The Chondroitin Sulfate Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Source (Bovine, Swine, Poultry, Shark, Synthetic), By Application (Nutraceuticals, Pharmaceuticals, Animal Feed, Personal Care & Cosmetics, Others).

Widening applications of Chondroitin Sulfate across medicines, biomaterials, and functional foods drive the market prospects for manufacturers and retailers. In particular, the rapid growth in the prevalence of Osteoarthritis fuels the Pharmaceutical-grade chondroitin sulfate sales. Anti-inflammatory Effects, support in Subchondral Bone Health, maintain the viscosity of tears and protects the corneal surface, use in topical formulations to aid wound healing, managing atherosclerosis by inhibiting the formation of atherosclerotic plaques, Inflammatory Bowel Disease, degenerative disc disease, and treatment of interstitial cystitis support the market outlook.

In addition to pharmaceutical applications, Chondroitin Sulfate is gaining demand growth from diverse end-use segments including nutraceuticals, animal feed, personal care, cosmetics, and others. Product launches are predominantly characterized by the development of combination supplements of chondroitin sulfate with glucosamine, collagen, hyaluronic acid, and others.

The Chondroitin Sulfate market is experiencing significant growth, driven by increasing demand for dietary supplements, particularly in the joint health sector. As populations age, the demand for chondroitin sulfate products is increasing rapidly. The number of people aged above 60 years will increase to 1.4 billion by 2030 and 2.1 billion by 2050 according to the United Nations Department of Economic and Social Affairs.

The increasing trend toward natural and clean-label products is also creating opportunities for chondroitin sulfate derived from non-bovine sources. According to a survey conducted by the National Center for Complementary and Integrative Health (NCCIH), chondroitin sulfate is a popular dietary supplement, with over 25% of adults aged 65 and older reporting the use of joint supplements that contain chondroitin sulphate.

Chondroitin Sulfate Market Analysis

The Chondroitin Sulfate market is experiencing significant growth, driven by increasing demand for dietary supplements, particularly in the joint health sector. As populations age, the demand for chondroitin sulfate products is increasing rapidly. The number of people aged above 60 years will increase to 1.4 billion by 2030 and 2.1 billion by 2050 according to the United Nations Department of Economic and Social Affairs. The increasing trend toward natural and clean-label products is also creating opportunities for chondroitin sulfate derived from non-bovine sources. According to a survey conducted by the National Center for Complementary and Integrative Health (NCCIH), chondroitin sulfate is a popular dietary supplement, with over 25% of adults aged 65 and older reporting the use of joint supplements that contain chondroitin sulfate.

Chondroitin Sulfate is a glycosaminoglycan (GAG) found naturally in the extracellular matrix of cartilage, where it contributes to the structural integrity and resilience of the tissue. It is proven to restore the balance between cartilage synthesis and degradation by inhibiting the activity of catabolic enzymes such as matrix metalloproteinases (MMPs) and aggrecanases in diverse clinical trials. In addition, it promotes the synthesis of proteoglycans and hyaluronic acid. The ability to modulate cytokine production, reducing the levels of pro-inflammatory mediators like interleukin-1β (IL-1β) and tumor necrosis factor-alpha (TNF-α) boosts anti-inflammatory properties.

| 1990 | 1995 | 2000 | 2005 | 2010 | 2015 | 2020 | 2025 | 2030 | |

| osteoarthritis (Million Patients) | 250 | 290 | 330 | 370 | 420 | 465 | 540 | 600 | 660 |

The primary goal of Osteoarthritis treatment is to reduce pain, disability and ultimately, to avoid joint replacement surgery. Chondroitin sulfate is widely marketed for osteoarthritis long-term management compared to nonsteroidal anti-inflammatory drugs and acetaminophen, driven by higher efficacy and low cost per patient. A meta-analysis published in the journal Annals of the Rheumatic Diseases identifies that chondroitin sulfate can reduce the symptoms of osteoarthritis by 20% to 30%, particularly in the knee and hip joints.

Chondroitin sulfate (CS) is a key component of cartilage, contributing to its structural integrity by binding to core proteins to form proteoglycans, which provide cartilage with its elastic and mechanical properties. Additionally, CS has anti-inflammatory effects by inhibiting the nuclear translocation of NF-κB, a protein linked to various chronic inflammatory conditions. CS also supports subchondral bone homeostasis by promoting a balanced anabolic/catabolic activity in the cartilage extracellular matrix. It achieves this by reducing the catabolic activity of chondrocytes through the inhibition of proteolytic enzymes like collagenase, elastase, phospholipase, and N-acetylglucosaminidase, while also enhancing the synthesis of proteoglycans (in vitro) and endogenous hyaluronic acid (in vivo).

Marine-sourced chondroitin sulfate is gaining popularity

Most chondroitin sulfate (CS) is derived from animal sources, primarily animal cartilage and connective tissue, as well as marine sources through various extraction methods. There is a growing trend towards marine and avian sources due to concerns over the safety and ethical sourcing of bovine and porcine chondroitin sulfate. Marine-sourced chondroitin sulfate, derived from fish and shark cartilage, is gaining popularity for its perceived purity and sustainability. Leading companies including TSI Group Ltd. and Seikagaku Corporation are investing in marine-sourced chondroitin sulfate production. ZipVit's Chondroitin formula is 90% marine, SeaTech's chondroitin sulfate C, Natures Aid Chondroitin Sulphate, and others are widely marketed. Safety concerns towards mad cow disease, H7N9 avian influenza, foot and mouth disease, hog cholera, and other food chain crises can be avoided by bony fish and other marine by-products. squids, sea cucumbers, sponges, mollusks, and primarily cartilaginous material from fish (ray, salmon, shark, and others) are widely used sources. In particular, cartilaginous fish is a potential source of 6S-enriched CS, driving the market prospects.

Chondroitin sulfate Market Share Insights

Bovine sourced Chondroitin sulfate generated the largest market share of 39.6% in 2024, owing to abundant availability, cost-effectiveness, and well-established use in dietary supplements and pharmaceuticals. Bovine-sourced chondroitin sulfate is also widely accepted by regulatory bodies like the FDA and EFSA, supporting the long-term market outlook. Move Free® Advanced Plus MSM & Vitamin D3 (Schiff Vitamins), Osteo Bi-Flex® Triple Strength (Rexall Sundown, Inc), OptiMSM, NOW® Glucosamine & Chondroitin, Kirkland Signature, and others are widely marketed. In addition, Swine sourced CS is the next largest segment, followed by poultry, shark, and synthetic in respective order.

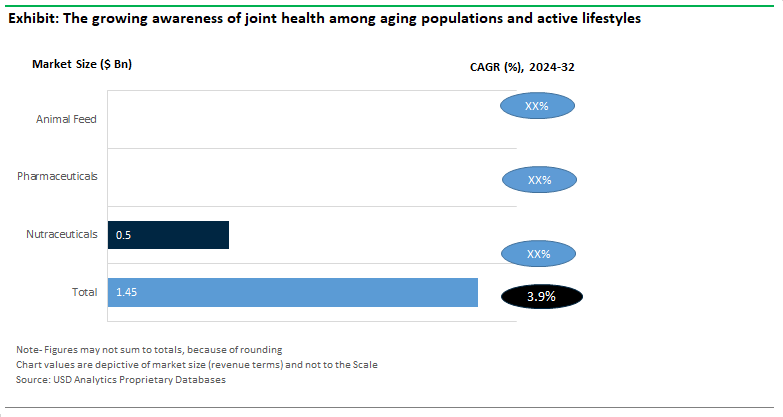

The nutraceutical segment generated the highest revenue share of 32.8% in 2024, driven by continuous product launches and increasing consumer demand for natural and preventative healthcare solutions. The growing awareness of joint health, particularly among aging populations and individuals with active lifestyles, significantly boosted the demand for chondroitin sulfate-based supplements. The widespread availability of nutraceutical products in capsules, tablets, and powder forms, made them accessible and appealing to a broad consumer base. Nature Made® TripleFlex, Solgar, Puritan's Pride Joint Soother, Vital Proteins Joint Collagen, Jarrow Formulas Glucosamine + Chondroitin + MSM, and others are gaining significant business growth. In particular, beauty supplements are gaining wide popularity among aged population.

Driven by a robust consumer base, high affordability, and consumer awareness, the North American market is estimated to account for 35.4% market share in the global CS market. According to the U.S. Census Bureau, the population aged 65 and older in the United States is projected to reach 80 million by 2040. Similarly, the Centers for Disease Control and Prevention (CDC) reports that osteoarthritis affects over 32.5 million adults in the United States and the National Institutes of Health (NIH) estimates that the consumer spending on dietary supplements in the United States reached approximately $55 billion in 2023, with joint health supplements, including chondroitin sulfate, being a significant portion of this expenditure. Accordingly, leading manufacturers are focusing on new product launches in the US and Canada.

The Chondroitin sulfate market is concentrated with companies focusing on new product launches for diverse applications. Bi-gen Extracts Pvt. Ltd, Bioiberica, S.A.U., BRF S.A., Hebei Sanxin Industrial Group Co. Ltd, Qingdao Wan Toulmin Biological Sources Co. Ltd, Seikagaku Corp, Sigma-Aldrich Corp, Sino Siam Biotechnique Company Ltd, TSI Group Ltd, ZPD A/S, and others are the leading companies in the industry.

Chondroitin sulfate Market Ecosystem

The Chondroitin sulfate industry is characterized by the presence of capital-intensive companies across the industry from raw material procurement to final product distribution.

|

Parameter |

Details |

|---|---|

|

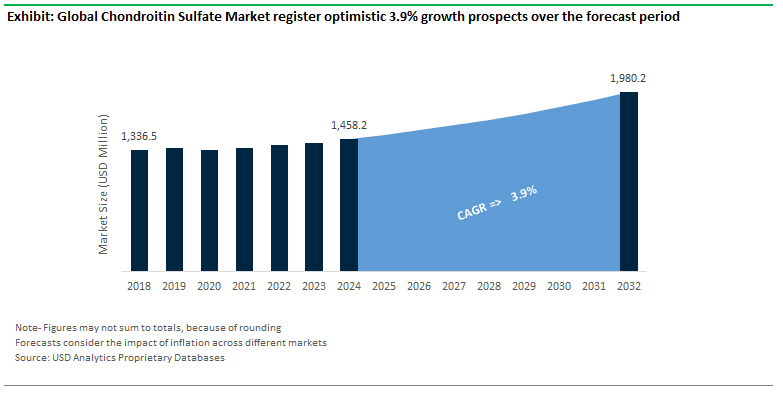

Market Size (2024) |

1.45 Billion USD |

|

Market Size (2032) |

1.97 Billion USD |

|

Market Growth Rate |

3.9% |

|

Largest Segment- Type |

Bovine sourced Chondroitin sulfate (39.6% Market Share) |

|

Largest Segment- Application |

Nutraceutical Application (32.8% Market Share) |

|

Largest Market- Region |

North America (35.4% Market Share) |

|

Segments |

Types, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Bi-gen Extracts Pvt. Ltd, Bioiberica, S.A.U., BRF S.A., Hebei Sanxin Industrial Group Co. Ltd, Qingdao Wan Toulmin Biological Sources Co. Ltd, Seikagaku Corp, Sigma-Aldrich Corp, Sino Siam Biotechnique Company Ltd, TSI Group Ltd, ZPD A/S |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Chondroitin Sulfate Market Segmentation

By Source

Bovine

Swine

Poultry

Shark

Synthetic

By Application

Nutraceuticals

Pharmaceuticals

Animal Feed

Personal Care & Cosmetics

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Bi-gen Extracts Pvt. Ltd

Bioiberica, S.A.U.

BRF S.A.

Hebei Sanxin Industrial Group Co. Ltd

Qingdao Wan Toulmin Biological Sources Co. Ltd

Seikagaku Corp

Sigma-Aldrich Corp

Sino Siam Biotechnique Company Ltd

TSI Group Ltd

ZPD A/S

• Gain access to detailed insights on the Chondroitin Sulfate Market, encompassing current market size, growth trends, and forecasts till 2032.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Chondroitin Sulfate Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Chondroitin Sulfate Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Chondroitin Sulfate Market Size Outlook, $ Million, 2021 to 2030

3.2 Chondroitin Sulfate Market Outlook by Type, $ Million, 2021 to 2030

3.3 Chondroitin Sulfate Market Outlook by Product, $ Million, 2021 to 2030

3.4 Chondroitin Sulfate Market Outlook by Application, $ Million, 2021 to 2030

3.5 Chondroitin Sulfate Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Chondroitin Sulfate Industry

4.2 Key Market Trends in Chondroitin Sulfate Industry

4.3 Potential Opportunities in Chondroitin Sulfate Industry

4.4 Key Challenges in Chondroitin Sulfate Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Chondroitin Sulfate Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Chondroitin Sulfate Market Outlook by Segments

7.1 Chondroitin Sulfate Market Outlook by Segments, $ Million, 2021- 2030

By Source

Bovine

Swine

Poultry

Shark

Synthetic

By Application

Nutraceuticals

Pharmaceuticals

Animal Feed

Personal Care & Cosmetics

Others

8 North America Chondroitin Sulfate Market Analysis and Outlook To 2030

8.1 Introduction to North America Chondroitin Sulfate Markets in 2024

8.2 North America Chondroitin Sulfate Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Chondroitin Sulfate Market size Outlook by Segments, 2021-2030

By Source

Bovine

Swine

Poultry

Shark

Synthetic

By Application

Nutraceuticals

Pharmaceuticals

Animal Feed

Personal Care & Cosmetics

Others

9 Europe Chondroitin Sulfate Market Analysis and Outlook To 2030

9.1 Introduction to Europe Chondroitin Sulfate Markets in 2024

9.2 Europe Chondroitin Sulfate Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Chondroitin Sulfate Market Size Outlook by Segments, 2021-2030

By Source

Bovine

Swine

Poultry

Shark

Synthetic

By Application

Nutraceuticals

Pharmaceuticals

Animal Feed

Personal Care & Cosmetics

Others

10 Asia Pacific Chondroitin Sulfate Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Chondroitin Sulfate Markets in 2024

10.2 Asia Pacific Chondroitin Sulfate Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Chondroitin Sulfate Market size Outlook by Segments, 2021-2030

By Source

Bovine

Swine

Poultry

Shark

Synthetic

By Application

Nutraceuticals

Pharmaceuticals

Animal Feed

Personal Care & Cosmetics

Others

11 South America Chondroitin Sulfate Market Analysis and Outlook To 2030

11.1 Introduction to South America Chondroitin Sulfate Markets in 2024

11.2 South America Chondroitin Sulfate Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Chondroitin Sulfate Market size Outlook by Segments, 2021-2030

By Source

Bovine

Swine

Poultry

Shark

Synthetic

By Application

Nutraceuticals

Pharmaceuticals

Animal Feed

Personal Care & Cosmetics

Others

12 Middle East and Africa Chondroitin Sulfate Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Chondroitin Sulfate Markets in 2024

12.2 Middle East and Africa Chondroitin Sulfate Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Chondroitin Sulfate Market size Outlook by Segments, 2021-2030

By Source

Bovine

Swine

Poultry

Shark

Synthetic

By Application

Nutraceuticals

Pharmaceuticals

Animal Feed

Personal Care & Cosmetics

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Bi-gen Extracts Pvt. Ltd

Bioiberica, S.A.U.

BRF S.A.

Hebei Sanxin Industrial Group Co. Ltd

Qingdao Wan Toulmin Biological Sources Co. Ltd

Seikagaku Corp

Sigma-Aldrich Corp

Sino Siam Biotechnique Company Ltd

TSI Group Ltd

ZPD A/S

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Source

Bovine

Swine

Poultry

Shark

Synthetic

By Application

Nutraceuticals

Pharmaceuticals

Animal Feed

Personal Care & Cosmetics

Others

Countries Analyzed

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Chondroitin Sulfate Market is one of the lucrative growth markets, poised to register a 3.9% growth (CAGR) between 2024 and 2032.

Bovine sourced Chondroitin sulfate (39.6% Market Share), Nutraceutical Application (32.8% Market Share), North America (35.4% Market Share)

Bi-gen Extracts Pvt. Ltd, Bioiberica, S.A.U., BRF S.A., Hebei Sanxin Industrial Group Co. Ltd, Qingdao Wan Toulmin Biological Sources Co. Ltd, Seikagaku Corp, Sigma-Aldrich Corp, Sino Siam Biotechnique Company Ltd, TSI Group Ltd, ZPD A/S

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: USD; Volume

The market is driven by the rising popularity of Chondroitin Sulfate in joint health supplements and osteoarthirits management along with increased use in nuraceutical formulations