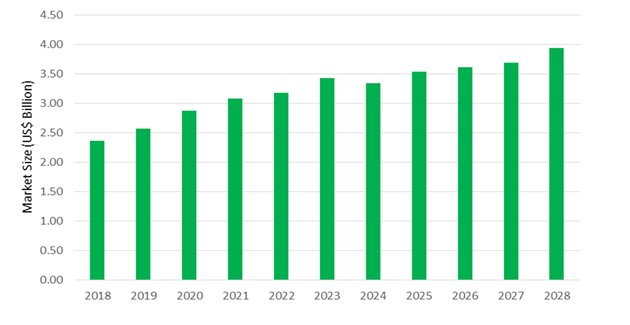

The global Idiopathic Pulmonary Fibrosis market size is estimated to be $3.1 Billion in 2023, at a CAGR of 4.01% between 2023 and 2030.

The increasing prevalence of the condition and growing awareness and affordability driven by the launch of generics and a strong pipeline to reverse the disease are poised to drive the market.

Idiopathic Pulmonary Fibrosis Market Analysis

Growing awareness about Idiotic pulmonary fibrosis (IPF), increasing prevalence of the condition, aging, and changing lifestyles coupled with smoking habits and absence of reversal treatment for IPF are encouraging companies to invest significantly in R&D to gain from the huge unmet demand. Companies like Gilead Sciences, Fibrinogen, Promedior, Galecto, Liminal BioSciences, Celgene Corp, and others are focusing on constantly assessing diverse mechanisms of action to identify potential treatment options.

IPF is a progressive, irreversible, and ultimately fatal disease characterized by progressive loss of lung function due to fibrosis, or scarring, in the lungs. The condition causes shortness of breath and a deterioration in lung function and exercise tolerance. The median survival time from diagnosis is two to three years. It typically occurs in patients over the age of 45 and tends to affect slightly more men than women. IPF is associated with increasing cough and dyspnea, greatly impacting patient quality of life and eventually leading to death from respiratory failure or complicating comorbidities.

Idiopathic Pulmonary Fibrosis Market Size Outlook

Market Dynamics

Market Trend- Small companies offer potential investment and partnership opportunities

Small and medium-size companies developing late-stage pipeline therapeutic candidates for IPF seek out potential investors, federal funding, or strategic partnering with larger and mature companies in the form of licensees or through strategic alliances.

Esbriet was originally developed by InterMune (a Brisbane, California-based biotechnology company) and it reached a definitive merger agreement with Roche in August 2014. Similarly, in February 2020, Promedior, Inc (developing PRM 151) announced the successful completion of its previously announced sale to Roche.

Galecto Biotech and PharmAkea, two clinical-stage pharmaceutical companies with robust pipelines in fibrotic diseases have merged into a single company- Galecto. The emerging company continues to focus on TD139/ GB0139.

Market Driver- IPF Has Strong Unmet Demand

IPF presents significant unmet demand potential. As both the approved drugs do not improve the fatal prognosis of IPF but instead slow the progression, there exists huge unmet market demand. Further, the high rate of treatment discontinuation also presents side effects such as gastrointestinal side effects, liver problems, nausea and vomiting, diarrhea, weight loss, high blood pressure, and others.

Companies often use a six-minute walking test (6 MWT) as one of the standard tests to obtain acceptance by physicians and patients. Pharmaceutical companies and institutes are investing in developing a drug that has minimal side effects and more efficacy.

Market Segmentation

The global Idiopathic Pulmonary Fibrosis Market is segmented into Drug Types, Mechanisms of Action, and Countries.

Nintedanib remains the dominant drug type for the period 2023 to 2030

Ofev is the brand name of Boehringer Ingelheim with the active ingredient of nintedanib mesylate. The inactive ingredients of OFEV include triglycerides, hard fat, and lecithin as fill materials. Nintedanib was approved for the treatment of IPF in October 2014 in the US, approved in January 2015 in the EU, and in Japan, it was approved in July 2015.

Ofev is a small molecule tyrosine kinase inhibitor. According to the company, OFEV has demonstrated consistent and sustained efficacy in patients with IPF by significantly slowing lung function decline vs. placebo. The drug also has similar efficacy to that of Esbriet. In the US, EU, and Japanese markets, the standard dose of Ofev is 150mg capsule twice daily. OFEV® 100 mg capsules are also made available by the company for adverse event (AE) management.

The drug has a high market share over Esbriet in the EU and Japan markets. Following the launch of generics for Esbrit, Ofev is also likely to lose some of its market share to generics.

Tyrosine kinase inhibitors dominated the industry in terms of market size with a 54.6% market share

OFEV is a multi-targeted tyrosine kinase inhibitor with antifibrotic and anti-inflammatory effects that inhibit key pathways leading to pulmonary fibrosis. It binds intracellularly to key tyrosine kinases that have been implicated in the pathogenesis of pulmonary fibrosis.

The drug candidate targets key receptors, platelet-derived growth factor receptor (PDGFR) α and ß, fibroblast growth factor receptor (FGFR) 1–3, vascular endothelial growth factor receptor (VEGFR) 1–3, and colony-stimulating factor 1 receptor (CSF1R), associated with pathogenic processes in pulmonary fibrosis to reduce Fibroblast proliferation, Migration, Fibroblast-to-myofibroblast transformation, and Activation of macrophages. In addition, OFEV® inhibits lymphocyte-specific tyrosine-protein kinase (Lck), involved in the activation of T cells, reducing the activation of fibroblasts and the synthesis and secretion of extracellular matrix (ECM).

North America remained the dominant market from 2023 to 2030

High awareness and affordability coupled with the increasing prevalence of the disease are the main market drivers for Idiopathic Pulmonary Fibrosis in developed countries in North America and Europe. Among regions, North America remained the global markets with the US being the world’s largest country for IPF treatment.

The US is the largest market for IPF treatment worldwide, driven by a large patient population, availability of treatment options, and high affordability. During 2022, the market registered around $2 billion in sales. Ofev continues to dominate the market structure with a rapid growth rate compared to Esbriet. However, the launch of generics is likely to lower the demand for both prescription products.

Segmentation

By Drug Type

By Mechanism of Action

By Region

Key Players

Leading companies profiled in the study include-

Idiopathic Pulmonary Fibrosis Market Outlook 2023

1 Market Overview

1.1 Introduction to Idiopathic Pulmonary Fibrosis Market

1.2 Scope of the Study

1.3 Research Objective

1.3.1 Key Market Scope and Segments

1.3.2 Players Covered

1.3.3 Years Considered

2 Executive Summary

2.1 2023 Idiopathic Pulmonary Fibrosis Industry- Market Statistics

3 Market Dynamics

3.1 Market Drivers

3.2 Market Challenges

3.3 Market Opportunities

3.4 Market Trends

4 Market Factor Analysis

4.1 Porter’s Five Forces

4.2 Market Entropy

4.2.1 Global Idiopathic Pulmonary Fibrosis Market Companies with Area Served

4.2.2 Products Offerings Global Idiopathic Pulmonary Fibrosis Market

5 COVID-19 Impact Analysis and Outlook Scenarios

5.1.1 Covid-19 Impact Analysis

5.1.2 Post-COVID-19 Scenario- Low Growth Case

5.1.3 Post-COVID-19 Scenario- Reference Growth Case

5.1.4 Post-COVID-19 Scenario- Low Growth Case

6 Global Idiopathic Pulmonary Fibrosis Market Trends

6.1 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) and CAGR (%) by Type (2018-2030)

6.2 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) and CAGR (%) by Applications (2018-2030)

6.3 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) and CAGR (%) by Regions (2018-2030)

7 Global Idiopathic Pulmonary Fibrosis Market Revenue (USD Million) by Type, and Applications (2018-2022)

7.1 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Type (2018-2022)

7.1.1 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million), Market Share (%) by Type (2018-2022)

7.2 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Applications (2018-2022)

7.2.1 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million), Market Share (%) by Applications (2018-2022)

8 Global Idiopathic Pulmonary Fibrosis Development Regional Status and Outlook

8.1 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Regions (2018-2022)

8.2 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Type, and Application (2018-2022)

8.2.1 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Country (2018-2022)

8.2.2 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Type (2018-2022)

8.2.3 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Applications (2018-2022)

8.3 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type, and Applications (USD Million) (2018-2022)

8.3.1 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Country (2018-2022)

8.3.2 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Type (2018-2022)

8.3.3 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Applications (2018-2022)

8.4 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million), and Revenue (USD Million) by Type, and Applications (2018-2022)

8.4.1 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Country (2018-2022)

8.4.2 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Type (2018-2022)

8.4.3 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Applications (2018-2022)

8.5 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type, and Applications (2018-2022)

8.5.1 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Country (2018-2022)

8.5.2 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Type (2018-2022)

8.5.3 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Applications (2018-2022)

8.6 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type, Technology, Application, Thickness (2018-2022)

8.6.1 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Country (2018-2022)

8.6.2 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Type (2018-2022)

8.6.3 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Applications (2018-2022)

9 Company Profiles

10 Global Idiopathic Pulmonary Fibrosis Market Revenue (USD Million), by Type, and Applications (2023-2030)

10.1 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) and Market Share (%) by Type (2023-2030)

10.1.1 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million), and Market Share (%) by Type (2023-2030)

10.2 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) and Market Share (%) by Applications (2023-2030)

10.2.1 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million), and Market Share (%) by Applications (2023-2030)

11 Global Idiopathic Pulmonary Fibrosis Development Regional Status and Outlook Forecast

11.1 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Regions (2023-2030)

11.2 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Type, and Applications (2023-2030)

11.2.1 North America Idiopathic Pulmonary Fibrosis Revenue (USD) Million by Country (2023-2030)

11.2.2 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type (2023-2030)

11.2.3 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million), Market Share (%) by Applications (2023-2030)

11.3 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type, and Applications (2023-2030)

11.3.1 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Country (2023-2030)

11.3.2 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type (2023-2030)

11.3.3 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Applications (2023-2030)

11.4 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) by Type, and Applications (2023-2030)

11.4.1 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Country (2023-2030)

11.4.2 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type (2023-2030)

11.4.3 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Applications (2023-2030)

11.5 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type, and Applications (2023-2030)

11.5.1 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Country (2023-2030)

11.5.2 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type (2023-2030)

11.5.3 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Applications (2023-2030)

11.6 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type, and Applications (2023-2030)

11.6.1 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Region (2023-2030)

11.6.2 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Type (2023-2030)

11.6.3 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million), by Applications (2023-2030)

12 Methodology and Data Sources

12.1 Methodology/Research Approach

12.1.1 Research Programs/Design

12.1.2 Market Size Estimation

12.1.3 Market Breakdown and Data Triangulation

12.2 Data Sources

12.2.1 Secondary Sources

12.2.2 Primary Sources

12.3 Disclaimer

List Of Tables

Table 1 Market Segmentation Analysis

Table 2 Global Idiopathic Pulmonary Fibrosis Market Companies with Areas Served

Table 3 Products Offerings Global Idiopathic Pulmonary Fibrosis Market

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) And CAGR (%) By Type (2018-2030)

Table 8 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) And CAGR (%) By Applications (2018-2030)

Table 9 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) And CAGR (%) By Regions (2018-2030)

Table 10 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Table 11 Global Idiopathic Pulmonary Fibrosis Revenue Market Share (%) By Type (2018-2022)

Table 12 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Table 13 Global Idiopathic Pulmonary Fibrosis Revenue Market Share (%) By Applications (2018-2022)

Table 14 Global Idiopathic Pulmonary Fibrosis Market Revenue (USD Million) By Regions (2018-2022)

Table 15 Global Idiopathic Pulmonary Fibrosis Market Share (%) By Regions (2018-2022)

Table 16 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2018-2022)

Table 17 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Table 18 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Table 19 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2018-2022)

Table 20 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Table 21 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Table 22 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2018-2022)

Table 23 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Table 24 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Table 25 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2018-2022)

Table 26 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Table 27 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Table 28 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Region (2018-2022)

Table 29 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Table 30 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Table 31 Financial Analysis

Table 32 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Table 33 Global Idiopathic Pulmonary Fibrosis Revenue Market Share (%) By Type (2023-2030)

Table 34 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Table 35 Global Idiopathic Pulmonary Fibrosis Revenue Market Share (%) By Applications (2023-2030)

Table 36 Global Idiopathic Pulmonary Fibrosis Market Revenue (USD Million), And Revenue (USD Million) By Regions (2023-2030)

Table 37 North America Idiopathic Pulmonary Fibrosis Revenue (USD)By Country (2023-2030)

Table 38 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Table 39 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Table 40 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2023-2030)

Table 41 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Table 42 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Table 43 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2023-2030)

Table 44 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Table 45 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Table 46 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2023-2030)

Table 47 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Table 48 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Table 49 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Region (2023-2030)

Table 50 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Region (2023-2030)

Table 51 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Table 52 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Table 53 Research Programs/Design for This Report

Table 54 Key Data Information from Secondary Sources

Table 55 Key Data Information from Primary Sources

List Of Figures

Figure 1 Market Scope

Figure 2 Porter’s Five Forces

Figure 3 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Figure 4 Global Idiopathic Pulmonary Fibrosis Revenue Market Share (%) By Type (2022)

Figure 5 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Figure 6 Global Idiopathic Pulmonary Fibrosis Revenue Market Share (%) By Applications (2022)

Figure 7 Global Idiopathic Pulmonary Fibrosis Market Revenue (USD Million) By Regions (2018-2022)

Figure 8 Global Idiopathic Pulmonary Fibrosis Market Share (%) By Regions (2022)

Figure 9 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2018-2022)

Figure 10 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Figure 11 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Figure 12 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2018-2022)

Figure 13 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Figure 14 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Figure 15 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2018-2022)

Figure 16 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Figure 17 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Figure 18 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2018-2022)

Figure 19 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Figure 20 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Figure 21 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Region (2018-2022)

Figure 22 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2018-2022)

Figure 23 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2018-2022)

Figure 24 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Figure 25 Global Idiopathic Pulmonary Fibrosis Revenue Market Share (%) By Type (2030)

Figure 26 Global Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Figure 27 Global Idiopathic Pulmonary Fibrosis Revenue Market Share (%) By Applications (2030)

Figure 28 Global Idiopathic Pulmonary Fibrosis Market Revenue (USD Million) By Regions (2023-2030)

Figure 29 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2023-2030)

Figure 30 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Figure 31 North America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Figure 32 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2023-2030)

Figure 33 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Figure 34 Europe Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Figure 35 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2023-2030)

Figure 36 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Figure 37 Asia Pacific Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Figure 38 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Country (2023-2030)

Figure 39 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Figure 40 South America Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Figure 41 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Region (2023-2030)

Figure 42 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Region (2023-2030)

Figure 43 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Type (2023-2030)

Figure 44 Middle East and Africa Idiopathic Pulmonary Fibrosis Revenue (USD Million) By Applications (2023-2030)

Figure 45 Bottom-Up and Top-Down Approaches For This Report

Figure 46 Data Triangulation

Market Segmentation

By Drug Type

By Mechanism of Action

By Region

The global Idiopathic Pulmonary Fibrosis market size is estimated to be $3.1 Billion in 2023

The market registered a CAGR of 4.01% between 2023 and 2030.

F. Hoffmann-La Roche Ltd, Boehringer Ingelheim, Fibrinogen, Bristol Myers Squibb, Galecto, Liminal Biosciences, Promedior, Celgene Corp, Cipla Inc, Horizon Therapeutics plc

Nintedanib, Anti-Fibrotic Agent, and Asia Pacific are the fastest-growing segments in the market.