The global Molded Fiber Packaging Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Trays, Clamshell Containers, Boxes, End Cap, Others), By Type (Thick-Wall, Transfer Molded, Thermoformed Fiber, Processed Pulp), By Source (Wood Pulp, Non-Wood Pulp), By End-User (Food and Beverage, Electronics, Personal Care, Healthcare, Others).

The market for molded fiber packaging is experiencing growth driven by the increasing demand for sustainable, biodegradable, and compostable packaging solutions in industries such as food and beverage, electronics, and healthcare. Key trends shaping the future of the industry include innovations in molded fiber manufacturing processes, material formulations, and product designs to meet consumer preferences for eco-friendly packaging options and regulatory requirements for packaging waste reduction. Advanced molded fiber packaging offers features such as shock absorption, moisture resistance, and customizability, ensuring product protection and branding opportunities while minimizing environmental impact. Moreover, the integration of recycled fibers, renewable resources, and closed-loop production systems addresses concerns about plastic pollution, carbon emissions, and resource depletion. Additionally, the growing emphasis on circular economy principles, waste management, and brand sustainability drives market demand for molded fiber packaging that supports responsible consumption and production practices. As brands and consumers prioritize packaging solutions that balance performance, sustainability, and cost-effectiveness, the molded fiber packaging market is poised for continued growth and innovation as a preferred choice for eco-conscious packaging across various industries.

The market report analyses the leading companies in the industry including EnviroPAK Corp, ESCO Technologies Inc, Henry Molded Products Inc, Heracles Packaging Co. SA, Huhtamäki Oyj, Orcon Industries Corp, Pactiv LLC, Paul Hartmann AG, ProtoPak Engineering Corp, UFP Technologies Inc.

A prominent trend in the molded fiber packaging market is the increasing demand for sustainable packaging solutions driven by environmental concerns and consumer preferences. Molded fiber packaging, made from recycled paper and other biodegradable materials, offers a eco-friendly alternative to traditional packaging materials such as plastics and foams. With growing awareness of plastic pollution and waste management issues, businesses across various industries are adopting molded fiber packaging for its renewable, compostable, and recyclable properties. Moreover, advancements in manufacturing technologies and product design are enhancing the performance, versatility, and aesthetic appeal of molded fiber packaging, driving its adoption in diverse applications including food and beverage, electronics, cosmetics, and healthcare.

The primary driver behind the growth of the molded fiber packaging market is the regulatory push towards eco-friendly packaging solutions aimed at reducing environmental impact and promoting sustainability. Governments around the world are implementing stringent regulations and policies to curb plastic waste, encourage recycling, and promote the use of biodegradable packaging materials. In response to these regulations, businesses are seeking alternative packaging solutions that align with sustainability goals and comply with regulatory requirements. Molded fiber packaging emerges as a viable option due to its eco-friendly attributes and ability to meet regulatory standards for packaging materials. Additionally, consumer awareness and advocacy for sustainable products further drive demand for molded fiber packaging, influencing purchasing decisions and shaping market dynamics.

An opportunity for market growth within the molded fiber packaging sector lies in offering customization and branding opportunities to businesses seeking to differentiate their products and enhance consumer engagement. Molded fiber packaging can be easily customized in terms of shape, size, color, and branding, allowing companies to create unique packaging designs that reflect their brand identity and resonate with their target audience. By offering personalized packaging solutions, manufacturers and suppliers can help businesses stand out in a competitive marketplace, strengthen brand loyalty, and enhance the overall customer experience. Moreover, innovations in printing technologies and surface treatments enable the incorporation of branding elements, graphics, and messaging onto molded fiber packaging, providing opportunities for creative expression and effective communication with consumers. Embracing customization and branding as key value propositions can unlock new revenue streams and drive market expansion in the molded fiber packaging industry.

The largest segment in the Molded Fiber Packaging Market is the Trays segment. This dominance is primarily due to diverse factors. Trays made from molded fiber are widely used for packaging various products across industries such as food and beverage, electronics, healthcare, and consumer goods. Molded fiber trays offer versatility, strength, and sustainability, making them suitable for a wide range of applications. Additionally, molded fiber trays provide excellent cushioning and protection for fragile items during transportation and handling, ensuring product safety and integrity. In addition, molded fiber trays are eco-friendly and biodegradable, aligning with the growing consumer demand for sustainable packaging solutions. Further, the trays segment includes a diverse range of tray types and sizes, catering to different product shapes, sizes, and packaging requirements. Whether it's for food packaging, electronics, or medical devices, molded fiber trays offer customizable solutions to meet specific needs. Over the forecast period, the combination of versatility, protection, sustainability, and customization options positions the Trays segment as the largest and most significant segment in the Molded Fiber Packaging Market.

The fastest-growing segment in the Molded Fiber Packaging Market is thermoformed Fiber segment. This growth is driven by Thermoformed fiber packaging offers numerous advantages over traditional molded fiber packaging methods. The thermoformed fiber packaging allows for the production of complex shapes and intricate designs with precise detail and accuracy, enabling customization to meet specific product packaging requirements. Additionally, thermoformed fiber packaging offers enhanced strength, durability, and protection for packaged products, making it suitable for a wide range of applications, including electronics, healthcare, and consumer goods. In addition, thermoformed fiber packaging is lightweight and cost-effective, providing an economical packaging solution for manufacturers while reducing transportation costs and environmental impact. Further, advancements in thermoforming technology, including automation, process optimization, and material innovation, have improved production efficiency and scalability, driving the adoption of thermoformed fiber packaging in various industries. Over the forecast period, the combination of versatility, performance, cost-effectiveness, and technological advancements positions thermoformed Fiber segment as the fastest-growing segment in the Molded Fiber Packaging Market.

The fastest-growing segment in the Molded Fiber Packaging Market is the Non-Wood Pulp segment. The rapid growth is driven by non-wood pulp, such as agricultural residues, recycled paper, and alternative fibers like bamboo and bagasse, offers sustainability benefits over traditional wood pulp. As environmental concerns continue to drive demand for eco-friendly packaging solutions, manufacturers are increasingly turning to non-wood pulp as a renewable and environmentally friendly material for molded fiber packaging. Additionally, non-wood pulp often requires less water and energy to produce compared to wood pulp, further reducing the environmental footprint of molded fiber packaging production. In addition, non-wood pulp sources are often more readily available and cost-effective than wood pulp, making them an attractive option for manufacturers seeking sustainable and affordable packaging materials. Further, advancements in processing technologies and fiber sourcing strategies have improved the quality and performance of non-wood pulp, expanding its applicability and driving its adoption in the molded fiber packaging industry. Over the forecast period, the combination of sustainability, cost-effectiveness, and technological advancements positions the Non-Wood Pulp segment as the fastest-growing segment in the Molded Fiber Packaging Market.

By Product

Trays

Clamshell Containers

Boxes

End Cap

Others

By Type

Thick-Wall

Transfer Molded

Thermoformed Fiber

Processed Pulp

By Source

Wood Pulp

Non-Wood Pulp

By End-User

Food and Beverage

Electronics

Personal Care

Healthcare

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

EnviroPAK Corp

ESCO Technologies Inc

Henry Molded Products Inc

Heracles Packaging Co. SA

Huhtamäki Oyj

Orcon Industries Corp

Pactiv LLC

Paul Hartmann AG

ProtoPak Engineering Corp

UFP Technologies Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Molded Fiber Packaging Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

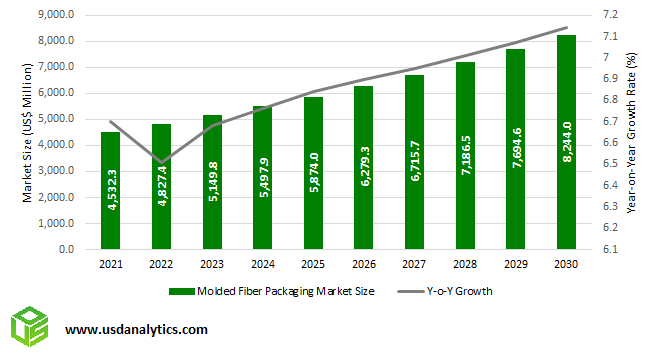

3.1 Global Molded Fiber Packaging Market Size Outlook, $ Million, 2021 to 2030

3.2 Molded Fiber Packaging Market Outlook by Type, $ Million, 2021 to 2030

3.3 Molded Fiber Packaging Market Outlook by Product, $ Million, 2021 to 2030

3.4 Molded Fiber Packaging Market Outlook by Application, $ Million, 2021 to 2030

3.5 Molded Fiber Packaging Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Molded Fiber Packaging Industry

4.2 Key Market Trends in Molded Fiber Packaging Industry

4.3 Potential Opportunities in Molded Fiber Packaging Industry

4.4 Key Challenges in Molded Fiber Packaging Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Molded Fiber Packaging Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Molded Fiber Packaging Market Outlook by Segments

7.1 Molded Fiber Packaging Market Outlook by Segments, $ Million, 2021- 2030

By Product

Trays

Clamshell Containers

Boxes

End Cap

Others

By Type

Thick-Wall

Transfer Molded

Thermoformed Fiber

Processed Pulp

By Source

Wood Pulp

Non-Wood Pulp

By End-User

Food and Beverage

Electronics

Personal Care

Healthcare

Others

8 North America Molded Fiber Packaging Market Analysis and Outlook To 2030

8.1 Introduction to North America Molded Fiber Packaging Markets in 2024

8.2 North America Molded Fiber Packaging Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Molded Fiber Packaging Market size Outlook by Segments, 2021-2030

By Product

Trays

Clamshell Containers

Boxes

End Cap

Others

By Type

Thick-Wall

Transfer Molded

Thermoformed Fiber

Processed Pulp

By Source

Wood Pulp

Non-Wood Pulp

By End-User

Food and Beverage

Electronics

Personal Care

Healthcare

Others

9 Europe Molded Fiber Packaging Market Analysis and Outlook To 2030

9.1 Introduction to Europe Molded Fiber Packaging Markets in 2024

9.2 Europe Molded Fiber Packaging Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Molded Fiber Packaging Market Size Outlook by Segments, 2021-2030

By Product

Trays

Clamshell Containers

Boxes

End Cap

Others

By Type

Thick-Wall

Transfer Molded

Thermoformed Fiber

Processed Pulp

By Source

Wood Pulp

Non-Wood Pulp

By End-User

Food and Beverage

Electronics

Personal Care

Healthcare

Others

10 Asia Pacific Molded Fiber Packaging Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Molded Fiber Packaging Markets in 2024

10.2 Asia Pacific Molded Fiber Packaging Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Molded Fiber Packaging Market size Outlook by Segments, 2021-2030

By Product

Trays

Clamshell Containers

Boxes

End Cap

Others

By Type

Thick-Wall

Transfer Molded

Thermoformed Fiber

Processed Pulp

By Source

Wood Pulp

Non-Wood Pulp

By End-User

Food and Beverage

Electronics

Personal Care

Healthcare

Others

11 South America Molded Fiber Packaging Market Analysis and Outlook To 2030

11.1 Introduction to South America Molded Fiber Packaging Markets in 2024

11.2 South America Molded Fiber Packaging Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Molded Fiber Packaging Market size Outlook by Segments, 2021-2030

By Product

Trays

Clamshell Containers

Boxes

End Cap

Others

By Type

Thick-Wall

Transfer Molded

Thermoformed Fiber

Processed Pulp

By Source

Wood Pulp

Non-Wood Pulp

By End-User

Food and Beverage

Electronics

Personal Care

Healthcare

Others

12 Middle East and Africa Molded Fiber Packaging Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Molded Fiber Packaging Markets in 2024

12.2 Middle East and Africa Molded Fiber Packaging Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Molded Fiber Packaging Market size Outlook by Segments, 2021-2030

By Product

Trays

Clamshell Containers

Boxes

End Cap

Others

By Type

Thick-Wall

Transfer Molded

Thermoformed Fiber

Processed Pulp

By Source

Wood Pulp

Non-Wood Pulp

By End-User

Food and Beverage

Electronics

Personal Care

Healthcare

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

EnviroPAK Corp

ESCO Technologies Inc

Henry Molded Products Inc

Heracles Packaging Co. SA

Huhtamäki Oyj

Orcon Industries Corp

Pactiv LLC

Paul Hartmann AG

ProtoPak Engineering Corp

UFP Technologies Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Trays

Clamshell Containers

Boxes

End Cap

Others

By Type

Thick-Wall

Transfer Molded

Thermoformed Fiber

Processed Pulp

By Source

Wood Pulp

Non-Wood Pulp

By End-User

Food and Beverage

Electronics

Personal Care

Healthcare

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Molded Fiber Packaging is forecast to reach $9.8 Billion in 2030 from $7.5 Billion in 2024, registering a CAGR of 4.6%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

EnviroPAK Corp, ESCO Technologies Inc, Henry Molded Products Inc, Heracles Packaging Co. SA, Huhtamäki Oyj, Orcon Industries Corp, Pactiv LLC, Paul Hartmann AG, ProtoPak Engineering Corp, UFP Technologies Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume