The global Aircraft Engine Test Cells Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Engine Test (Turbofan, Turbojet, Turboshaft, Piston engine, APU), By Solution (Test Cell, Component Test Bench, Data Acquisition & Control System, Software, Ancillary System), By End-User (OEMs, MROs, Airlines and Operators), By Point of Sale, New Installations, Retrofit & Upgrades, Maintenance & Services).

The Aircraft Engine Test Cells Market in 2024 serves as a critical infrastructure for the testing, validation, and maintenance of aircraft engines, providing specialized facilities and equipment to simulate operating conditions, measure performance parameters, and diagnose engine health. Aircraft engine test cells, also known as test stands or test rigs, enable engineers and technicians to conduct ground-based engine testing, including functional testing, endurance testing, performance mapping, and troubleshooting, ensuring the safety, reliability, and efficiency of aircraft propulsion systems. The market experiences significant growth driven by factors such as the expansion of commercial aviation fleets, the development of next-generation aircraft engines, and the increasing focus on engine efficiency, emissions reduction, and noise abatement. Aircraft engine test cell suppliers innovate to offer comprehensive testing solutions tailored to different engine types, sizes, and performance requirements, incorporating advanced instrumentation, data acquisition systems, and safety protocols. Additionally, advancements in test cell automation, remote monitoring, and predictive maintenance technologies optimize testing workflows and reduce turnaround times for engine testing campaigns. Furthermore, collaborations between engine manufacturers, MRO (Maintenance, Repair, and Overhaul) providers, and regulatory authorities drive technology standardization, validation, and certification to ensure compliance with aviation safety standards and industry best practices. As the aerospace industry evolves to meet sustainability and performance goals, the aircraft engine test cells market remains essential in enabling rigorous testing and validation of next-generation aircraft propulsion systems.

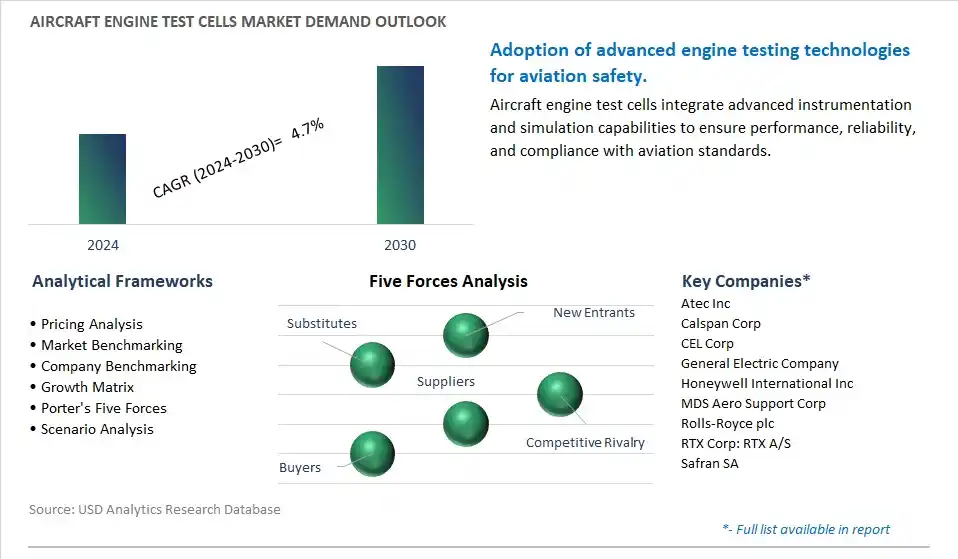

The global Aircraft Engine Test Cells Market Industry is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Aircraft Engine Test Cells Market Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Aircraft Engine Test Cells Market Industry include- Atec Inc, Calspan Corp, CEL Corp, General Electric Company, Honeywell International Inc, MDS Aero Support Corp, Rolls-Royce plc, RTX Corp: RTX A/S, Safran SA

A significant trend in the Aircraft Engine Test Cells Market is the increasing demand for aircraft engine testing services. With the continuous advancements in aviation technology and the development of new aircraft engines, there's a growing need for comprehensive testing facilities to validate engine performance, reliability, and safety before deployment. Aircraft engine test cells offer controlled environments for conducting a wide range of tests, including endurance tests, performance tests, vibration tests, and altitude tests, ensuring that engines meet regulatory requirements and performance specifications. As aerospace companies and engine manufacturers prioritize rigorous testing to enhance aircraft safety and efficiency, the demand for advanced and scalable engine test cells is expected to rise, driving market growth and innovation in testing solutions for the aviation industry.

A key driver propelling the Aircraft Engine Test Cells Market is the expansion of commercial air travel and fleet modernization programs worldwide. With the increasing demand for air travel, particularly in emerging economies, airlines are expanding their fleets and investing in new-generation aircraft equipped with fuel-efficient engines and advanced technologies. As aircraft manufacturers ramp up production to meet the demand, there's a need for robust engine testing infrastructure to ensure the reliability and performance of aircraft engines throughout their operational life. Moreover, with the emergence of electric and hybrid propulsion systems in aviation, there's a growing need for specialized test cells capable of accommodating alternative propulsion technologies. This drives the demand for aircraft engine test cells, supporting the growth of the aviation industry and facilitating the safe and efficient operation of commercial aircraft fleets globally.

An opportunity in the Aircraft Engine Test Cells Market lies in the integration of digital twin and predictive maintenance technologies to enhance testing capabilities and optimize engine performance. Digital twin technology enables real-time simulation and analysis of engine behavior, allowing engineers to predict potential issues and optimize engine performance parameters during testing. By integrating digital twin models with engine test cells, aerospace companies can conduct virtual tests, simulate various operating conditions, and identify performance optimizations before physical testing, reducing time-to-market and testing costs. Furthermore, predictive maintenance algorithms can analyze test data and provide insights into engine health, enabling proactive maintenance and reducing downtime. By embracing digital twin and predictive maintenance technologies, aircraft engine test cell manufacturers can offer advanced testing solutions that improve efficiency, reliability, and safety in aircraft engine development and maintenance, thus capitalizing on the opportunities presented by digital transformation in the aviation industry.

By Engine Test

By Solution

By End-User

By Point of Sale

Geographical Analysis

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Aircraft Engine Test Cells Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Aircraft Engine Test Cells Market Size Outlook, $ Million, 2021 to 2030

3.2 Aircraft Engine Test Cells Market Outlook by Type, $ Million, 2021 to 2030

3.3 Aircraft Engine Test Cells Market Outlook by Product, $ Million, 2021 to 2030

3.4 Aircraft Engine Test Cells Market Outlook by Application, $ Million, 2021 to 2030

3.5 Aircraft Engine Test Cells Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Aircraft Engine Test Cells Industry

4.2 Key Market Trends in Aircraft Engine Test Cells Industry

4.3 Potential Opportunities in Aircraft Engine Test Cells Industry

4.4 Key Challenges in Aircraft Engine Test Cells Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Aircraft Engine Test Cells Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Aircraft Engine Test Cells Market Outlook by Segments

7.1 Aircraft Engine Test Cells Market Outlook by Segments, $ Million, 2021- 2030

By Engine Test

Turbofan

Turbojet

Turboshaft

Piston engine

APU

By Solution

Test Cell

Component Test Bench

Data Acquisition & Control System

Software

Ancillary System

By End-User

OEMs

MROs

Airlines and Operators

By Point of Sale

New Installations

Retrofit & Upgrades

Maintenance & Services

8 North America Aircraft Engine Test Cells Market Analysis and Outlook To 2030

8.1 Introduction to North America Aircraft Engine Test Cells Markets in 2024

8.2 North America Aircraft Engine Test Cells Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Aircraft Engine Test Cells Market size Outlook by Segments, 2021-2030

By Engine Test

Turbofan

Turbojet

Turboshaft

Piston engine

APU

By Solution

Test Cell

Component Test Bench

Data Acquisition & Control System

Software

Ancillary System

By End-User

OEMs

MROs

Airlines and Operators

By Point of Sale

New Installations

Retrofit & Upgrades

Maintenance & Services

9 Europe Aircraft Engine Test Cells Market Analysis and Outlook To 2030

9.1 Introduction to Europe Aircraft Engine Test Cells Markets in 2024

9.2 Europe Aircraft Engine Test Cells Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Aircraft Engine Test Cells Market Size Outlook by Segments, 2021-2030

By Engine Test

Turbofan

Turbojet

Turboshaft

Piston engine

APU

By Solution

Test Cell

Component Test Bench

Data Acquisition & Control System

Software

Ancillary System

By End-User

OEMs

MROs

Airlines and Operators

By Point of Sale

New Installations

Retrofit & Upgrades

Maintenance & Services

10 Asia Pacific Aircraft Engine Test Cells Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Aircraft Engine Test Cells Markets in 2024

10.2 Asia Pacific Aircraft Engine Test Cells Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Aircraft Engine Test Cells Market size Outlook by Segments, 2021-2030

By Engine Test

Turbofan

Turbojet

Turboshaft

Piston engine

APU

By Solution

Test Cell

Component Test Bench

Data Acquisition & Control System

Software

Ancillary System

By End-User

OEMs

MROs

Airlines and Operators

By Point of Sale

New Installations

Retrofit & Upgrades

Maintenance & Services

11 South America Aircraft Engine Test Cells Market Analysis and Outlook To 2030

11.1 Introduction to South America Aircraft Engine Test Cells Markets in 2024

11.2 South America Aircraft Engine Test Cells Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Aircraft Engine Test Cells Market size Outlook by Segments, 2021-2030

By Engine Test

Turbofan

Turbojet

Turboshaft

Piston engine

APU

By Solution

Test Cell

Component Test Bench

Data Acquisition & Control System

Software

Ancillary System

By End-User

OEMs

MROs

Airlines and Operators

By Point of Sale

New Installations

Retrofit & Upgrades

Maintenance & Services

12 Middle East and Africa Aircraft Engine Test Cells Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Aircraft Engine Test Cells Markets in 2024

12.2 Middle East and Africa Aircraft Engine Test Cells Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Aircraft Engine Test Cells Market size Outlook by Segments, 2021-2030

By Engine Test

Turbofan

Turbojet

Turboshaft

Piston engine

APU

By Solution

Test Cell

Component Test Bench

Data Acquisition & Control System

Software

Ancillary System

By End-User

OEMs

MROs

Airlines and Operators

By Point of Sale

New Installations

Retrofit & Upgrades

Maintenance & Services

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Atec Inc

Calspan Corp

CEL Corp

General Electric Company

Honeywell International Inc

MDS Aero Support Corp

Rolls-Royce plc

RTX Corp: RTX A/S

Safran SA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Engine Test

By Solution

By End-User

By Point of Sale

Geographical Analysis

The global Aircraft Engine Test Cells Market is one of the lucrative growth markets, poised to register a 4.7% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Atec Inc, Calspan Corp, CEL Corp, General Electric Company, Honeywell International Inc, MDS Aero Support Corp, Rolls-Royce plc, RTX Corp: RTX A/S, Safran SA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume