The global Synthetic dyes market demand is driven by industrial demand, regulatory influences, technological advancements, and shifting environmental and consumer preferences. Synthetic dyes are predominantly used in the textile industry, which is a major driver of their sales. According to data from the U.S. Census Bureau and Dye trade associations, the textile industry’s growth correlates with increased demand for synthetic dyes. In addition to textile industry demand, rapid growth in digital printing industry, advanced pigment launch, robust packaging demand are encouraging the market prospects. Further, rapid demand for plastics and fashion fibers is driving the market outlook. Expansion into emerging markets, particularly in Asia-Pacific and Latin America, driven by increasing industrial activities, rising consumer demand, and economic development.

Consistency and diverse colors, low cost, and no need for mordants and fixants drive the sales volume of Synthetic dyes across textile, paper, leather, and other industries. Increasing demand from the textile industry, advancements in dyeing technology, and a growing focus on high-performance dyes drive market growth.

Leading manufacturers including Huntsman Corp, Clariant, BASF SE, Kiri Industries, and others are focusing on Sustainability, Technological Advancements such as waterless dyeing processes and more efficient application methods, developing and marketing dyes that meet stricter environmental and health standards, compliance with standards set by agencies like REACH and TSCA, and others. Government regulations and industry standards play a crucial role in shaping market practices and ensuring the safety and environmental sustainability of synthetic dyes. Accordingly, manufacturers are focusing on innovation, sustainability, and compliance to maintain their competitive edge.

The fashion industry relies heavily on synthetic dyes to produce a vast array of colors and patterns. Synthetic dyes offer consistency in color quality and performance, which is essential for meeting the demands of fashion trends and seasonal collections. The World Trade Organization (WTO) reports that global textile consumption is expected to reach around 113 million metric tons by 2025, driven by growing demand in emerging markets and increasing population.

The International Trade Centre (ITC) provides data indicating that textile exports were valued at approximately USD 847 billion in 2021. Major exporters include China, India, and the European Union. China’s textile exports were valued at approximately USD 290 billion in 2022, making it the largest exporter of textiles globally, according to the General Administration of Customs of China. In addition, Synthetic dyes are widely used in home textiles, including curtains, upholstery, and carpets.

The demand for customizable and durable home textiles drives the need for synthetic dyes that offer excellent colorfastness and resistance to fading. There is also a growing market for high-performance home textiles that require specialized synthetic dyes. For instance, stain-resistant or easy-care fabrics often incorporate synthetic dyes designed to enhance functionality and longevity. In addition, technical textiles for industrial applications, such as automotive interiors, protective clothing, and geotextiles that provide specific performance characteristics, such as UV resistance or flame retardancy are gaining significant business growth. Medical textiles also present a strong demand for synthetic dyes owing to increased need for hygienic, durable, and color-stable materials drives the demand for specialized synthetic dyes.

Ecovative’s MycoDye (bio-based synthetic dyes made from mycelium fungi), RiteDye technology by ColorZen (Eliminates the need for water in the dyeing process), DyStar’s EcoProtect (Formulated with fewer hazardous substances and and better resource efficiency), SABIC’s Polycarbonate synthetic dyes that offer improved sustainability characteristics, and others present strong growth prospects for the industry.

Amidst stringent regulations such as REACH, TSCA, and others governing the industry, companies are developing synthetic dyes that are biodegradable and have a lower environmental impact. Advancing waterless dyeing techniques, which use less water or alternative methods for applying dyes, are also observed in the industry. Over the forecast period, developing new synthetic dyes with superior properties, such as enhanced colorfastness, resistance to fading, and better performance under various conditions, opens opportunities for specialized applications and premium markets. Smart dyes, digital dyeing process, personalized and customized products, expanding local production facilities, and others are widely observed.

Synthetic Dyes Market Share Insights

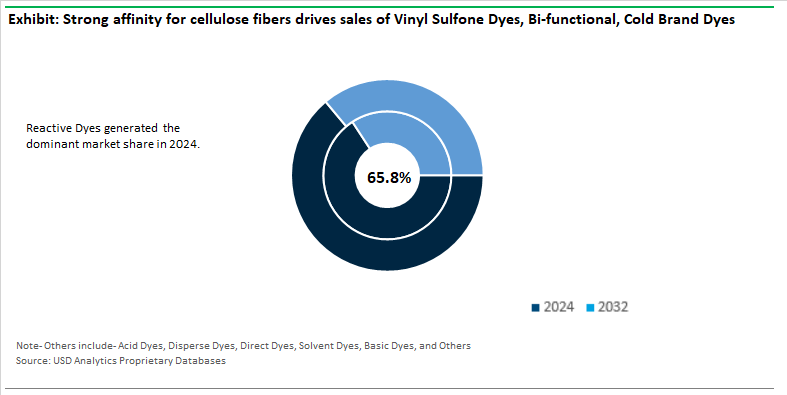

The reactive dyes segment represents the largest market share of 65.8% within the Synthetic Dyes industry, followed by 23% market share held by disperse dyes. The reactive dyes are primarily used in the textile industry due to their strong affinity for cellulose fibers, such as cotton and viscose, allowing for vibrant and durable coloration. Different types of reactive dyes including Vinyl Sulfone Dyes (stability and superior fastness properties for use in the dyeing of cotton and viscose fabrics), Bi-functional (combine two reactive groups, offering improved dyeing efficiency and color fastness), Cold Brand Dyes (preferred for delicate fabrics and eco-friendly processes) encourage their use across textile and other applications.

Driven by robust market potential, large capital-intensive companies including Huntsman Corporation (AVITERA SE), Clariant AG (Remazol), Dystar Group (Levafix and Remazol brands) continue to invest in R&D. To ensure regulatory compliance, major companies are focusing sustainable dyeing solutions. For instance, The Ministry of Textiles, Government of India, has been promoting the use of eco-friendly dyes through various initiatives, such as the Integrated Processing Development Scheme (IPDS), which provides financial assistance to textile units for adopting environmentally friendly dyeing technologies.

The paints and coatings industry is the largest application in the industry, with around 44.2% market share in 2024, driven by its extensive applications across construction, automotive, aerospace, and industrial sectors. The rapid growth of infrastructure projects, particularly in emerging economies, drives the demand for paints and coatings. Further, the growing emphasis on developing eco-friendly coatings with low VOC (volatile organic compound) content.

Companies are investing in water-based, powder, and bio-based coatings to meet regulatory requirements and consumer preferences. Companies like PPG and AkzoNobel have introduced advanced digital tools for color matching and formulation, improving efficiency and customer satisfaction. Recent innovations include bio-based and waterborne coatings that reduce environmental impact. PPG's "SIGMA Air Pure" and AkzoNobel's "Plant-based Dulux" exemplify this trend. Further, Sherwin-Williams' acquisition of Valspar and PPG's expansion into emerging markets demonstrate the industry's consolidation and global reach.

The liquid form of synthetic dyes holds around 62.3% of the market share within the synthetic dyes industry, driven by ease of use, better compatibility with automated processes, and improved handling and storage characteristics. Liquid dyes are especially preferred in large-scale industrial applications, where consistent quality, rapid mixing, and precise dosing are critical. Liquid dyes are more straightforward to apply than powder dyes, particularly in industries where automated dyeing and coloring processes are standard.

The ability to mix liquid dyes directly into solutions without the need for pre-dissolution simplifies the dyeing process, making it more efficient. In addition, Liquid dyes offer better consistency in color output, which is crucial in industries like textiles, printing inks, and plastics. Liquid dyes are also less prone to dust generation, which can be a significant issue with powder dyes. Additionally, liquid dyes are often easier to clean up, minimizing environmental impact in case of spills.

Huntsman has expanded its liquid dye offerings with the AVITERA® SE range, known for its low environmental impact. These dyes are engineered to reduce water and energy consumption during textile processing, aligning with the growing demand for sustainable practices in the industry. Similarly, DyStar has introduced the Sera® range of liquid dyes, specifically designed for high-performance textile applications.

These dyes offer excellent fastness properties, vibrant colors, and are suitable for a wide range of fabrics, including cotton, polyester, and blends. Clariant’s Novacron® liquid dyes are designed for superior performance in both reactive and disperse dyeing processes. The range includes products that provide deep, rich colors with high wet fastness, catering to the needs of the apparel and home textiles markets.

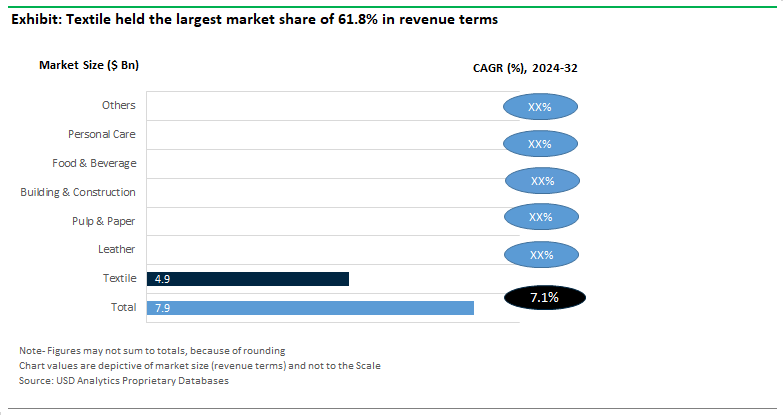

Synthetic dyes are widely used across Textile, Leather, Pulp & Paper, Building & Construction, Food & Beverage, Personal Care, and Other industries. Of these, Textile segment held the dominant market share of 61.8% market share, accounting for $4.9 Billion revenue, driven by the textile sector's vast and diverse requirements for dyes in fabric coloring, printing, and finishing processes. The textile industry utilizes a wide range of fabrics, including cotton, polyester, nylon, and blends, each requiring specific dye formulations.

Synthetic dyes, especially reactive, disperse, and direct dyes, are crucial in achieving the desired colors and fastness properties in these fabrics. Leading textile-producing countries, such as China, India, Bangladesh, and Vietnam, rely heavily on synthetic dyes to meet the demands of both domestic and international markets.

The ability to produce vibrant, long-lasting colors in a cost-effective manner makes synthetic dyes indispensable to apparel manufacturers. Beyond apparel, synthetic dyes are widely used in home textiles (such as bed linens, curtains, and carpets) and technical textiles (such as automotive interiors and industrial fabrics), further contributing to the textile industry’s dominance in dye consumption. The European Apparel and Textile Confederation (EURATEX) highlights that the EU's textile and clothing industry is a leading sector in the region, with an annual turnover exceeding €162 billion.

The Asia-Pacific region is poised to be the largest and fastest-growing market for synthetic dyes, driven by rapid industrialization, the expansion of the textile industry, and increasing demand from various end-user sectors. The region's 7.8% CAGR growth is supported by key countries like China, India, Bangladesh, and Vietnam, which are major players in the global textile and dyeing industries. According to the National Bureau of Statistics of China, the country produced approximately 55.8 million tons of textiles in 2022.

Similarly, The Ministry of Textiles, Government of India, reported that India's textile industry accounts for about 14% of the country's total industrial production and employs over 45 million people. The Bangladesh Garment Manufacturers and Exporters Association (BGMEA) reports that the country's textile industry, particularly in ready-made garments, is a key driver of its economy, with exports reaching $42.6 billion in 2022.

Further, governments and industry associations are promoting circular economy models in the textile sector, encouraging recycling and reuse of fabrics. In particular, Vietnam’s textile and garment industry is expanding rapidly, with significant investments in modernizing dyeing facilities and adopting environmentally friendly dyeing practices. The Vietnam Textile and Apparel Association (VITAS) reports that the country’s exports of dyed textiles and garments are on the rise, driven by favorable trade agreements and a growing reputation as a reliable manufacturing hub.

The global synthetic dyes market is a highly competitive and fragmented industry, with various segments like reactive dyes, disperse dyes, acid dyes, and direct dyes.

Archroma Management LLC, Aries Dye Chem Inc, Atul Ltd, BASF SE, Bodal Chemicals Ltd, Clariant International Ltd, Colorantes Industriales S.A. de C.V., Cromatos S.A, DuPont de Nemours Inc, DyStar Group, Dystar Singapore Pte Ltd, Everlight Chemical Industrial Corp, Haining Tongyuan Chemical Factory, Heubach GmbH, Huntsman Corp, Kemira Oyj, Kiri Industries Ltd, Lanxess AG, Loxim Industries Ltd, Milliken & Company, OCI Company Ltd, Organic Dyes and Pigments LLC, Ravi Dyeware Co. Pvt. Ltd, Stahl Holdings BV, Steiner Group Ltd, Sumitomo Chemical Co. Ltd, Synthesia A.S., Trumpler GmbH & Co. KG, Vedant Textile Pigments Ltd, Waterside colours Ltd, Zhejiang Longsheng Group Co. Ltd.

The synthetic dyes market ecosystem is a complex network of interconnected entities, including raw material suppliers, manufacturers, distributors, end-users, and regulatory bodies. This ecosystem influences the production, distribution, and consumption of synthetic dyes, driving industry trends and market dynamics.

|

Parameter |

Details |

|

Market Size (2024) |

$7.9 Billion |

|

Market Size (2032) |

$13.7 Billion |

|

Market Growth Rate |

7.1% |

|

Largest Segment- Product |

Reactive Dyes (65.8% Market Share) |

|

Largest Segment- Form |

Liquid Form (62.3% Market Share) |

|

Fastest Growing Market- Region |

Asia Pacific (7.8% CAGR growth) |

|

Largest End-User Industry |

Paints and Coatings (44.2% market share) |

|

Segments |

Products, Technologies, Forms, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Archroma Management LLC, Aries Dye Chem Inc, Atul Ltd, BASF SE, Bodal Chemicals Ltd, Clariant International Ltd, Colorantes Industriales S.A. de C.V., Cromatos S.A, DuPont de Nemours Inc, DyStar Group, Dystar Singapore Pte Ltd, Everlight Chemical Industrial Corp, Haining Tongyuan Chemical Factory, Heubach GmbH, Huntsman Corp, Kemira Oyj, Kiri Industries Ltd, Lanxess AG, Loxim Industries Ltd, Milliken & Company, OCI Company Ltd, Organic Dyes and Pigments LLC, Ravi Dyeware Co. Pvt. Ltd, Stahl Holdings BV, Steiner Group Ltd, Sumitomo Chemical Co. Ltd, Synthesia A.S., Trumpler GmbH & Co. KG, Vedant Textile Pigments Ltd, Waterside colours Ltd, Zhejiang Longsheng Group Co. Ltd |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Types

Applications

Forms

Structures

End-Users

Countries Analyzed

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Synthetic Dyes Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Synthetic Dyes Market Size by Segments, 2018- 2023

Key Statistics, 2024

Synthetic Dyes Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Synthetic Dyes Types, 2018-2023

Synthetic Dyes Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Synthetic Dyes Applications, 2018-2023

8. Synthetic Dyes Market Size Outlook by Segments, 2024- 2032

Synthetic Dyes Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Synthetic Dyes Types, 2024-2032

Synthetic Dyes Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Synthetic Dyes Applications, 2024-2032

Synthetic Dyes Market Size Outlook by Form, USD Million, 2024-2032

Growth Comparison (y-o-y) across Synthetic Dyes Forms, 2024-2032

Synthetic Dyes Market Size Outlook by Structure, USD Million, 2024-2032

Growth Comparison (y-o-y) across Synthetic Dyes Structures, 2024-2032

Synthetic Dyes Market Size Outlook by End-Users, USD Million, 2024-2032

Growth Comparison (y-o-y) across Synthetic Dyes End-Users, 2024-2032

9. Synthetic Dyes Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Synthetic Dyes Market Size Outlook by Type, 2021- 2032

United States Synthetic Dyes Market Size Outlook by Application, 2021- 2032

United States Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

11. Canada Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Canada Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Canada Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

12. Mexico Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Mexico Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Mexico Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

13. Germany Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Germany Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Germany Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

14. France Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

France Synthetic Dyes Market Size Outlook by Type, 2021- 2032

France Synthetic Dyes Market Size Outlook by Application, 2021- 2032

France Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Synthetic Dyes Market Size Outlook by Type, 2021- 2032

United Kingdom Synthetic Dyes Market Size Outlook by Application, 2021- 2032

United Kingdom Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

10. Spain Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Spain Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Spain Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

16. Italy Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Italy Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Italy Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

17. Benelux Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Benelux Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Benelux Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

18. Nordic Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Nordic Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Nordic Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Rest of Europe Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Rest of Europe Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

20. China Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

China Synthetic Dyes Market Size Outlook by Type, 2021- 2032

China Synthetic Dyes Market Size Outlook by Application, 2021- 2032

China Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

21. India Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

India Synthetic Dyes Market Size Outlook by Type, 2021- 2032

India Synthetic Dyes Market Size Outlook by Application, 2021- 2032

India Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

22. Japan Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Japan Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Japan Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

23. South Korea Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Synthetic Dyes Market Size Outlook by Type, 2021- 2032

South Korea Synthetic Dyes Market Size Outlook by Application, 2021- 2032

South Korea Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

24. Australia Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Australia Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Australia Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

25. South East Asia Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Synthetic Dyes Market Size Outlook by Type, 2021- 2032

South East Asia Synthetic Dyes Market Size Outlook by Application, 2021- 2032

South East Asia Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

27. Brazil Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Brazil Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Brazil Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

28. Argentina Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Argentina Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Argentina Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Rest of South America Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Rest of South America Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Synthetic Dyes Market Size Outlook by Type, 2021- 2032

United Arab Emirates Synthetic Dyes Market Size Outlook by Application, 2021- 2032

United Arab Emirates Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Saudi Arabia Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Saudi Arabia Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Rest of Middle East Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Rest of Middle East Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

33. South Africa Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Synthetic Dyes Market Size Outlook by Type, 2021- 2032

South Africa Synthetic Dyes Market Size Outlook by Application, 2021- 2032

South Africa Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Synthetic Dyes Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Synthetic Dyes Market Size Outlook by Type, 2021- 2032

Rest of Africa Synthetic Dyes Market Size Outlook by Application, 2021- 2032

Rest of Africa Synthetic Dyes Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Types

Applications

Forms

Structures

End-Users

Countries Analyzed

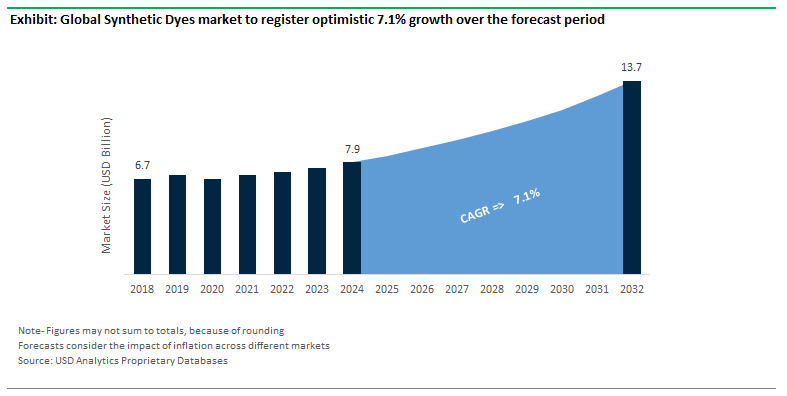

Global Synthetic Dyes Market Size is valued at $7.9 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.1% to reach $13.7 Billion by 2032.

Reactive Dyes (65.8% Market Share), Liquid Form (62.3% Market Share), Paints and Coatings (44.2% market share)

Archroma Management LLC, Aries Dye Chem Inc, Atul Ltd, BASF SE, Bodal Chemicals Ltd, Clariant International Ltd, Colorantes Industriales S.A. de C.V., Cromatos S.A, DuPont de Nemours Inc, DyStar Group, Dystar Singapore Pte Ltd, Everlight Chemical Industrial Corp, Haining Tongyuan Chemical Factory, Heubach GmbH, Huntsman Corp, Kemira Oyj, Kiri Industries Ltd, Lanxess AG, Loxim Industries Ltd, Milliken & Company, OCI Company Ltd, Organic Dyes and Pigments LLC, Ravi Dyeware Co. Pvt. Ltd, Stahl Holdings BV, Steiner Group Ltd, Sumitomo Chemical Co. Ltd, Synthesia A.S., Trumpler GmbH & Co. KG, Vedant Textile Pigments Ltd, Waterside colours Ltd, Zhejiang Longsheng Group Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume

Asia Pacific (7.8% CAGR growth)