The global Metal Additive Manufacturing Market Size is estimated to be $4.9 Billion in 2023 and is poised to register 22.85% growth over the forecast period from 2024 to 2032.

Increasing demand from the aerospace & defense industries, Mass production of components, Potential Opportunities in academic institutions, and Increased usage of metal-based additive manufacturing in Industrial applications are among the main market dynamics

Additive manufacturing is one of the rapidly emerging technologies in manufacturing with the rapid shift in applications from mere plastic prototyping to mass production of complex parts across end-user verticals. The application verticals of the technology also expanded rapidly during the past few years including automotive, aerospace and defense, industrial applications, consumer goods, medical, academic institutions, oil and gas, electronics, railways, building, and construction. However, metal-based printing is largely restricted to dental, construction, aerospace, and automotive, among others.

Further, the industry witnessed a significant surge in the choice of materials used for printing including polymers, ceramics, and metals. Of these, metallic materials are attracting customers from both industrial and research segments. The main advantages of metal-based manufacturing offer advantages of reduced wastage, enhanced quality of the end product, lower pollutant emissions, and on-demand production.

Among metals, the choice of metals for printing is increasing steadily but those suitable for production in current conditions include aluminum and alloys, stainless steel, titanium, copper, nickel, platinum, palladium, tantalum, gold, silver, and others. A significant volume of the research on metal additive manufacturing is devoted to identifying new metals, alloys, and combinations for use in manufacturing. New materials such as magnetic alloys, functionally graded materials, nano-architected metals, and others are widely being researched.

Continuous research and development in metal-based additive manufacturing across the value chain including material, systems, software, application design, and production phases are being observed. Technological advancements have supported the use of metal additive manufacturing for producing complex geometric parts. Though currently, low volume production is being observed, these advancements are likely to support the mass-scale production of complex parts over the forecast period.

On the other hand, in addition to a limited choice of metals, other challenges associated with metal-based 3D printing such as low printing quality, high maintenance requirements, part size limitations, varying standards across countries, and initial costs involved in setup, can pose restrictions to the market growth.

The aircraft industry is one of the early adopters of 3D printing technology. Driven by the advantages of lower costs and reduced weight, aerospace companies are widely opting for manufacturing complex parts of aircraft including wings, jigs, and engine components.

For instance, in May 2021, GE Aviation announced that the company is replacing investment casting with 3D printing for four bleed air parts from a land/marine turbine. The company also uses the GE Leap engine fuel nozzle, a Turboprop engine made from additive manufacturing technology.

In 2020, Latvia-based AM Craft purchased four large-scale production-grade Stratasys F900 3D Printers for its aircraft interiors. Similarly, in 2019, Spirit AeroSystems installed a titanium structural component in Boeing 787. Airbus also uses metal brackets and bleed pipes, turbine cover door hinges made from the metal additive manufacturing process.

Further, companies are also focusing on using additive manufacturing for the repair and maintenance of components, which will support strong market growth. GE also plans to extend the technology to aircraft by enabling speedy printing of the products.

Titanium and its alloys are among the widely used metals in the aerospace industry due to their superior mechanical properties and accuracy levels. With declining production costs, industrial mass production continues to grow in the aerospace industry, which will support the market growth outlook over the forecast period.

The sales of metal additive manufacturing printers, materials, services, and software for mass-scale production of direct components are the main market driver for the expansion of the industry. Mass customization is set to drive the demand for complex and tailor-made designs.

The drive towards direct parts production is supporting the market growth. In particular, jewelry, home décor, fashion, watchmaking, and architecture industries are quickly adopting the technology. The technology offers design flexibility and freedom of creating using metals such as gold, titanium, and other metals.

Further, more spare parts and components are being planned for mass production in the automotive sector. Metal frames, functional electronics such as sensors and antenna patterns, and other components are also being produced on a mass scale for use in electronic devices such as smartphones, tablet components, and covers.

Mass customization is also one of the potential market drivers in the healthcare industry, as it offers design and production flexibility to build metal objects. Implants, devices, tools, and supplies are widely being produced in the industry, customized to individual requirements.

The global Metal Additive Manufacturing Market is segmented into Types, Applications, and Countries.

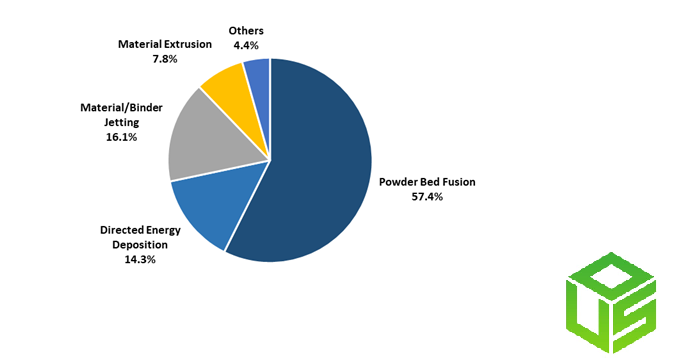

The powder bed fusion process functions on the principle of fusing material particles. It uses heat sources such as laser or electron beams to melt and fuse material powder that enables the manufacturing of a vast array of geometrically complex products.

The 3D printing technology is the largest used technology worldwide as manufacturers can benefit from substantial advantages such as a relatively inexpensive process, large range of material options, freedom of design, used widely for visual models and prototypes, reduced material wastage, enables rapid prototyping and low volume production and fast product development times among others.

There are several variants of powder bed fusion technology, based on the type of heat source and the materials used. The different Powder Bed Fusion methods notably include- Selective laser sintering (SLS), Selective Laser Melting (SLM), Selective Heat Sintering (SHS), Direct Metal Laser Sintering (DMLS), Electron Beam Melting (EBM), and others.

SLS- SLS technology uses a computer-controlled CO2 laser beam to coalesce powdered material layer-by-layer and creates a solid structure. The technology does not require an additional support structure, provides high thermal resistance, and is widely used for batch production. However, it typically uses plastics as raw materials. The surface finish produced by SLS is also rough compared to other 3D printing technologies.

Aerospace and Defence remain the dominant user of Metal Additive Manufacturing during the forecast period

Aerospace companies were some of the first to adopt additive manufacturing. Continuous advancements in technologies are supporting a wide range of metals and alloys to be used in the industry. The commercial aircraft industry is among the early adopters of additive manufacturing. Further, defense mechanisms including military applications and missile systems also widely used 3D printing technologies.

Lower costs, faster lead times, design flexibility and ability to print small and extremely complex parts, and weight reduction advantages among others are the main drivers for the rapid adoption of 3D printing in the aerospace and defense industries.

Wide range of applications from the manufacturing of on-demand MRO, internal parts such as air filter boxes, brackets, fuel tanks, interior components, clips and clamps, external parts such as Battery compartments, Camera mount and gimbal, Propulsion components, Rocket motors, Fuel injectors, Combustion chambers, Payload enclosures, and others are produced through additive manufacturing.

Leading aerospace players such as Boeing, Airbus, GE Aviation, and others continue to rely on 3D printing for manufacturing products on a production scale. For instance, GE Aviation produces LEAP fuel nozzles and Turboprop engines, and Airbus is using 3D printing for metal brackets and bleed pipes, cover door Hinges, and titanium parts.

Driven by the US, North America dominates the global Metal Additive Manufacturing market.

United States- The US is the largest consumer of metal additive manufacturing worldwide. Widespread use in industrial production to create lighter, stronger parts and systems is supporting the market outlook.

The US is the major consumer of additive manufacturing due to the early adoption of the technology across a wide range of end-use industries. Low interest rates coupled with the presence of a large number of additive manufacturing service providers support the market growth.

In addition to aerospace and defense, automotive and medical industries, applications for additive manufacturing are expanding. 3D printing services exist all around the country, offering a wide range of services from rapid prototyping services to 3D software services for creating custom STL files.

Prototyping is the widely used application segment in the country with both companies and research organizations opting for the application. Components are manufactured directly from a 3D CAD file, which eliminates the cost and lengthy process of having fixtures or dies created.

Leading companies are offering wide applications such as manufacturing, jigs & fixtures, production components, prototyping, packaging applications, design, and composite tooling. Business expansions, partnerships, and collaborations coupled with new product launches are among the leading growth strategies opted by companies in the country.

By Type

By Application

By Region

Leading companies profiled in the study include-

Metal Additive Manufacturing Market Outlook 2023

1 Market Overview

1.1 Introduction to Metal Additive Manufacturing Market

1.2 Scope of the Study

1.3 Research Objective

1.3.1 Key Market Scope and Segments

1.3.2 Players Covered

1.3.3 Years Considered

2 Executive Summary

2.1 2023 Metal Additive Manufacturing Industry- Market Statistics

3 Market Dynamics

3.1 Market Drivers

3.2 Market Challenges

3.3 Market Opportunities

3.4 Market Trends

4 Market Factor Analysis

4.1 Porter’s Five Forces

4.2 Market Entropy

4.2.1 Global Metal Additive Manufacturing Market Companies with Area Served

4.2.2 Products Offerings Global Metal Additive Manufacturing Market

5 COVID-19 Impact Analysis and Outlook Scenarios

5.1.1 Covid-19 Impact Analysis

5.1.2 Post-COVID-19 Scenario- Low Growth Case

5.1.3 Post-COVID-19 Scenario- Reference Growth Case

5.1.4 Post-COVID-19 Scenario- Low Growth Case

6 Global Metal Additive Manufacturing Market Trends

6.1 Global Metal Additive Manufacturing Revenue (USD Million) and CAGR (%) by Type (2018-2028)

6.2 Global Metal Additive Manufacturing Revenue (USD Million) and CAGR (%) by Applications (2018-2028)

6.3 Global Metal Additive Manufacturing Revenue (USD Million) and CAGR (%) by Regions (2018-2028)

7 Global Metal Additive Manufacturing Market Revenue (USD Million) by Type, and Applications (2018-2022)

7.1 Global Metal Additive Manufacturing Revenue (USD Million) by Type (2018-2022)

7.1.1 Global Metal Additive Manufacturing Revenue (USD Million), Market Share (%) by Type (2018-2022)

7.2 Global Metal Additive Manufacturing Revenue (USD Million) by Applications (2018-2022)

7.2.1 Global Metal Additive Manufacturing Revenue (USD Million), Market Share (%) by Applications (2018-2022)

8 Global Metal Additive Manufacturing Development Regional Status and Outlook

8.1 Global Metal Additive Manufacturing Revenue (USD Million) By Regions (2018-2022)

8.2 North America Metal Additive Manufacturing Revenue (USD Million) by Type, and Application (2018-2022)

8.2.1 North America Metal Additive Manufacturing Revenue (USD Million) by Country (2018-2022)

8.2.2 North America Metal Additive Manufacturing Revenue (USD Million) by Type (2018-2022)

8.2.3 North America Metal Additive Manufacturing Revenue (USD Million) by Applications (2018-2022)

8.3 Europe Metal Additive Manufacturing Revenue (USD Million), by Type, and Applications (USD Million) (2018-2022)

8.3.1 Europe Metal Additive Manufacturing Revenue (USD Million), by Country (2018-2022)

8.3.2 Europe Metal Additive Manufacturing Revenue (USD Million) by Type (2018-2022)

8.3.3 Europe Metal Additive Manufacturing Revenue (USD Million) by Applications (2018-2022)

8.4 Asia Pacific Metal Additive Manufacturing Revenue (USD Million), and Revenue (USD Million) by Type, and Applications (2018-2022)

8.4.1 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) by Country (2018-2022)

8.4.2 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) by Type (2018-2022)

8.4.3 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) by Applications (2018-2022)

8.5 South America Metal Additive Manufacturing Revenue (USD Million), by Type, and Applications (2018-2022)

8.5.1 South America Metal Additive Manufacturing Revenue (USD Million), by Country (2018-2022)

8.5.2 South America Metal Additive Manufacturing Revenue (USD Million) by Type (2018-2022)

8.5.3 South America Metal Additive Manufacturing Revenue (USD Million) by Applications (2018-2022)

8.6 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million), by Type, Technology, Application, Thickness (2018-2022)

8.6.1 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) by Country (2018-2022)

8.6.2 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) by Type (2018-2022)

8.6.3 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) by Applications (2018-2022)

9 Company Profiles

10 Global Metal Additive Manufacturing Market Revenue (USD Million), by Type, and Applications (2023-2028)

10.1 Global Metal Additive Manufacturing Revenue (USD Million) and Market Share (%) by Type (2023-2028)

10.1.1 Global Metal Additive Manufacturing Revenue (USD Million), and Market Share (%) by Type (2023-2028)

10.2 Global Metal Additive Manufacturing Revenue (USD Million) and Market Share (%) by Applications (2023-2028)

10.2.1 Global Metal Additive Manufacturing Revenue (USD Million), and Market Share (%) by Applications (2023-2028)

11 Global Metal Additive Manufacturing Development Regional Status and Outlook Forecast

11.1 Global Metal Additive Manufacturing Revenue (USD Million) By Regions (2023-2028)

11.2 North America Metal Additive Manufacturing Revenue (USD Million) by Type, and Applications (2023-2028)

11.2.1 North America Metal Additive Manufacturing Revenue (USD) Million by Country (2023-2028)

11.2.2 North America Metal Additive Manufacturing Revenue (USD Million), by Type (2023-2028)

11.2.3 North America Metal Additive Manufacturing Revenue (USD Million), Market Share (%) by Applications (2023-2028)

11.3 Europe Metal Additive Manufacturing Revenue (USD Million), by Type, and Applications (2023-2028)

11.3.1 Europe Metal Additive Manufacturing Revenue (USD Million), by Country (2023-2028)

11.3.2 Europe Metal Additive Manufacturing Revenue (USD Million), by Type (2023-2028)

11.3.3 Europe Metal Additive Manufacturing Revenue (USD Million), by Applications (2023-2028)

11.4 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) by Type, and Applications (2023-2028)

11.4.1 Asia Pacific Metal Additive Manufacturing Revenue (USD Million), by Country (2023-2028)

11.4.2 Asia Pacific Metal Additive Manufacturing Revenue (USD Million), by Type (2023-2028)

11.4.3 Asia Pacific Metal Additive Manufacturing Revenue (USD Million), by Applications (2023-2028)

11.5 South America Metal Additive Manufacturing Revenue (USD Million), by Type, and Applications (2023-2028)

11.5.1 South America Metal Additive Manufacturing Revenue (USD Million), by Country (2023-2028)

11.5.2 South America Metal Additive Manufacturing Revenue (USD Million), by Type (2023-2028)

11.5.3 South America Metal Additive Manufacturing Revenue (USD Million), by Applications (2023-2028)

11.6 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million), by Type, and Applications (2023-2028)

11.6.1 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million), by Region (2023-2028)

11.6.2 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million), by Type (2023-2028)

11.6.3 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million), by Applications (2023-2028)

12 Methodology and Data Sources

12.1 Methodology/Research Approach

12.1.1 Research Programs/Design

12.1.2 Market Size Estimation

12.1.3 Market Breakdown and Data Triangulation

12.2 Data Sources

12.2.1 Secondary Sources

12.2.2 Primary Sources

12.3 Disclaimer

List Of Tables

Table 1 Market Segmentation Analysis

Table 2 Global Metal Additive Manufacturing Market Companies with Areas Served

Table 3 Products Offerings Global Metal Additive Manufacturing Market

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Metal Additive Manufacturing Revenue (USD Million) And CAGR (%) By Type (2018-2028)

Table 8 Global Metal Additive Manufacturing Revenue (USD Million) And CAGR (%) By Applications (2018-2028)

Table 9 Global Metal Additive Manufacturing Revenue (USD Million) And CAGR (%) By Regions (2018-2028)

Table 10 Global Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Table 11 Global Metal Additive Manufacturing Revenue Market Share (%) By Type (2018-2022)

Table 12 Global Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Table 13 Global Metal Additive Manufacturing Revenue Market Share (%) By Applications (2018-2022)

Table 14 Global Metal Additive Manufacturing Market Revenue (USD Million) By Regions (2018-2022)

Table 15 Global Metal Additive Manufacturing Market Share (%) By Regions (2018-2022)

Table 16 North America Metal Additive Manufacturing Revenue (USD Million) By Country (2018-2022)

Table 17 North America Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Table 18 North America Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Table 19 Europe Metal Additive Manufacturing Revenue (USD Million) By Country (2018-2022)

Table 20 Europe Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Table 21 Europe Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Table 22 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Country (2018-2022)

Table 23 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Table 24 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Table 25 South America Metal Additive Manufacturing Revenue (USD Million) By Country (2018-2022)

Table 26 South America Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Table 27 South America Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Table 28 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Region (2018-2022)

Table 29 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Table 30 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Table 31 Financial Analysis

Table 32 Global Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Table 33 Global Metal Additive Manufacturing Revenue Market Share (%) By Type (2023-2028)

Table 34 Global Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Table 35 Global Metal Additive Manufacturing Revenue Market Share (%) By Applications (2023-2028)

Table 36 Global Metal Additive Manufacturing Market Revenue (USD Million), And Revenue (USD Million) By Regions (2023-2028)

Table 37 North America Metal Additive Manufacturing Revenue (USD)By Country (2023-2028)

Table 38 North America Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Table 39 North America Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Table 40 Europe Metal Additive Manufacturing Revenue (USD Million) By Country (2023-2028)

Table 41 Europe Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Table 42 Europe Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Table 43 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Country (2023-2028)

Table 44 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Table 45 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Table 46 South America Metal Additive Manufacturing Revenue (USD Million) By Country (2023-2028)

Table 47 South America Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Table 48 South America Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Table 49 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Region (2023-2028)

Table 50 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Region (2023-2028)

Table 51 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Table 52 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Table 53 Research Programs/Design for This Report

Table 54 Key Data Information from Secondary Sources

Table 55 Key Data Information from Primary Sources

List Of Figures

Figure 1 Market Scope

Figure 2 Porter’s Five Forces

Figure 3 Global Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Figure 4 Global Metal Additive Manufacturing Revenue Market Share (%) By Type (2022)

Figure 5 Global Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Figure 6 Global Metal Additive Manufacturing Revenue Market Share (%) By Applications (2022)

Figure 7 Global Metal Additive Manufacturing Market Revenue (USD Million) By Regions (2018-2022)

Figure 8 Global Metal Additive Manufacturing Market Share (%) By Regions (2022)

Figure 9 North America Metal Additive Manufacturing Revenue (USD Million) By Country (2018-2022)

Figure 10 North America Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Figure 11 North America Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Figure 12 Europe Metal Additive Manufacturing Revenue (USD Million) By Country (2018-2022)

Figure 13 Europe Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Figure 14 Europe Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Figure 15 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Country (2018-2022)

Figure 16 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Figure 17 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Figure 18 South America Metal Additive Manufacturing Revenue (USD Million) By Country (2018-2022)

Figure 19 South America Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Figure 20 South America Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Figure 21 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Region (2018-2022)

Figure 22 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Type (2018-2022)

Figure 23 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Applications (2018-2022)

Figure 24 Global Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Figure 25 Global Metal Additive Manufacturing Revenue Market Share (%) By Type (2028)

Figure 26 Global Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Figure 27 Global Metal Additive Manufacturing Revenue Market Share (%) By Applications (2028)

Figure 28 Global Metal Additive Manufacturing Market Revenue (USD Million) By Regions (2023-2028)

Figure 29 North America Metal Additive Manufacturing Revenue (USD Million) By Country (2023-2028)

Figure 30 North America Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Figure 31 North America Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Figure 32 Europe Metal Additive Manufacturing Revenue (USD Million) By Country (2023-2028)

Figure 33 Europe Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Figure 34 Europe Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Figure 35 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Country (2023-2028)

Figure 36 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Figure 37 Asia Pacific Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Figure 38 South America Metal Additive Manufacturing Revenue (USD Million) By Country (2023-2028)

Figure 39 South America Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Figure 40 South America Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Figure 41 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Region (2023-2028)

Figure 42 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Region (2023-2028)

Figure 43 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Type (2023-2028)

Figure 44 Middle East and Africa Metal Additive Manufacturing Revenue (USD Million) By Applications (2023-2028)

Figure 45 Bottom-Up and Top-Down Approaches For This Report

Figure 46 Data Triangulation

By Type

By Application

By Region

The global Metal Additive Manufacturing Market Size is estimated to be $5.1 Billion in 2023.

The market is poised to register 22.85% growth over the forecast period from 2023 to 2030.

Norsk Titanium AS, EOS Optical Systems, Stratasys Ltd, 3D Systems Corp, Materialise N.V., GE Additive, Sisma Spa, BeAM S.A.S, Farsoon Technologies, DMG Mori

Powder Bed Fusion, Aerospace and Defence, and Asia Pacific are the fastest-growing segments in the market.