The smart connected insulin pens, caps, and attachments market is a comprehensive study of different types, applications, companies, and countries. It provides a detailed outlook across prefilled and reusable types, first-generation and second-generation smart-connected insulin pens, caps, and attachments. Further, market revenue forecasts across hospitals, clinics, ambulatory service centers, and home care settings are provided in the report.

Smart Connected Insulin Pens, Caps, and Attachments Market Study highlights, 2023

Smart Connected Insulin Pens, Caps, and Attachments Market Outlook to 2030

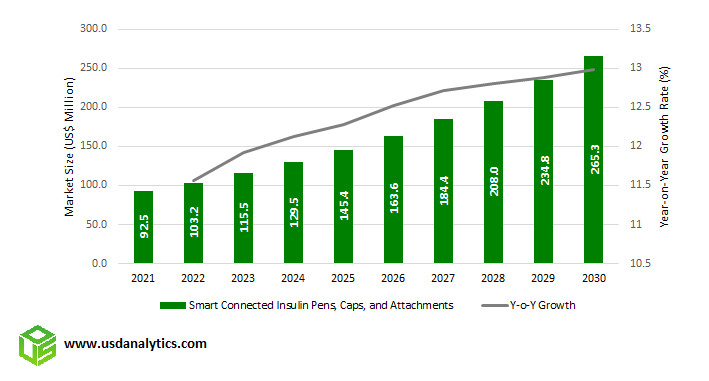

The smart connected insulin pens, caps, and attachments market is valued at $103.5 million in 2022. Driven by robust market potential, several companies are launching new products across categories. Further, increased adoption across end-users is encouraging the demand for smart connected insulin pens, caps, and attachments.

The chart below provides the market revenue forecast for Smart Connected Insulin Pens, Caps, and Attachments Market to 2030-

Smart Connected Insulin Pens, Caps, and Attachments Industry Analysis

Smart insulin pens that can inject insulin with an intuitive smartphone app to efficiently manage diabetes through proper insulin delivery are gaining rapid interest across markets. Diabetes management is a complex process and requires continuous blood glucose monitoring to ensure the condition does not interfere with the regular lives of the diabetic population. Smart insulin pens offer potential advantages over vials and syringes, as they allow for precise dosing, lower pain, improved adherence, and others to increase patient satisfaction.

Pens

Currently, there are approximately 537 million patients living with diabetes around the world, and the diabetes population is forecast to increase to 783 million in 2045. Diabetes is also reported as the seventh leading cause of death in the world. Further, the percentage of people with diabetes increases with age, which supports the need for sophisticated insulin delivery systems that are patient-friendly. In addition, 3 in 4 adults with diabetes live in low- and middle-income countries, and accordingly, launching products at low prices remains a key growth strategy for rapid expansion.

The use of vials and syringes remained the widely used way of insulin administration. Difficulty in administration, ensuring no bubbles are present in syringes, and measuring the exact volume required presents challenges for patients and caregivers. Accordingly, the shift towards insulin pens with relatively fewer efforts is gaining wide market penetration.

Over the recent past, the drive towards smart insulin pens where sensors are attached to the pens, or deployed with smart caps or entire smart pens is widely observed. Products with smart upgrades on the volume administered, available in the pen, and other information are being put forward to online portals to attract a wide range of the population. Both first-generation pens with memory and other advancements and second-generation pens that can transmit data through Bluetooth, Wi-Fi, and other networks are likely to gain robust market share over the forecast period.

The recent developments in the field of digital health solutions including technological advancements in the fields of connected devices, software, and virtual platforms are assisting in achieving glycemic control through consistent and optimized insulin.

Dose amount, dose timing, insulin quality, and other parameters are calculated and shared on online platforms to address the challenges of missed doses, mistimed doses, dosing errors, and dosing miscalculation. With automatic logging of insulin delivery data, patients can monitor if the dose has been administered or whether the wrong dose was given, and receive an alert if they forget to take an injection.

Caps

To overcome the vision and mobility challenges and to ensure adequate levels of insulin in injected based on the patient’s sugar levels, smart caps are gaining wide interest among patients and care providers. Data tracking caps, in particular, are gaining rapid interest across segments. Caps that calculate each dose based on current blood sugar level, carbohydrate levels, and settings prescribed by physicians are marketed by companies.

Attachments

SmartPilot (attachment), InsulClock, Clipsulin, EasyLog, InsulCheck, and others are widely marketed attachments for insulin pens. Compatibility to a wide range of insulin types, display of time, type, the quantity of insulin administered, reminders for dosing, assessment of food/glucose input, temperature fluctuations, long battery life, and memory, Alerts patients about missed, extra, and next doses, the elapsed time between injections, alert on successful administration, and others are among the key features marketed by companies offering these attachments.

Market Trends- Rapid growth in the digital diabetes management market supports the demand for smart insulin pens, caps, and attachments

Advancements in the digital health field are encouraging rapid growth in the digital diabetes management market. The increasing number of smartphone apps for effective diabetes management is supporting the market for digital diabetes market.

The global digital diabetes management market comprising smart glucose monitors, continuous blood glucose monitoring systems, smart insulin pens, smart insulin pumps, software apps, and others is valued at around $12.7 billion in 2021. The market witnessed a significant demand increase during the pandemic period and the trend is likely to continue through the post-pandemic period.

We expect the market for digital diabetes management market to increase from $12.7 billion in 2021 to $27 billion in 2030, at a compounded annual growth rate of 8.6%. An increasing number of product launches coupled with the advent of new-generation technologies such as IoT, connected health, artificial intelligence, and others remain the key market drivers.

Recent Developments in the industry support strong revenue growth for companies

Leading insulin manufacturers, including Eli Lilly, Digital Medics, Sanofi, Diamesco, Novo Nordisk, and others are focusing on developing indigenous models and partnering with startup companies to develop integrated smart insulin pen devices.

Medtronic’s reusable smart pen system- InPen tracks active insulin while delivering short-acting insulins. The reusable smart insulin pen uses Bluetooth technology to send dose information to a mobile app. It is used for U-100 Lilly Humalog® and Novo Nordisk NovoLog.

Novo Nordisk is planning to smarten up its disposable insulin pens with digital diabetes device maker Biocorp. The company’s NovoPen-6 & NovoPen Echo Plus is smart insulin pens that automatically record insulin dosing information about each injection.

In May 2021, Becton, Dickinson, and Company planned to spin off the company's Diabetes Care business as an independent, publicly traded company –NewCo. The company plans to invest in novel insulin delivery technologies, including type 2 patch technologies.

Further, Eli Lilly also planned to make the Tempo Pen insulin injector and Tempo Smart Button, a small device that automatically records medication usage compatible with diabetes management platforms from Dexcom, Glooko, Roche, and Mydiabby Healthcare.

Ypsomed is focusing on smart solutions including SmartPilot for YpsoMate (with advanced adherence monitoring by transforming the YpsoMate autoinjector into a fully connected smart product system), Smart UnoPen add-on (Transforms the dial-and-dose UnoPen into a fully connected system).

In 2020, Abbott and Insulet announced a Partnership to integrate next-generation glucose sensing and automated insulin delivery technologies for seamless diabetes care.

In 2019, Sanofi acquired the rights from BIOCORP to a non-exclusive distribution of Mallya from 2020. Further, BIOCORP is developing an exclusive Mallya version for SoloStar. BioCorp and Roche Diabetes Care France announced the launch of the Mallya smart insulin pen device in France in 2021, and also concluded an agreement with Novo Nordisk on the development and distribution of a Mallya smart add-on device for the Novo Nordisk FlexTouch pen. Further, BIOCORP and Merck KGaA agreed to collaborate on the development and global distribution of a specific version of Mallya for drug delivery devices.

Similarly, Sanofi and Roche agreed to co-work on the adoption of a connected add-on for disposable insulin pens.

In May 2021, Bigfoot Biomedical obtained FDA Clearance for the Bigfoot Unity™ Diabetes Management System, which features smartpen caps for insulin pens. According to the company, it integrates with Abbott’s Freestyle Libre 2 system and is also compatible with rapid- and long-acting disposable insulin pens of Eli Lilly and Company, Novo Nordisk, Sanofi, and other leading players.

In addition, insulin pen attachments include InsulClock (InsulCloud), Clipsulin (Diabnext), EasyLog (Biocorp), and InsulCheck (Innovation Zed). In 2021, Innovation Zed announced the 2022 Launch of InsulCheck DOSE Add-on Technology for Insulin Pens.

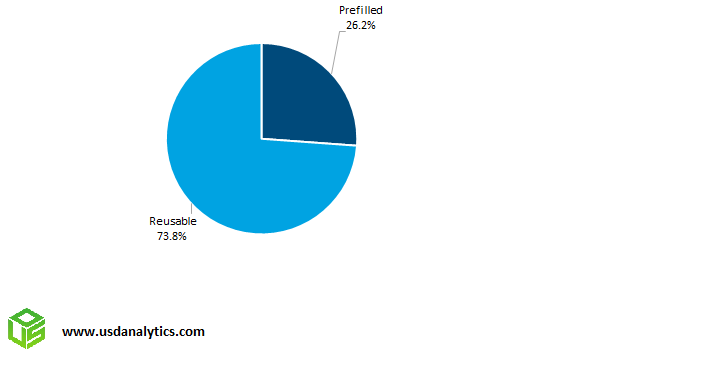

Market Share Analysis- Prefilled Smart Connected Insulin Pens, Caps, and Attachments continue to gain rapid market penetration

Pre-filled smart insulin pens are widely used among type-2 diabetes patients. Mounting smart sensor caps on top of the pen so it can record dosage data and automatically transmit it to a smartphone app.

These are preferred by the majority of patients as disposable pens are easier to handle, discreet in public use, and ensure proper dose delivery. There is no need to replace the cartridge in the prefilled pens. Prefilled disposable pens with a Bluetooth-enabled attachment to communicate with a virtual platform.

The majority of the companies offering prefilled conventional pens are converting them to smart delivery devices by integrating caps and attachments. For instance, FlexPen, which is compatible with insulin smart caps is quickly gaining market penetration with a wide dose range and small increments. Similarly, Lilly’s existing prefilled, disposable insulin pen is being integrated with Tempo Smart Button for smart pen benefits.

Smart Connected Insulin Pens, Caps, and Attachments Market Segmentation

Types

Generation

Applications

Smart Connected Insulin Pens Caps Attachments Companies Profiled in the Research Study

Rapid growth in digital diabetes management, Growth in the geriatric population volume, Focus on developing markets, Increasing Prevalence of Diabetes worldwide, Potential benefits of smart insulin pens, Recent Developments in the industry support strong revenue growth for companies

The global Smart connected insulin pens, caps, and attachments market is valued at $115.5 in 2023.

The market is likely to register 12.5% Compounded annual growth rate over the forecast period

Amidst robust growth potential, Novo Nordisk A/S, Eli Lily and Company, Sanofi SA, Ypsomed Holding AG, BigFoot, Animas Corp, Tandem Diabetes Care, Inc, Becton, Dickinson and Company, Medtronic Plc, and others are investing significantly in business expansion

Reusable is currently the largest segment type while prefilled type is poised to register the fastest growth at 13.1% CAGR