The global Medical Sensors Marketstudy analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Component (Flow Sensor, Biosensor, Temperature Sensor, Pressure Sensor, Others), By Application (Clinical Applications, Consumer Applications).

The Medical Sensors market in 2024 plays a crucial role in advancing healthcare diagnostics, monitoring, and treatment by providing real-time, accurate, and actionable data on patient physiology, disease progression, and therapeutic response. Medical sensors encompass a diverse range of sensing technologies, including electrochemical, optical, acoustic, pressure, temperature, and motion sensors, integrated into medical devices and systems such as patient monitors, wearable devices, implantable devices, diagnostic equipment, and point-of-care testing devices. These sensors enable continuous monitoring of vital signs, physiological parameters, and biomarkers, facilitating early detection of medical conditions, personalized treatment interventions, and remote patient management. Market dynamics are driven by factors such as the increasing prevalence of chronic diseases, growing demand for remote patient monitoring solutions, advancements in sensor miniaturization and connectivity, and rising investments in digital health technology. Collaboration between sensor manufacturers, healthcare providers, technology developers, and regulatory agencies fosters innovation in the medical sensors market, leading to the development of miniaturized, wireless, and energy-efficient sensor solutions that improve patient outcomes, enhance clinical workflows, and optimize healthcare delivery.

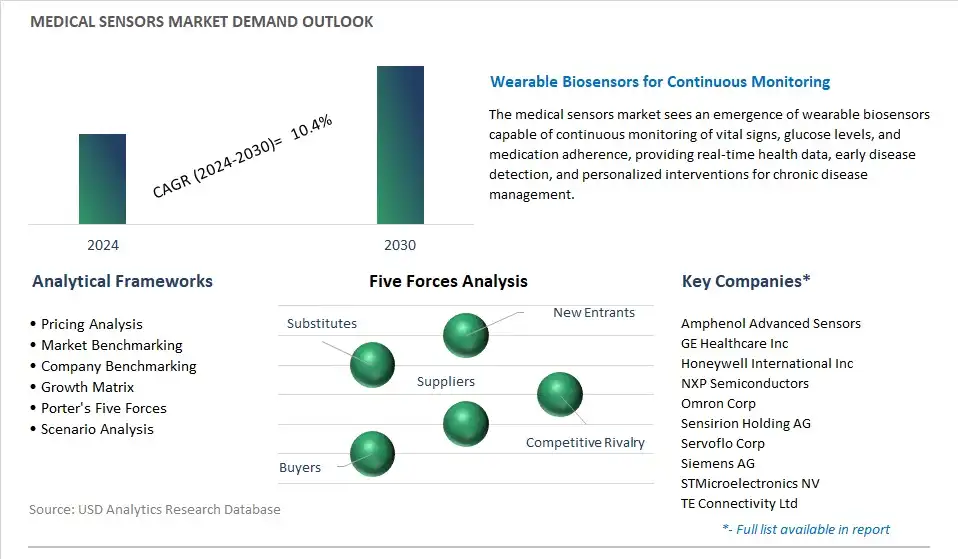

One prominent trend in the medical sensors market is the rapid advancements in wearable health technology. As wearable devices become increasingly sophisticated and affordable, there is a growing adoption of wearable sensors for monitoring various physiological parameters such as heart rate, blood pressure, glucose levels, and activity levels. These wearable sensors offer real-time data monitoring, remote patient monitoring capabilities, and insights into individual health metrics, empowering users to track their health status, manage chronic conditions, and make informed lifestyle choices. The trend towards wearable health technology reflects the convergence of healthcare and consumer electronics, driving innovation in medical sensors and expanding their applications beyond traditional healthcare settings.

A significant driver fueling the growth of the medical sensors market is the growing demand for remote patient monitoring and telehealth solutions. With the rise of chronic diseases, aging populations, and the increasing need for healthcare services, there is a shift towards remote care delivery models that enable continuous monitoring of patient health outside of traditional healthcare settings. Medical sensors play a crucial role in remote patient monitoring by capturing vital signs, physiological parameters, and biometric data, allowing healthcare providers to remotely monitor patient health status, detect early warning signs, and intervene proactively to prevent complications. The drive towards remote patient monitoring and telehealth solutions accelerates the adoption of medical sensors, driving market growth and innovation in sensor technology for healthcare applications.

An emerging opportunity in the medical sensors market lies in the integration of sensors with artificial intelligence (AI) and data analytics to derive actionable insights, personalize healthcare interventions, and improve patient outcomes. By leveraging AI algorithms and advanced data analytics techniques, healthcare providers can analyze large volumes of sensor data in real-time, identify patterns, predict health trends, and customize treatment plans based on individual patient needs. Additionally, integrating sensor data with electronic health records (EHRs) and other health information systems enables comprehensive health monitoring, data-driven decision-making, and population health management initiatives. The integration of medical sensors with AI and data analytics presents opportunities for market differentiation, innovation, and value creation in the evolving landscape of digital healthcare delivery.

By Component

Flow Sensor

Biosensor

Temperature Sensor

Pressure Sensor

Others

By Application

Clinical Applications

Consumer Applications

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amphenol Advanced Sensors

GE Healthcare Inc

Honeywell International Inc

NXP Semiconductors

Omron Corp

Sensirion Holding AG

Servoflo Corp

Siemens AG

STMicroelectronics NV

TE Connectivity Ltd

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Medical Sensors Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Medical Sensors Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Medical Sensors Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Medical Sensors Market Size Outlook, $ Million, 2021 to 2030

3.2 Medical Sensors Market Outlook by Type, $ Million, 2021 to 2030

3.3 Medical Sensors Market Outlook by Product, $ Million, 2021 to 2030

3.4 Medical Sensors Market Outlook by Application, $ Million, 2021 to 2030

3.5 Medical Sensors Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Medical Sensors Industry

4.2 Key Market Trends in Medical Sensors Industry

4.3 Potential Opportunities in Medical Sensors Industry

4.4 Key Challenges in Medical Sensors Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Medical Sensors Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Medical Sensors Market Outlook by Segments

7.1 Medical Sensors Market Outlook by Segments, $ Million, 2021- 2030

By Component

Flow Sensor

Biosensor

Temperature Sensor

Pressure Sensor

Others

By Application

Clinical Applications

Consumer Applications

8 North America Medical Sensors Market Analysis and Outlook To 2030

8.1 Introduction to North America Medical Sensors Markets in 2024

8.2 North America Medical Sensors Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Medical Sensors Market size Outlook by Segments, 2021-2030

By Component

Flow Sensor

Biosensor

Temperature Sensor

Pressure Sensor

Others

By Application

Clinical Applications

Consumer Applications

9 Europe Medical Sensors Market Analysis and Outlook To 2030

9.1 Introduction to Europe Medical Sensors Markets in 2024

9.2 Europe Medical Sensors Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Medical Sensors Market Size Outlook by Segments, 2021-2030

By Component

Flow Sensor

Biosensor

Temperature Sensor

Pressure Sensor

Others

By Application

Clinical Applications

Consumer Applications

10 Asia Pacific Medical Sensors Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Medical Sensors Markets in 2024

10.2 Asia Pacific Medical Sensors Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Medical Sensors Market size Outlook by Segments, 2021-2030

By Component

Flow Sensor

Biosensor

Temperature Sensor

Pressure Sensor

Others

By Application

Clinical Applications

Consumer Applications

11 South America Medical Sensors Market Analysis and Outlook To 2030

11.1 Introduction to South America Medical Sensors Markets in 2024

11.2 South America Medical Sensors Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Medical Sensors Market size Outlook by Segments, 2021-2030

By Component

Flow Sensor

Biosensor

Temperature Sensor

Pressure Sensor

Others

By Application

Clinical Applications

Consumer Applications

12 Middle East and Africa Medical Sensors Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Medical Sensors Markets in 2024

12.2 Middle East and Africa Medical Sensors Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Medical Sensors Market size Outlook by Segments, 2021-2030

By Component

Flow Sensor

Biosensor

Temperature Sensor

Pressure Sensor

Others

By Application

Clinical Applications

Consumer Applications

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Amphenol Advanced Sensors

GE Healthcare Inc

Honeywell International Inc

NXP Semiconductors

Omron Corp

Sensirion Holding AG

Servoflo Corp

Siemens AG

STMicroelectronics NV

TE Connectivity Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Component

Flow Sensor

Biosensor

Temperature Sensor

Pressure Sensor

Others

By Application

Clinical Applications

Consumer Applications

The global Medical Sensors Market is one of the lucrative growth markets, poised to register a 10.4% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amphenol Advanced Sensors, GE Healthcare Inc, Honeywell International Inc, NXP Semiconductors, Omron Corp, Sensirion Holding AG, Servoflo Corp, Siemens AG, STMicroelectronics NV, TE Connectivity Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume