The Gastrointestinal Endoscopy Devices Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Product (Hemostasis devices, Capsule endoscopes, GI videoscopes, Biopsy devices, Endoscopic retrograde cholangiopancreatography devices (ERCP), Others), By End-User (Hospitals, Diagnostic Centers, Others).

The Gastrointestinal Endoscopic Devices market in 2024 addresses the demand for medical devices and instruments used in diagnostic and therapeutic endoscopic procedures for visualizing and treating gastrointestinal (GI) disorders such as colorectal cancer, inflammatory bowel disease (IBD), and gastrointestinal bleeding. Gastrointestinal endoscopic devices include gastroscopes, colonoscopes, enteroscopes, endoscopic ultrasound (EUS) probes, capsule endoscopes, and accessories such as biopsy forceps, snares, and hemostatic clips, enabling minimally invasive interventions such as tissue sampling, polypectomy, and stent placement. Market dynamics are driven by factors such as the increasing incidence of GI diseases and cancers, advancements in endoscope design and imaging technology, and the demand for early detection and precise treatment of gastrointestinal conditions. Collaboration between medical device manufacturers, gastroenterologists, and interventional radiologists drives innovation and market growth in gastrointestinal endoscopic devices, supporting improved diagnostic accuracy, therapeutic efficacy, and patient outcomes in gastrointestinal endoscopy.

A prominent trend in the gastrointestinal endoscopic devices market is the continuous advancements in minimally invasive endoscopic procedures. Endoscopic techniques have evolved significantly over the years, enabling healthcare providers to diagnose and treat gastrointestinal conditions with greater precision, safety, and efficiency. Innovations such as capsule endoscopy, virtual colonoscopy, and advanced imaging technologies like confocal laser endomicroscopy are revolutionizing the field, allowing for earlier detection of lesions, improved tissue visualization, and targeted therapeutic interventions. This trend is driven by the growing preference for minimally invasive procedures among patients and healthcare providers, as well as the demand for technologies that enhance diagnostic accuracy and therapeutic outcomes while minimizing patient discomfort and recovery time.

A key driver in the gastrointestinal endoscopic devices market is the rising incidence of gastrointestinal diseases and cancer. Gastrointestinal disorders such as colorectal cancer, inflammatory bowel disease, gastroesophageal reflux disease (GERD), and peptic ulcers pose significant health burdens globally, driving the demand for diagnostic and therapeutic endoscopic procedures. Additionally, advancements in cancer screening programs and the growing adoption of colonoscopy as a primary screening modality for colorectal cancer are fueling market growth, as endoscopic devices play a critical role in early detection, surveillance, and treatment of gastrointestinal malignancies. The increasing prevalence of risk factors such as aging population, obesity, and unhealthy lifestyle habits further contributes to the demand for gastrointestinal endoscopic devices as essential tools for disease management and prevention.

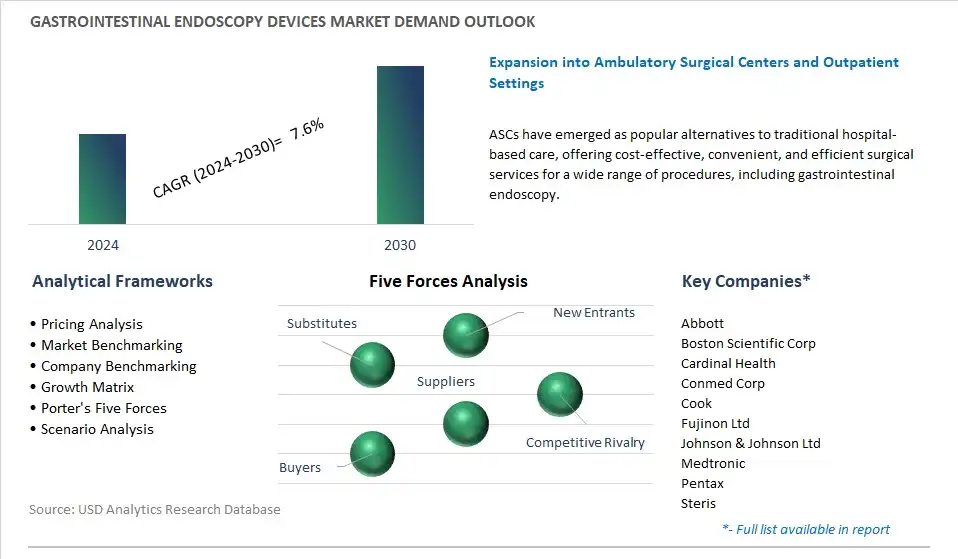

An opportunity for growth in the gastrointestinal endoscopic devices market lies in the expansion into ambulatory surgical centers (ASCs) and outpatient settings. ASCs have emerged as popular alternatives to traditional hospital-based care, offering cost-effective, convenient, and efficient surgical services for a wide range of procedures, including gastrointestinal endoscopy. By focusing on developing endoscopic devices that are specifically designed for use in ASCs and outpatient clinics, manufacturers can capitalize on the shift towards outpatient care delivery models and cater to the growing demand for minimally invasive procedures performed outside of hospital settings. This approach not only expands market reach but also aligns with healthcare trends towards value-based care, patient-centered services, and improved access to preventive and diagnostic healthcare services for gastrointestinal conditions.

By Product

Hemostasis devices

Capsule endoscopes

GI videoscopes

Biopsy devices

Endoscopic retrograde cholangiopancreatography devices (ERCP)

Others

By End-User

Hospitals

Diagnostic Centers

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Abbott

Boston Scientific Corp

Cardinal Health

Conmed Corp

Cook

Fujinon Ltd

Johnson & Johnson Ltd

Medtronic

Pentax

Steris

Stryker Corp

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Gastrointestinal Endoscopy Devices Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Gastrointestinal Endoscopy Devices Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Gastrointestinal Endoscopy Devices Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Gastrointestinal Endoscopy Devices Market Size Outlook, $ Million, 2021 to 2030

3.2 Gastrointestinal Endoscopy Devices Market Outlook by Type, $ Million, 2021 to 2030

3.3 Gastrointestinal Endoscopy Devices Market Outlook by Product, $ Million, 2021 to 2030

3.4 Gastrointestinal Endoscopy Devices Market Outlook by Application, $ Million, 2021 to 2030

3.5 Gastrointestinal Endoscopy Devices Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Gastrointestinal Endoscopy Devices Market Industry

4.2 Key Market Trends in Gastrointestinal Endoscopy Devices Market Industry

4.3 Potential Opportunities in Gastrointestinal Endoscopy Devices Market Industry

4.4 Key Challenges in Gastrointestinal Endoscopy Devices Market Industry

5 Market Factor Analysis

5.1 Competitive Landscape

5.1.1 Global Gastrointestinal Endoscopy Devices Market Share by Company (%), 2023

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Gastrointestinal Endoscopy Devices Market Outlook By Segments

7.1 Gastrointestinal Endoscopy Devices Market Outlook by Segments

By Product

Hemostasis devices

Capsule endoscopes

GI videoscopes

Biopsy devices

Endoscopic retrograde cholangiopancreatography devices (ERCP)

Others

By End-User

Hospitals

Diagnostic Centers

Others

8 North America Gastrointestinal Endoscopy Devices Market Analysis And Outlook To 2030

8.1 Introduction to North America Gastrointestinal Endoscopy Devices Markets in 2024

8.2 North America Gastrointestinal Endoscopy Devices Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Gastrointestinal Endoscopy Devices Market size Outlook by Segments, 2021-2030

By Product

Hemostasis devices

Capsule endoscopes

GI videoscopes

Biopsy devices

Endoscopic retrograde cholangiopancreatography devices (ERCP)

Others

By End-User

Hospitals

Diagnostic Centers

Others

9 Europe Gastrointestinal Endoscopy Devices Market Analysis And Outlook To 2030

9.1 Introduction to Europe Gastrointestinal Endoscopy Devices Markets in 2024

9.2 Europe Gastrointestinal Endoscopy Devices Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Gastrointestinal Endoscopy Devices Market Size Outlook By Segments, 2021-2030

By Product

Hemostasis devices

Capsule endoscopes

GI videoscopes

Biopsy devices

Endoscopic retrograde cholangiopancreatography devices (ERCP)

Others

By End-User

Hospitals

Diagnostic Centers

Others

10 Asia Pacific Gastrointestinal Endoscopy Devices Market Analysis And Outlook To 2030

10.1 Introduction to Asia Pacific Gastrointestinal Endoscopy Devices Markets in 2024

10.2 Asia Pacific Gastrointestinal Endoscopy Devices Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Gastrointestinal Endoscopy Devices Market size Outlook by Segments, 2021-2030

By Product

Hemostasis devices

Capsule endoscopes

GI videoscopes

Biopsy devices

Endoscopic retrograde cholangiopancreatography devices (ERCP)

Others

By End-User

Hospitals

Diagnostic Centers

Others

11 South America Gastrointestinal Endoscopy Devices Market Analysis And Outlook To 2030

11.1 Introduction to South America Gastrointestinal Endoscopy Devices Markets in 2024

11.2 South America Gastrointestinal Endoscopy Devices Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Gastrointestinal Endoscopy Devices Market size Outlook by Segments, 2021-2030

By Product

Hemostasis devices

Capsule endoscopes

GI videoscopes

Biopsy devices

Endoscopic retrograde cholangiopancreatography devices (ERCP)

Others

By End-User

Hospitals

Diagnostic Centers

Others

12 Middle East And Africa Gastrointestinal Endoscopy Devices Market Analysis And Outlook To 2030

12.1 Introduction to Middle East and Africa Gastrointestinal Endoscopy Devices Markets in 2024

12.2 Middle East and Africa Gastrointestinal Endoscopy Devices Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Gastrointestinal Endoscopy Devices Market size Outlook by Segments, 2021-2030

By Product

Hemostasis devices

Capsule endoscopes

GI videoscopes

Biopsy devices

Endoscopic retrograde cholangiopancreatography devices (ERCP)

Others

By End-User

Hospitals

Diagnostic Centers

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Abbott

Boston Scientific Corp

Cardinal Health

Conmed Corp

Cook

Fujinon Ltd

Johnson & Johnson Ltd

Medtronic

Pentax

Steris

Stryker Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Endoscopes

Camera Heads

Visualization Systems

Biopsy Devices

Capsule Endoscopes

Transmitters and Receivers

Robot-Assisted Endoscopes

By Application

Laparoscopy

Obstetrics/Gynecology Endoscopy

Arthroscopy

Urology Endoscopy

Bronchoscopy

ENT Endoscopy

Mediastinoscopy

By End User

Hospitals and Clinics

Ambulatory Surgery Centers

Others

The global Gastrointestinal Endoscopy Devices Market is one of the lucrative growth markets, poised to register a 7.6% growth (CAGR) between 2024 and 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abbott, Boston Scientific Corp, Cardinal Health, Conmed Corp, Cook, Fujinon Ltd, Johnson & Johnson Ltd, Medtronic, Pentax, Steris, Stryker Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume