The Genetic Testing Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Technology (Next Generation Sequencing, Array Technology, PCR - based Testing, FISH, Others), By Application (Ancestry & Ethnicity, Traits Screening, Genetic Disease Carrier Status, New Baby Screening, Health and Wellness - Predisposition/ Risk / Tendency), By Product (Consumables, Equipment, Software & Services), By Channel, Online, Offline), By End-User (Hospitals & Clinics, Diagnostic Laboratories, Others).

The genetic testing market in 2024 serves the demand for molecular diagnostics, genomic profiling, and personalized medicine services used in genetic screening, disease risk assessment, and pharmacogenomics testing to identify inherited genetic mutations, gene variants, and chromosomal abnormalities associated with hereditary disorders, genetic predispositions, and individual responses to drug therapy, providing patients, healthcare providers, and genetic counselors with actionable insights into genetic health risks, disease susceptibility, and treatment options for informed decision-making and personalized healthcare interventions. Genetic testing encompasses a wide range of methodologies and techniques, including DNA sequencing, polymerase chain reaction (PCR), fluorescence in situ hybridization (FISH), and microarray analysis, enabling the detection, analysis, and interpretation of genetic variations, gene expression patterns, and genomic alterations for clinical diagnostics, disease management, and precision medicine applications across diverse medical specialties and therapeutic areas. Market dynamics are driven by factors such as the increasing prevalence of genetic diseases and hereditary conditions, the growing adoption of next-generation sequencing (NGS) and whole genome sequencing (WGS) technologies, and advancements in genetic testing platforms, bioinformatics tools, and genetic counseling services for improved genetic risk assessment, early disease detection, and personalized treatment strategies. Collaboration between genetic testing laboratories, healthcare providers, and genetic counseling organizations drives innovation and market growth in genetic testing, supporting more accurate, comprehensive, and accessible genetic diagnostics and genomic medicine solutions for patients and populations worldwide.

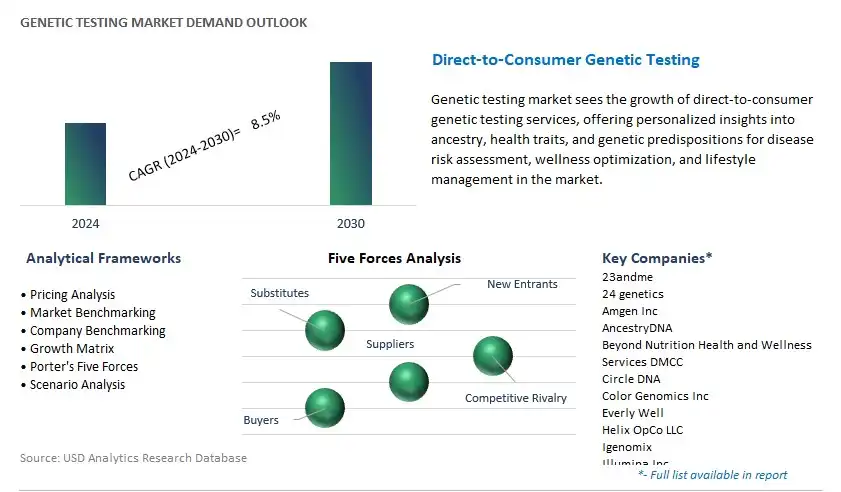

A significant trend in the Genetic Testing market is the increasing demand for direct-to-consumer (DTC) genetic testing services. Consumers are increasingly interested in understanding their genetic predispositions to diseases, ancestry, and traits, driving the adoption of DTC genetic testing kits. This trend is fueled by factors such as the declining cost of genetic testing, advancements in technology making testing more accessible, and growing consumer awareness of personalized medicine. As a result, genetic testing companies are expanding their offerings to cater to the direct consumer market, providing insights into health risks, ancestry, and lifestyle choices.

A key driver in the Genetic Testing market is the continuous advancements in genomic technologies and the shift towards precision medicine. Rapid developments in sequencing technologies, such as next-generation sequencing (NGS), have significantly reduced the cost and time required for genetic testing, making it more accessible to healthcare providers and patients. Additionally, the paradigm shift towards precision medicine, which emphasizes tailored healthcare interventions based on individual genetic makeup, is driving the demand for genetic testing across various medical specialties. The increasing integration of genetic testing into clinical practice for disease diagnosis, prognosis, and treatment selection further propels market growth.

An opportunity for market expansion in the Genetic Testing market lies in the continued growth of applications such as non-invasive prenatal testing (NIPT) and cancer screening. NIPT, which enables the detection of fetal chromosomal abnormalities using maternal blood samples, is gaining traction as a safer and more accurate alternative to traditional invasive prenatal diagnostic procedures. Similarly, genetic testing for cancer screening and risk assessment is becoming increasingly important in early detection, prognosis, and personalized treatment selection. By investing in research and development to enhance the accuracy, reliability, and affordability of NIPT and cancer screening tests, genetic testing companies can capitalize on the growing demand for these applications and expand their market reach.

By Technology

Next Generation Sequencing

Array Technology

PCR - based Testing

FISH

Others

By Application

Ancestry & Ethnicity

Traits Screening

Genetic Disease Carrier Status

New Baby Screening

Health and Wellness - Predisposition/ Risk / Tendency

By Product

Consumables

Equipment

Software & Services

By Channel

Online

Offline

By End-User

Hospitals & Clinics

Diagnostic Laboratories

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

23andme

24 genetics

Amgen Inc

AncestryDNA

Beyond Nutrition Health and Wellness Services DMCC

Circle DNA

Color Genomics Inc

Everly Well

Helix OpCo LLC

Igenomix

Illumina Inc

Mapmygenome

MyDNA

MyHeritage Ltd

Myriad Genetics Inc

Tellmegen

VitaGen

*- List Not Exhaustive

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Genetic Testing Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Genetic Testing Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Genetic Testing Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Genetic Testing Market Size Outlook, $ Million, 2021 to 2030

3.2 Genetic Testing Market Outlook by Type, $ Million, 2021 to 2030

3.3 Genetic Testing Market Outlook by Product, $ Million, 2021 to 2030

3.4 Genetic Testing Market Outlook by Application, $ Million, 2021 to 2030

3.5 Genetic Testing Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Genetic Testing Market Industry

4.2 Key Market Trends in Genetic Testing Market Industry

4.3 Potential Opportunities in Genetic Testing Market Industry

4.4 Key Challenges in Genetic Testing Market Industry

5 Market Factor Analysis

5.1 Competitive Landscape

5.1.1 Global Genetic Testing Market Share by Company (%), 2023

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Genetic Testing Market Outlook By Segments

7.1 Genetic Testing Market Outlook by Segments

By Technology

Next Generation Sequencing

Array Technology

PCR - based Testing

FISH

Others

By Application

Ancestry & Ethnicity

Traits Screening

Genetic Disease Carrier Status

New Baby Screening

Health and Wellness - Predisposition/ Risk / Tendency

By Product

Consumables

Equipment

Software & Services

By Channel

Online

Offline

By End-User

Hospitals & Clinics

Diagnostic Laboratories

Others

8 North America Genetic Testing Market Analysis And Outlook To 2030

8.1 Introduction to North America Genetic Testing Markets in 2024

8.2 North America Genetic Testing Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Genetic Testing Market size Outlook by Segments, 2021-2030

By Technology

Next Generation Sequencing

Array Technology

PCR - based Testing

FISH

Others

By Application

Ancestry & Ethnicity

Traits Screening

Genetic Disease Carrier Status

New Baby Screening

Health and Wellness - Predisposition/ Risk / Tendency

By Product

Consumables

Equipment

Software & Services

By Channel

Online

Offline

By End-User

Hospitals & Clinics

Diagnostic Laboratories

Others

9 Europe Genetic Testing Market Analysis And Outlook To 2030

9.1 Introduction to Europe Genetic Testing Markets in 2024

9.2 Europe Genetic Testing Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Genetic Testing Market Size Outlook By Segments, 2021-2030

By Technology

Next Generation Sequencing

Array Technology

PCR - based Testing

FISH

Others

By Application

Ancestry & Ethnicity

Traits Screening

Genetic Disease Carrier Status

New Baby Screening

Health and Wellness - Predisposition/ Risk / Tendency

By Product

Consumables

Equipment

Software & Services

By Channel

Online

Offline

By End-User

Hospitals & Clinics

Diagnostic Laboratories

Others

10 Asia Pacific Genetic Testing Market Analysis And Outlook To 2030

10.1 Introduction to Asia Pacific Genetic Testing Markets in 2024

10.2 Asia Pacific Genetic Testing Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Genetic Testing Market size Outlook by Segments, 2021-2030

By Technology

Next Generation Sequencing

Array Technology

PCR - based Testing

FISH

Others

By Application

Ancestry & Ethnicity

Traits Screening

Genetic Disease Carrier Status

New Baby Screening

Health and Wellness - Predisposition/ Risk / Tendency

By Product

Consumables

Equipment

Software & Services

By Channel

Online

Offline

By End-User

Hospitals & Clinics

Diagnostic Laboratories

Others

11 South America Genetic Testing Market Analysis And Outlook To 2030

11.1 Introduction to South America Genetic Testing Markets in 2024

11.2 South America Genetic Testing Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Genetic Testing Market size Outlook by Segments, 2021-2030

By Technology

Next Generation Sequencing

Array Technology

PCR - based Testing

FISH

Others

By Application

Ancestry & Ethnicity

Traits Screening

Genetic Disease Carrier Status

New Baby Screening

Health and Wellness - Predisposition/ Risk / Tendency

By Product

Consumables

Equipment

Software & Services

By Channel

Online

Offline

By End-User

Hospitals & Clinics

Diagnostic Laboratories

Others

12 Middle East And Africa Genetic Testing Market Analysis And Outlook To 2030

12.1 Introduction to Middle East and Africa Genetic Testing Markets in 2024

12.2 Middle East and Africa Genetic Testing Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Genetic Testing Market size Outlook by Segments, 2021-2030

By Technology

Next Generation Sequencing

Array Technology

PCR - based Testing

FISH

Others

By Application

Ancestry & Ethnicity

Traits Screening

Genetic Disease Carrier Status

New Baby Screening

Health and Wellness - Predisposition/ Risk / Tendency

By Product

Consumables

Equipment

Software & Services

By Channel

Online

Offline

By End-User

Hospitals & Clinics

Diagnostic Laboratories

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

23andme

24 genetics

Amgen Inc

AncestryDNA

Beyond Nutrition Health and Wellness Services DMCC

Circle DNA

Color Genomics Inc

Everly Well

Helix OpCo LLC

Igenomix

Illumina Inc

Mapmygenome

MyDNA

MyHeritage Ltd

Myriad Genetics Inc

Tellmegen

VitaGen

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Technology

Next Generation Sequencing

Array Technology

PCR - based Testing

FISH

Others

By Application

Ancestry & Ethnicity

Traits Screening

Genetic Disease Carrier Status

New Baby Screening

Health and Wellness - Predisposition/ Risk / Tendency

By Product

Consumables

Equipment

Software & Services

By Channel

Online

Offline

By End-User

Hospitals & Clinics

Diagnostic Laboratories

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Genetic Testing Market is one of the lucrative growth markets, poised to register a 8.5% growth (CAGR) between 2024 and 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

23andme, 24 genetics, Amgen Inc, AncestryDNA, Beyond Nutrition Health and Wellness Services DMCC, Circle DNA, Color Genomics Inc, Everly Well, Helix OpCo LLC, Igenomix, Illumina Inc, Mapmygenome, MyDNA, MyHeritage Ltd, Myriad Genetics Inc, Tellmegen, VitaGen

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume