The global bioreactor market analysis and outlook study provide a complete analysis of the industry in 2023 and the market outlook to 2030. It provides information on different bioreactor types including R&D purpose bioreactors, Biopharmaceutical manufacturing purpose bioreactors. Further, different materials including glass, stainless steel, and single-use bioreactor markets are analyzed. In addition, lab-scale, pilot-scale, and full-scale bioreactors are analyzed. Further, different scale ranges from below 1L to 10L, 11L to 200L, 200L to 1000L, and above 1000L are included in the research study. Leading companies are profiled and country-wise forecasts are provided for 2030.

Bioreactor Market Report Highlights

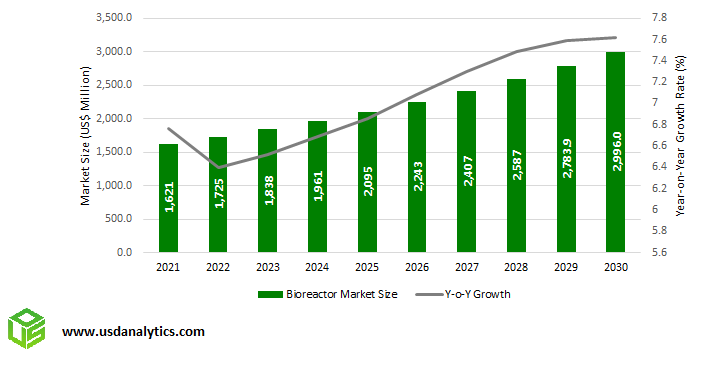

Bioreactor Market Outlook to 2030

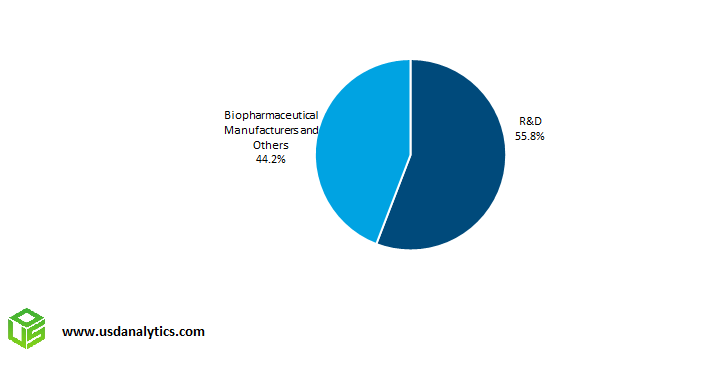

Global Bioreactor Market Analysis, 2023

Among materials, bioreactors in demand include glass bioreactors, stainless steel bioreactors, and single-use bioreactors. Of these, stainless steel bioreactors are the largest type of material, driven by their widespread use in R&D activities, and in academic and research organizations. Single-use bioreactors are the fastest-growing type of bioreactors. Driven by low capital investment, higher flexibility, and low maintenance, biopharmaceutical companies are increasingly opting for single-use bioreactors. The segment is poised to register a 10.4% CAGR over the forecast period. Technical advancements in mixing, fermentation, and other aspects are encouraging market growth for the segment.

North America is the largest market for bioreactors, driven by large-scale biopharmaceutical R&D activities in the US. The region also witnesses demand for bioreactors from other end-user industries such as food and beverages, sustainable energy, and bioplastics. The region accounted for 41% market share in 2022. On the other hand, China is the fastest-growing market for bioreactors, estimated to register a 10.1% CAGR over the forecast period to 2030. The highest growth rate is largely attributable to the focus of biopharmaceutical companies on biologics, significant operations in commercial production, and increasing R&D activities.

In terms of the range of scales, the bioreactors end-user industry is analyzed in three scale ranges- lab scale bioreactor, pilot scale bioreactor, and full-scale bioreactor. Lab scale bioreactor is the leading market segment with a 50.6% market share.

Danaher Corporation, Eppendorf AG, GE Healthcare, Merck Millipore Corporation, Sartorius AG, Thermo Fisher Scientific, Inc, Bioengineering AG, Applikon Biotechnology Inc, Praj HiPurity Systems Limited, Infors HT, and Solaris Biotech are the leading OEMs in the industry. Amid intense competitive conditions, these companies are also operating as system integrators, where in addition to supplying the equipment, they are also providing services such as integration, instrumentation, programming, and control. Companies are also offering attractive designs, colors, and graphics in bioreactors and promoting sustainable designs to attract customers.

Bioreactor Market Share Analysis- Strong demand for biologics drug discovery market

The $1,725 million global Bioreactor market is growing at a rapid rate and is expected to post a CAGR of 7.2% during the period 2023-2030. The R&D departments are set to be the fastest-growing users of bioreactors, in particular, single-use bioreactors. The segment is expected to register the highest CAGR over the forecast period to 2030. CMO (Contract Manufacturing Organizations) are also witnessing strong support in the industry driven by the demand for biologics.

Bioreactor Market Trends- Widening uses of Bioreactors across industries

Companies manufacture bioreactors in diverse scale ranges and shape to cater to the demand from various applications. The scale ranges from a capacity of a few millimeters to large bioreactors of the size of above 100 cubic meters are being manufactured.

Key application areas of bioreactors include –

The food and beverage industry is one of the key users of bioreactors for the fermentation process, for the addition of vitamins, colorants, flavoring, antioxidants, alcohol, and others. Strong demand for the global $14.2 billion vegan foods, which is poised to register a 9.2% CAGR over the forecast period to 2026 will support the bioreactor market growth. Instead of growing an entire plant, bioreactors enable the production of fibers and nutrients. However, fermentation in the food and beverages industry requires precise and constant supervision in strain development, sterility, feeding strategy, and process control optimization activities. Manufacturers of bioreactors are focusing on extending support services to assist clients through automation concepts and harmonized control strategies for oxygen, pH, temperature, and feed addition.

Drug development and production companies and institutes are increasingly using bioreactors for the development and multiplication of stem cells. The pharmaceutical industry uses bioreactors to hold cells, bacterial, mammalian, and other organisms to harness their natural biochemical processes. The bioreactors enable cost savings and consistent product quality achievement in the process. Accordingly, the demand for reliable and scalable bioreactors is increasing significantly. Companies are widely manufacturing tailor-made bioreactors in addition to standard bioreactors.

Other biotechnological applications such as bio-based chemicals and plastics as companies and institutes focus more on renewable plastics, which are made from organic materials with the help of enzymes and micro-organisms. Further, sustainable energy production applications to produce Biogas and biofuel in the form of bio-methane, bioethanol, biodiesel, and other applications are increasingly being researched using bioreactors.

Bioreactor Market Drivers- Strong demand for biologics drug discovery market

The global biologics drug discovery market is estimated to be $8.5 billion in 2020. The market is expected to register a CAGR of 10.7% over the forecast period from 2020 to 2028. In particular, monoclonal antibodies, recombinant proteins, and others are expected to dominate the industry. North America, driven by the US, is the leading market with a 41.6% market share during the year. Superior efficacy, better interaction with the target as well as specificity towards targets are the main factors driving the market demand. Investments from leading pharmaceutical companies will drive the biologics drug discovery market, which will fuel the use of bioreactors.

Bioreactor Market Drivers- The launch of biosimilars presents strong growth opportunities

In 2019, the US FDA approved ten biosimilars and in 2020, three biosimilars- Mylan’s Hulio®, a Humira® (adalimumab) biosimilar; Pfizer’s Nyvepria™, a Neulasta® (pegfilgrastim) biosimilar; and Amgen’s Riabni™, a Rituxan® (rituximab) biosimilar were approved. Further, new biosimilars are in line for approval in oncology, oncology supportive care, nephrology/oncology supportive care, and inflammation. The expiry of patents and strong growth opportunities for generics and biosimilars is encouraging significant R&D activity. Accordingly, several biopharmaceutical manufacturers are incorporating bioreactors into their discovery and development processes.

Bioreactor Market Segmentation

Leading Bioreactor Companies analyzed in the report-

United States Bioreactor Market Size Outlook

The US dominates the North American bioreactors market with a 76.4% market share during 2022. It is estimated to dominate the regional and global markets throughout the forecast period.

Presence of a huge biopharmaceuticals market. In particular, the country is the market leader in biopharmaceuticals R&D. Biologics and biosimilars are highly focused in the country due to the large market. Patent expiries of prescription drugs coupled with R&D for the development of new medicines will drive the bioreactors market growth over the forecast period.

Among types, single-user biopharmaceuticals will dominate the industry driven by their low CAPEX and no contamination advantages. Companies increasingly manufacture specialized bioprocessing equipment for the biotech, pharmaceutical, food, beverage, and dairy industries.

1. Executive Summary

1.1 Introduction to Bioreactor Markets

1.2 Bioreactor Market Size Outlook, 2021- 2030

1.3 Growth Opportunities in Bioreactor Industry

1.4 Winning Strategies for the post-pandemic future

2. Report Guide

2.1 Market Definition and Scope

2.2 Market Segmentation

2.3 Research Methodology

2.4 Forecast Methodology

2.5 List of Abbreviations

3. Growth Opportunity Analysis

3.1 Key Bioreactor Market Trends

3.1.1 Widening uses of Bioreactors across industries

3.1.2 Technological advancements in Single-use Technologies drive usage of systems

3.1.3 Adoption of Single-use bioreactors and Hybrid Bioreactors

3.2 Key Bioreactor Market Growth Drivers

3.2.1 Role of EPC Consultants continues to remain vital

3.2.2 Strong demand for biologics drug discovery market

3.2.3 Increasing demand from small companies and start-ups

3.2.4 Launch of biosimilars presents strong growth opportunities

3.3 Key Bioreactor Market Growth Restraints

3.3.1 Intense competitive conditions

3.3.2 Regulatory concerns related to SUBs

4 Bioreactor Market Outlook – Scenario Analysis

4.1 Low Growth Case Scenario Forecasts: Bioreactor Market Size Outlook to 2030

4.2 Reference Growth Case Scenario Forecasts: Bioreactor Market Size Outlook to 2030

4.3 High Growth Case Scenario Forecasts: Bioreactor Market Size Outlook to 2030

5. Bioreactor Market Segmentation- Outlook by Application

5.1 Bioreactor Market Share Analysis by Application, 2023

5.2 R&D Bioreactor Market Outlook to 2030

5.3 Biopharmaceutical Companies Bioreactor Market Outlook to 2030

6. Bioreactor Market Segmentation- Outlook by Material

6.1 Bioreactor Market Share Analysis by Material, 2023

6.2 Glass Bioreactor Market Outlook to 2030

6.3 Stainless Steel Bioreactor Market Outlook to 2030

6.4 Single-Use Bioreactor Market Outlook to 2030

7. Bioreactor Market Segmentation- Outlook by Production

7.1 Bioreactor Market Share Analysis by Production, 2023

7.2 Lab-scale Production: Bioreactor Market Revenue Outlook to 2030

7.3 Pilot-scale Production: Bioreactor Market Revenue Outlook to 2030

7.4 Full-scale Production: Bioreactor Market Revenue Outlook to 2030

8. Bioreactor Market Segmentation- Outlook by Scale of Operations

8.1 Bioreactor Market Share Analysis by Scale of Operations, 2023

8.2 <1L to 10L: Bioreactor Market Revenue Outlook to 2030

8.3 11L to 200L: Bioreactor Market Revenue Outlook to 2030

8.4 200L to 1000L: Bioreactor Market Revenue Outlook to 2030

8.5 >1000L: Bioreactor Market Revenue Outlook to 2030

9. North America Bioreactor Market Outlook and Opportunities to 2030

9.1 Market Snapshot, 2023

9.2 North America Bioreactor Market Growth Opportunities

9.2.1 North America Bioreactor Market Outlook by Type, 2021 to 2030

9.2.3 North America Bioreactor Market Outlook by End-User Industry, 2021 to 2030

9.2.4 North America Bioreactor Market Outlook by Country, 2021 to 2030

9.3 United States Bioreactor Market Outlook, 2021 to 2030

9.4 Canada Bioreactor Market Outlook, 2021 to 2030

9.5 Mexico Bioreactor Market Outlook, 2021 to 2030

10. Europe Bioreactor Market Outlook and Opportunities to 2030

10.1 Market Snapshot, 2023

10.2 Europe Bioreactor Market Growth Opportunities

10.2.1 Europe Bioreactor Market Outlook by Type, 2021 to 2030

10.2.3 Europe Bioreactor Market Outlook by End-User Industry, 2021 to 2030

10.2.4 Europe Bioreactor Market Outlook by Country, 2021 to 2030

10.3 Germany Bioreactor Market Outlook, 2021 to 2030

10.4 France Bioreactor Market Outlook, 2021 to 2030

10.5 United Kingdom Bioreactor Market Outlook, 2021 to 2030

10.6 Spain Bioreactor Market Outlook, 2021 to 2030

10.7 Italy Bioreactor Market Outlook, 2021 to 2030

10.8 Other Europe Bioreactor Market Outlook, 2021 to 2030

11. Asia Pacific Bioreactor Market Outlook and Opportunities to 2030

11.1 Market Snapshot, 2023

11.2 Asia Pacific Bioreactor Market Growth Opportunities

11.2.1 Asia Pacific Bioreactor Market Outlook by Type, 2021 to 2030

11.2.3 Asia Pacific Bioreactor Market Outlook by End-User Industry, 2021 to 2030

11.2.4 Asia Pacific Bioreactor Market Outlook by Country, 2021 to 2030

11.3 China Bioreactor Market Outlook, 2021 to 2030

11.4 Japan Bioreactor Market Outlook, 2021 to 2030

11.5 India Bioreactor Market Outlook, 2021 to 2030

11.6 South Korea Bioreactor Market Outlook, 2021 to 2030

11.7 Indonesia Bioreactor Market Outlook, 2021 to 2030

11.8 Other Asia Pacific Bioreactor Market Outlook, 2021 to 2030

12. South and Central America Bioreactor Market Outlook and Opportunities to 2030

12.1 Market Snapshot, 2023

12.2 South and Central America Bioreactor Market Growth Opportunities

12.2.1 South and Central America Bioreactor Market Outlook by Type, 2021 to 2030

12.2.3 South and Central America Bioreactor Market Outlook by End-User Industry, 2021 to 2030

12.2.4 South and Central America Bioreactor Market Outlook by Country, 2021 to 2030

12.3 Brazil Bioreactor Market Outlook, 2021 to 2030

12.4 Argentina Bioreactor Market Outlook, 2021 to 2030

12.5 Other Latin America Bioreactor Market Outlook, 2021 to 2030

13. Middle East and Africa Bioreactor Market Outlook and Opportunities to 2030

13.1 Market Snapshot, 2023

13.2 Middle East and Africa Bioreactor Market Growth Opportunities

13.2.1 Middle East and Africa Bioreactor Market Outlook by Type, 2021 to 2030

13.2.3 Middle East and Africa Bioreactor Market Outlook by End-User Industry, 2021 to 2030

13.2.4 Middle East and Africa Bioreactor Market Outlook by Country, 2021 to 2030

13.3 Saudi Arabia Bioreactor Market Outlook, 2021 to 2030

13.4 United Arab Emirates (the UAE) Bioreactor Market Outlook, 2021 to 2030

13.5 Other Middle East Bioreactor Market Outlook, 2021 to 2030

13.6 Egypt Bioreactor Market Outlook, 2021 to 2030

13.7 South Africa Bioreactor Market Outlook, 2021 to 2030

13.8 Other Africa Bioreactor Market Outlook, 2021 to 2030

14. Profiles of major world Bioreactor Companies

14.1 Danaher Corporation

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

14.2 Eppendorf AG

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

14.3 GE Healthcare

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

14.4 Merck Millipore Corporation

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

14.5 Thermo Fisher Scientific, Inc

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

14.6 Sartorius AG

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

14.7 Amec Foster Wheeler

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

14.8 Flour Corp

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

14.9 Technip SA

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

- Financial Profile

14.10 Jacobs Engineering Group

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

- Financial Profile

15. Appendix

15.1 Publisher’s Expertise

15.2 List of Tables and Charts

15.3 List of Exhibits

15.4 Legal Disclaimer

Widening uses of Bioreactors across industries, Technological advancements in Single-use Technologies, Adoption of Single-use bioreactors and Hybrid Bioreactors, increasing Role of EPC Consultants, Strong demand for biologics drug discovery, Increasing demand from small companies and start-ups, Increasing biopharmaceutical R&D, and Launch of biosimilars presents strong growth opportunities

The global Bioreactor market revenue for 2023 is estimated at $1,838 million.

Amidst robust growth prospects across end-user industries, the Bioreactor market is poised to register a growth rate of 7.23% compounded annually between 2023 and 2030.

Leading bioreactor OEMs including Danaher Corporation, Eppendorf AG, GE Healthcare, Merck Millipore Corporation, Thermo Fisher Scientific, Sartorius AG, and others are analyzed. Further, technology and EPC companies including Amec Foster Wheeler, Flour Corp, Technip SA, and Jacobs Engineering Group are also analyzed.

11L to 200L range Bioreactors are the fastest growing types with a forecast CAGR of 7.4% over the forecast period.