A significant driver for the Women's Health Diagnostics market is the increasing awareness and focus on preventive healthcare for women. Factors such as rising healthcare expenditure, initiatives promoting early detection of diseases, and growing advocacy for women's health rights are driving demand for advanced diagnostic technologies. Women are actively seeking comprehensive health screenings and diagnostics to detect potential health issues early, leading to improved treatment outcomes and quality of life.

One potential opportunity in the Women's Health Diagnostics market lies in the integration of artificial intelligence (AI) and digital health technologies. AI algorithms can analyze vast amounts of data from diagnostic tests, medical history, and lifestyle factors to provide personalized health insights and predictive analytics. Digital health platforms can facilitate remote monitoring, telemedicine consultations, and patient engagement, enhancing accessibility and convenience for women seeking diagnostic services. Capitalizing on this opportunity involves investing in AI-driven diagnostic tools, developing user-friendly digital platforms, and leveraging data analytics to offer proactive and personalized healthcare solutions for women.

The Pregnancy & Fertility Diagnostics segment stands out as the fastest-growing segment in the Women's Health Diagnostics Market. This growth can be attributed to several key factors. Firstly, increasing awareness and education about reproductive health have led to a rising number of women seeking early diagnosis and monitoring of pregnancy and fertility-related issues. Additionally, advancements in diagnostic technologies, such as home pregnancy tests and fertility monitoring devices, have made it easier for women to conveniently assess their reproductive health status in the comfort of their homes. Moreover, societal trends such as delayed childbirth and the growing prevalence of lifestyle-related factors impacting fertility have contributed to a higher demand for fertility diagnostics. Furthermore, the expanding availability and accessibility of fertility clinics and specialized healthcare services catering to pregnancy and fertility-related concerns have further fueled the growth of this segment. As a result, the Pregnancy & Fertility Diagnostics segment presents significant growth opportunities within the Women's Health Diagnostics Market landscape.

The market research study provides in-depth insights into leading companies including the SWOT analyses, product profile, financial details, and recent developments acrossAbbott Laboratories, Becton, Dickinson and Company, F. Hoffmann-la Roche Ltd, Ge Healthcare, Hologic Inc, Koninklijke Philips N.V., Quest Diagnostics Inc, Siemens AG

By Application

Cancer

Infectious diseases

Osteoporosis

Pregnancy & fertility

Prenatal

By End-User

Hospitals

Laboratory

Home care

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Abbott Laboratories

Becton, Dickinson and Company

F. Hoffmann-la Roche Ltd

Ge Healthcare

Hologic Inc

Koninklijke Philips N.V.

Quest Diagnostics Inc

Siemens AG

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Women's Health Diagnostics Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Women's Health Diagnostics Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Women's Health Diagnostics Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Women's Health Diagnostics Market Size Outlook, $ Million, 2021 to 2030

3.2 Women's Health Diagnostics Market Outlook by Type, $ Million, 2021 to 2030

3.3 Women's Health Diagnostics Market Outlook by Product, $ Million, 2021 to 2030

3.4 Women's Health Diagnostics Market Outlook by Application, $ Million, 2021 to 2030

3.5 Women's Health Diagnostics Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Women's Health Diagnostics Industry

4.2 Key Market Trends in Women's Health Diagnostics Industry

4.3 Potential Opportunities in Women's Health Diagnostics Industry

4.4 Key Challenges in Women's Health Diagnostics Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Women's Health Diagnostics Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Women's Health Diagnostics Market Outlook by Segments

7.1 Women's Health Diagnostics Market Outlook by Segments, $ Million, 2021- 2030

By Application

Cancer

Infectious diseases

Osteoporosis

Pregnancy & fertility

Prenatal

By End-User

Hospitals

Laboratory

Home care

Others

8 North America Women's Health Diagnostics Market Analysis and Outlook To 2030

8.1 Introduction to North America Women's Health Diagnostics Markets in 2024

8.2 North America Women's Health Diagnostics Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Women's Health Diagnostics Market size Outlook by Segments, 2021-2030

By Application

Cancer

Infectious diseases

Osteoporosis

Pregnancy & fertility

Prenatal

By End-User

Hospitals

Laboratory

Home care

Others

9 Europe Women's Health Diagnostics Market Analysis and Outlook To 2030

9.1 Introduction to Europe Women's Health Diagnostics Markets in 2024

9.2 Europe Women's Health Diagnostics Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Women's Health Diagnostics Market Size Outlook by Segments, 2021-2030

By Application

Cancer

Infectious diseases

Osteoporosis

Pregnancy & fertility

Prenatal

By End-User

Hospitals

Laboratory

Home care

Others

10 Asia Pacific Women's Health Diagnostics Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Women's Health Diagnostics Markets in 2024

10.2 Asia Pacific Women's Health Diagnostics Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Women's Health Diagnostics Market size Outlook by Segments, 2021-2030

By Application

Cancer

Infectious diseases

Osteoporosis

Pregnancy & fertility

Prenatal

By End-User

Hospitals

Laboratory

Home care

Others

11 South America Women's Health Diagnostics Market Analysis and Outlook To 2030

11.1 Introduction to South America Women's Health Diagnostics Markets in 2024

11.2 South America Women's Health Diagnostics Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Women's Health Diagnostics Market size Outlook by Segments, 2021-2030

By Application

Cancer

Infectious diseases

Osteoporosis

Pregnancy & fertility

Prenatal

By End-User

Hospitals

Laboratory

Home care

Others

12 Middle East and Africa Women's Health Diagnostics Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Women's Health Diagnostics Markets in 2024

12.2 Middle East and Africa Women's Health Diagnostics Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Women's Health Diagnostics Market size Outlook by Segments, 2021-2030

By Application

Cancer

Infectious diseases

Osteoporosis

Pregnancy & fertility

Prenatal

By End-User

Hospitals

Laboratory

Home care

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Abbott Laboratories

Becton, Dickinson and Company

F. Hoffmann-la Roche Ltd

Ge Healthcare

Hologic Inc

Koninklijke Philips N.V.

Quest Diagnostics Inc

Siemens AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Cancer

Infectious diseases

Osteoporosis

Pregnancy & fertility

Prenatal

By End-User

Hospitals

Laboratory

Home care

Others

Countries Analyzed

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Women's Health Diagnostics Market is one of the lucrative growth markets, poised to register a 8.1% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abbott Laboratories, Becton, Dickinson and Company, F. Hoffmann-la Roche Ltd, Ge Healthcare, Hologic Inc, Koninklijke Philips N.V., Quest Diagnostics Inc, Siemens AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume