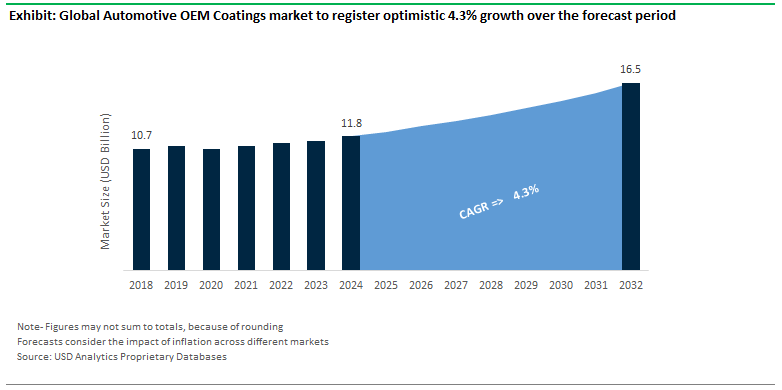

Automotive OEM Coatings Market Size is estimated to increase at a 4.3% CAGR over the forecast period from $11.8 Billion 2024 to $15.2 Billion in 2030.

As global automobile production continues to rise, driven by the recovery of key economies and the increasing demand for personal vehicles, the demand for OEM coatings. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached approximately 92.7 million units in 2023, marking a significant recovery from the pandemic-induced downturn. Robust demand growth in automotive sales is encouraging leading coating providers to strengthen their product portfolio across Primer (adhesion to the substrate), Basecoat (wide variety of colors and effects), Topcoat (impart special properties to the painted components), Clearcoat (from matt to high gloss), and others.

|

Year |

2019 |

2020 |

2021 |

2022 |

2023 |

|

New Vehicle Sales (Million) |

92.1 |

79.7 |

83.6 |

82.9 |

92.7 |

One-component and two-component water-borne, solvent-borne primers suitable for diverse substrates including PP-EPDM, ABS, PC-PBT, ABS-PC, PA, and others are marketed by companies. One-component and two-component Solventborne and Waterborne basecoats for exterior and interior for solid colors and effect colors are marketed. In addition, top coats suitable for metal substrates, exterior and interior applications, PU-based, Gloss, Matt and others products are marketed. Acrylic-thixotropic clearcoat, Thixotropic Acrylic Polyester clearcoat suitable for flexible plastic, metal and other substrates are widely marketed. Companies are widely marketing high sagging limit, high scratch resistance, wide application window, and other properties.

The rapid electrification of vehicles is fundamentally reshaping the automotive industry, driving the need for innovative coating solutions that cater to the unique requirements of electric vehicles (EVs). According to the International Energy Agency (IEA), electric car sales stood at 14 million in 2023, with the share of EVs in new car sales volume increasing to 18% during the year. EVs require specialized coatings for critical components such as battery packs, electric motors, and power electronics. Battery packs in EVs operate under high thermal stress, which can affect their efficiency and lifespan. The U.S. Department of Energy (DOE) emphasizes the importance of thermal management in EV battery systems, noting that effective thermal regulation can extend battery life by 50-100%.

In addition, the trend towards the use of lightweight materials such as aluminum, carbon fiber, and advanced composites require new coatings specifically designed for these materials. According to the European Commission, lightweight materials can reduce vehicle weight by up to 40%, which translates to a 10-15% improvement in energy efficiency.

Stringent regulations including the EU's target to reduce average CO2 emissions from new cars to 95 grams per kilometer by 2025, the US Environmental Protection Agency (EPA) regulations aimed at reducing hazardous air pollutants (HAPs) in the automotive industry, and others encourage companies like Tesla, Ford, and General Motors are leading the charge, investing heavily in coatings that can meet the unique demands of their EV lineups. Further, with the share of Electric Vehicles (EVs) poised to increase to 30% by 2030, the demand for automotive OEM coatings is set to increase robustly over the forecast period.

The automotive industry is increasingly focusing on sustainable practices, including advancements in coatings technology- adoption of low-bake and high-solid coatings. Low-bake coatings designed to cure at lower temperatures compared to traditional coatings are gaining significant business growth. Lower curing temperatures reduce the overall carbon footprint associated with energy use and typically cure at temperatures ranging from 120°C to 140°C, significantly lower than the standard 180°C to 200°C required for conventional coatings.

In addition, High-solid coatings have a higher concentration of solid materials compared to traditional coatings, which reduces the amount of volatile organic compounds (VOCs) released into the atmosphere. As they provide better resistance to wear and weathering, they can enhance the lifespan and appearance of the vehicle. PPG Industries, in particular, is developing low-bake and high-solid coatings for passenger cars and commercial vehicles. Ford also has integrated low-bake and high-solid coatings into its production lines to align with its sustainability goals while Toyota’s use of high-solid coatings to achieve a 20% reduction in VOC emissions from its paint shops.

Automotive OEM Coatings Market Share Insights

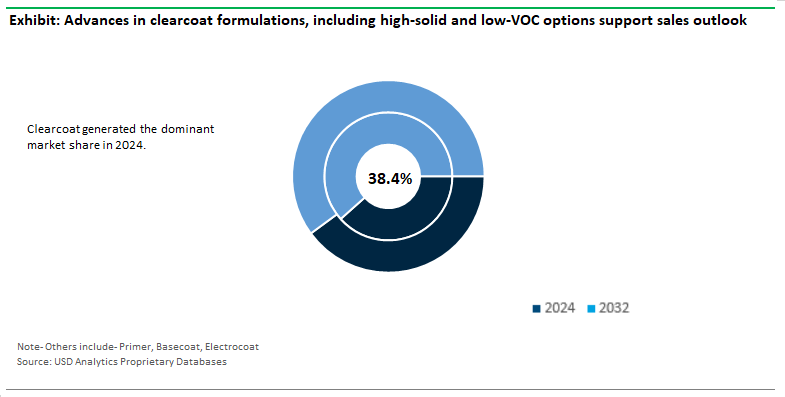

The Clearcoat segment represents the largest market share of 38.4% within the Automotive OEM Coatings industry, driven by the launch of premium products. Clearcoats are the final layer applied to automotive surfaces after the base color coat and protect the base coat from environmental damage, provide a high-gloss finish and enhance the aesthetic appeal, and overall durability and longevity of the paint. Advances in clearcoat formulations, including high-solid and low-VOC options, nanotechnology based clearcoats for improving scratch resistance, self-cleaning properties, and others support the market outlook.

Growing trends in vehicle customization will continue to enhance the demand for high-quality and versatile clearcoats. New clearcoats are increasingly designed to withstand harsh environmental conditions and physical wear. For example, PPG’s DELFLEET ONE® and BASF’s R-M® Onyx HD Clearcoat emphasize scratch and UV resistance, addressing common concerns related to vehicle longevity and maintenance. Further, AkzoNobel’s Sikkens Autoclear Plus 2K and Sherwin-Williams’ Acryliq® Clearcoat present advancements in waterborne technology and low-VOC content.

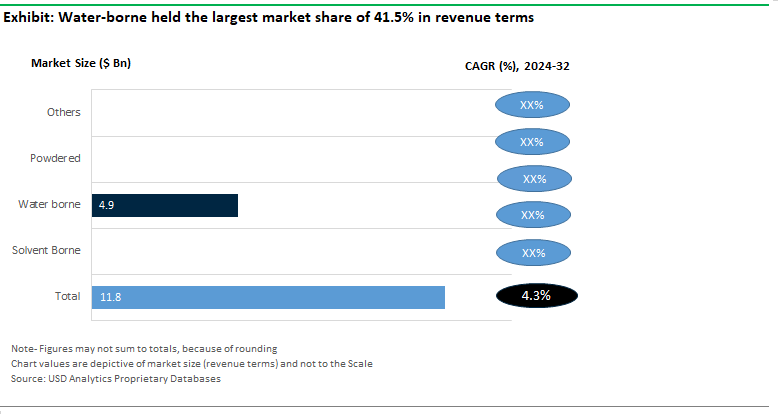

Among Automotive OEM Coatings technologies, Water-based Technology is projected to be the largest revenue generator

The Water-based coating segment generated the highest revenue of $4.9 Billion in 2024. Companies are increasingly focusing on developing and launching water-borne coatings to meet regulatory requirements and consumer demands for more sustainable and high-performance solutions. Sikkens Autoclear® Waterborne Clearcoat, R-M® Onyx HD Waterborne Basecoat, Acryliq® Waterborne Basecoat, PPG DELFLEET® ESSENTIAL Waterborne Basecoat, Advancion Corporation DMMOPA (N,N-Dimethyl-3 methoxypropyl-amine, CAS No.: 20650-07-1), and others continue to foray into the industry.

Waterborne paint systems represent a significant advancement in car paint technology. In particular, with the rise of new consumer business models such as ridesharing services and the trend of longer vehicle lifespans, people are using their cars more frequently and for extended periods. The development of scratch resistant coatings, burnish-resistant matte finish coatings, and self-healing coatings with protection, performance, and aesthetics are widely marketed.

The Asia-Pacific region is a crucial market for automotive OEM coatings, driven by robust automotive production, rising vehicle ownership, and increasing environmental regulations. The region is poised to register a 4.8% CAGR over the forecast period, driven by increasing automotive manufacturing in China, India, South East Asia, Japan, and other countries. Rapid industrialization and increasing consumer demand are driving the growth of the automotive OEM coatings in these countries.

Companies are introducing advanced waterborne coatings to meet stricter VOC regulations and address environmental concerns. For instance, BASF launched its R-M® Onyx HD waterborne basecoat in late 2022. Further, PPG Industries introduced the DELFLEET® ESSENTIAL waterborne basecoat in 2023. Leading companies such as Sherwin-Williams announced an expansion of its production capabilities in India, BASF has partnered with several Asian automotive OEMs to co-develop tailored coating solutions. In addition, innovative clearcoat technologies and specialty finishes are being developed to meet the demands of a more personalized vehicle experience- driving the long-term market outlook.

The automotive OEM coatings market is a competitive and dynamic sector, characterized by the presence of several major players who lead in various segments of the market. The market is influenced by factors such as technological advancements, regulatory requirements, and changing consumer preferences. Akzo Nobel N.V., Axalta Coating Systems LLC, BASF SE, Guangdong Futian Chemical Industry Co. Ltd, Guangzhou Yatu Chemical Co. Ltd, Kansai Paint Co. Ltd, KCC Corp, Kinlita Chemical Co. Ltd, Nippon Paint Holdings Co. Ltd, PPG Industries Inc, Prime Coatings Co. Ltd, Sherwin-Williams Company, Strong Chemical Co. Ltd, The Valspar Corp (Sherwin-Williams), and others are the leading companies in the industry.

|

Parameter |

Details |

|

Market Size (2024) |

$11.8 Billion |

|

Market Size (2032) |

$15.2 Billion |

|

Market Growth Rate |

4.3% |

|

Largest Segment- Product |

Clearcoat (38.4% Market Share) |

|

Largest Segment- Technology |

Water-borne Technology ($4.9 Billion Revenue) |

|

Fastest Growing Market- Region |

Asia Pacific (4.8% CAGR) |

|

Largest End-User Industry |

Passenger Cars |

|

Segments |

Products, Technologies, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Akzo Nobel N.V., Axalta Coating Systems LLC, BASF SE, Guangdong Futian Chemical Industry Co. Ltd, Guangzhou Yatu Chemical Co. Ltd, Kansai Paint Co. Ltd, KCC Corp, Kinlita Chemical Co. Ltd, Nippon Paint Holdings Co. Ltd, PPG Industries Inc, Prime Coatings Co. Ltd, Sherwin-Williams Company, Strong Chemical Co. Ltd, The Valspar Corp (Sherwin-Williams) |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

The Automotive OEM Coatings industry is characterized by the presence of capital-intensive companies across the industry from raw material procurement to final product distribution.

Type

Solvent Borne

Water borne

Powdered

Others

Layer

Primer

Basecoat

Electrocoat

Clearcoat

Vehicle

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Akzo Nobel N.V.

Axalta Coating Systems LLC

BASF SE

Guangdong Futian Chemical Industry Co. Ltd

Guangzhou Yatu Chemical Co. Ltd

Kansai Paint Co. Ltd

KCC Corp

Kinlita Chemical Co. Ltd

Nippon Paint Holdings Co. Ltd

PPG Industries Inc

Prime Coatings Co. Ltd

Sherwin-Williams Company

Strong Chemical Co. Ltd

The Valspar Corp (Sherwin-Williams)

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Automotive OEM Coatings Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Automotive OEM Coatings Market Size by Segments, 2018- 2023

Key Statistics, 2024

Automotive OEM Coatings Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Automotive OEM Coatings Types, 2018-2023

Automotive OEM Coatings Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Automotive OEM Coatings Applications, 2018-2023

8. Automotive OEM Coatings Market Size Outlook by Segments, 2024- 2032

Automotive OEM Coatings Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Automotive OEM Coatings Types, 2024-2032

Automotive OEM Coatings Market Size Outlook by Layer, USD Million, 2024-2032

Growth Comparison (y-o-y) across Automotive OEM Coatings Layers, 2024-2032

Automotive OEM Coatings Market Size Outlook by Vehicle, USD Million, 2024-2032

Growth Comparison (y-o-y) across Automotive OEM Coatings Vehicles, 2024-2032

9. Automotive OEM Coatings Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

United States Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

United States Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

11. Canada Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Canada Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Canada Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

12. Mexico Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Mexico Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Mexico Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

13. Germany Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Germany Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Germany Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

14. France Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

France Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

France Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

France Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

United Kingdom Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

United Kingdom Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

10. Spain Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Spain Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Spain Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

16. Italy Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Italy Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Italy Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

17. Benelux Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Benelux Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Benelux Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

18. Nordic Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Nordic Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Nordic Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Rest of Europe Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Rest of Europe Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

20. China Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

China Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

China Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

China Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

21. India Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

India Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

India Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

India Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

22. Japan Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Japan Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Japan Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

23. South Korea Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

South Korea Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

South Korea Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

24. Australia Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Australia Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Australia Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

25. South East Asia Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

South East Asia Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

South East Asia Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

27. Brazil Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Brazil Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Brazil Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

28. Argentina Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Argentina Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Argentina Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Rest of South America Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Rest of South America Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

United Arab Emirates Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

United Arab Emirates Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Saudi Arabia Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Saudi Arabia Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Rest of Middle East Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Rest of Middle East Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

33. South Africa Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

South Africa Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

South Africa Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Automotive OEM Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Automotive OEM Coatings Market Size Outlook by Type, 2021- 2032

Rest of Africa Automotive OEM Coatings Market Size Outlook by Application, 2021- 2032

Rest of Africa Automotive OEM Coatings Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Type

Solvent Borne

Water borne

Powdered

Others

Layer

Primer

Basecoat

Electrocoat

Clearcoat

Vehicle

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Automotive OEM Coatings is forecast to reach $15.2 Billion in 2030 from $11.8 Billion in 2024, registering a CAGR of 4.3%

Clearcoat (38.4% Market Share), Water-borne Technology ($4.9 Billion Revenue), Water-borne Technology ($4.9 Billion Revenue)

Akzo Nobel N.V., Axalta Coating Systems LLC, BASF SE, Guangdong Futian Chemical Industry Co. Ltd, Guangzhou Yatu Chemical Co. Ltd, Kansai Paint Co. Ltd, KCC Corp, Kinlita Chemical Co. Ltd, Nippon Paint Holdings Co. Ltd, PPG Industries Inc, Prime Coatings Co. Ltd, Sherwin-Williams Company, Strong Chemical Co. Ltd, The Valspar Corp (Sherwin-Williams)

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume

Asia Pacific (4.8% CAGR)