Oil Country Tubular Goods (OCTG) markets are offering huge growth potential for companies in the current high oil price environment. The industry is characterized by strong demand for both seamless and welded OCTG products. The Oil Country Tubular Goods (OCTG) research study provides insights into different grades including API and Premium types and their forecasts for 2030. Leading companies offering OCTG products and their business profiles are included from 2021 to 2030. Further, the OCTG market size outlook across 25 countries worldwide is included in the industry analysis.

An increase in oil and gas upstream activity and supply constraints resulted in tight market conditions and are exerting upward pressure on the Oil Country tubular goods. Leading companies are investing in expanding their capacity of producing high-quality casing and tubing, drill pipe, premium connections, sucker rods, pipe accessories, and coiled tubing products. With drilling and completion activity will continue to trend higher in 2023, the demand for OCTG is expected to remain robust over the forecast period.

Amidst strong demand growth conditions, most producers are operating at high utilization rates of their plants. With the demand trend estimated to continue in the near to medium-term future, any constraint on the supply side can result in significant price spikes. To cater to the market demand growth in the long term, several companies are emphasizing setting up new plants and expanding production capacity.

As the shortage of tubular goods results in fluctuations in the production process, leading consumers are concluding long-term supply contracts with producing companies. Producers are also likely to enter into stocking programs with primary stocking distributors. However, we anticipate the tight supply conditions to be eased over the medium-term future as new capacity comes online and OCTG supply manages to keep pace.

The global OCTG market is analyzed across seamless and welded types. Both seamless and welded OCTG share basic physical characteristics and are used in oil and gas drilling and well-completion activities. However, the difference is in terms of the maximum grades, and yield strengths that can be produced vary between the different types. While higher grades and heavier wall thicknesses are obtained through the seamless type of production, welded type is suitable for low-grade applications such as line pipes, API casing, and others in a cost-effective manner.

The prices for value-added OCTG continue to increase significantly across the globe, encouraging small and medium-scale companies to invest in the business segment.

To compete in the regional markets, aggressive marketing campaigns to promote brand awareness and new product launches. Promotion through mobile apps, social media platforms, on-premise sampling, and other techniques are widely observed.

Leading companies profiled in the report include- Tenaris, TMK Group, Vallourec, Oil Country Tubular Ltd, United States Steel Corp, ArcelorMittal SA, EVRAZ, ILJIN Steel Corporation, JFE Steel Corporation, Sumitomo Corporation, Ipsco Enterprises Inc, others.

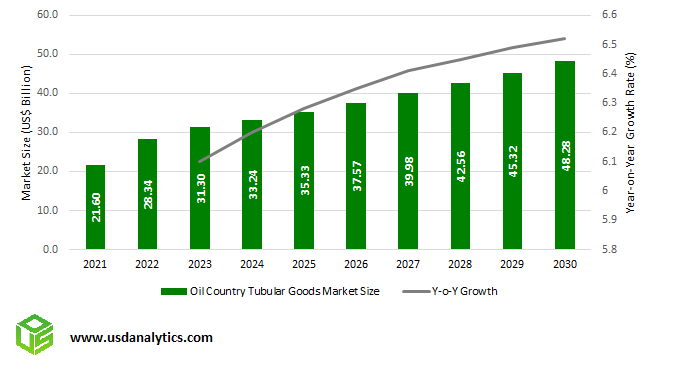

The global Oil Country Tubular Goods Market Size stood at $28.3 billion in 2022 and is poised to register 6.4% growth over the forecast period from 2023 to 2030

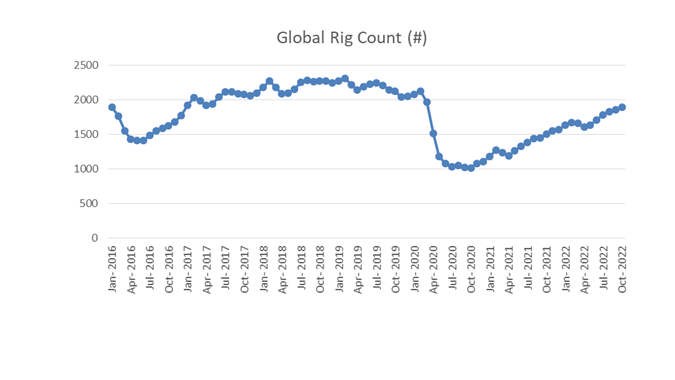

The global Oil Country Tubular Goods market is poised to record high growth over the long-term future driven by adoption across emerging applications and the introduction of innovative products for diverse customer bases. Major market trends shaping the demand outlook of the industry include the increase in Oil and Gas Exploration Activities, Increased Investment in unconventional oil and gas resources, steady growth in international oil rig count, and casings account for the dominant share in the OCTG industry.

According to Baker Hughes Corp, the global average rig count stood at 1,893 in October 2022. Comparatively, the average monthly rig count was 1,504 in October 2021 and 1,016 in October 2020. The COVID-19 pandemic had a significant negative impact on the industry. With recovering market conditions, the demand for oil and gas rigs is increasing steadily, thereby fuelling the OCTG casings, tubing, drill pipes, accessories, and other products.

The rapid surge in drilling activity in 2021 and 2022 has had a major impact on the OCTG market. An increase in steel prices resulted in significant fluctuations in the profitability of companies. Steel with corrosion-resistant alloys comprising a significant volume of molybdenum plus chromium and possibly nickel is used widely in OCTG.

The ongoing Russia-Ukraine war is likely to have a significant impact on the supply-demand balance over the medium-term future. Raw material prices witnessed an upsurge in the recent past driven by disruptions in the supply chain, material input cost increases, and increasing inflation conditions.

In addition, the US, and other markets are witnessing the foray of low-priced OCTG imports, which can pose challenges to domestic producers.

Seamless OCTG products are widely used in high-pressure applications in the oil and gas industry.

As the products have no joint in the cross-sections throughout their length, they are widely used in upstream operations, the transmission of fluids, downstream pipes for oil, gas, and petroleum products, and general plumbing applications in utility service applications.

It possesses unique features of strength and anti-bending. Accordingly, applications requiring high-pressure endurance, great strength, and uniformity of structure often opt for seamless products.

As the seamless pipe is manufactured by extruding the metal to the required length, the cost of the product is relatively higher than other types.

.png )

Types

Grades

Companies

Regions

1. Executive Summary

1.1 Introduction to Oil Country Tubular Goods Markets

1.2 Oil Country Tubular Goods Market Size Outlook, 2021- 2030

1.3 Growth Opportunities in Oil Country Tubular Goods Industry

1.4 Winning Strategies for the post-pandemic future

2. Report Guide

2.1 Market Definition and Scope

2.2 Market Segmentation

2.3 Research Methodology

2.4 Forecast Methodology

2.5 List of Abbreviations

3. Growth Opportunity Analysis

3.1 Key Oil Country Tubular Goods Market Trends

3.1.1 Increase in Oil and Gas Exploration Activities

3.1.2 Technological Advancements in the OCTG industry

3.1.3 Casings account for the dominant share of the OCTG industry

3.2 Key Oil Country Tubular Goods Market Growth Drivers

3.2.1 Increased Investment in Unconventional Oil and Gas Resources

3.2.2 Steady Growth in International Oil Rig Count

3.3 Key Oil Country Tubular Goods Market Growth Restraints

3.3.1 Environmental Issues

3.3.2 Increased raw material costs

3.3.3 Growing penetration of lower-priced imports

4 Oil Country Tubular Goods Market Outlook – Scenario Analysis

4.1 Low Growth Case Scenario Forecasts: Oil Country Tubular Goods Market Size Outlook to 2030

4.2 Reference Growth Case Scenario Forecasts: Oil Country Tubular Goods Market Size Outlook to 2030

4.3 High Growth Case Scenario Forecasts: Oil Country Tubular Goods Market Size Outlook to 2030

5. Oil Country Tubular Goods Market Segmentation- Outlook by Type

5.1 Oil Country Tubular Goods Market Share Analysis by Type, 2023

5.2 Seamless OCTG Market Outlook to 2030

5.3 Welded OCTG Market Outlook to 2030

6. Oil Country Tubular Goods Market Segmentation- Outlook by Grade

6.1 Oil Country Tubular Goods Market Share Analysis by Grade, 2023

6.2 API Grade Oil Country Tubular Goods Market Outlook to 2030

6.3 Premium Grade Oil Country Tubular Goods Market Outlook to 2030

7. Oil Country Tubular Goods Market Segmentation- Outlook by Application

7.1 Oil Country Tubular Goods Market Share Analysis by Application, 2023

7.2 Upstream: Oil Country Tubular Goods Market Outlook to 2030

7.3 Midstream: Oil Country Tubular Goods Market Outlook to 2030

7.4 Downstream: Oil Country Tubular Goods Market Outlook to 2030

8. North America Oil Country Tubular Goods Market Outlook and Opportunities to 2030

8.1 Market Snapshot, 2023

8.2 North America Oil Country Tubular Goods Market Growth Opportunities

8.2.1 North America Oil Country Tubular Goods Market Outlook by Type, 2021 to 2030

8.2.2 North America Oil Country Tubular Goods Market Outlook by Application, 2021 to 2030

8.2.3 North America Oil Country Tubular Goods Market Outlook by Country, 2021 to 2030

8.3 United States Oil Country Tubular Goods Market Outlook, 2021 to 2030

8.4 Canada Oil Country Tubular Goods Market Outlook, 2021 to 2030

8.5 Mexico Oil Country Tubular Goods Market Outlook, 2021 to 2030

9. Europe Oil Country Tubular Goods Market Outlook and Opportunities to 2030

9.1 Market Snapshot, 2023

9.2 Europe Oil Country Tubular Goods Market Growth Opportunities

9.2.1 Europe Oil Country Tubular Goods Market Outlook by Type, 2021 to 2030

9.2.2 Europe Oil Country Tubular Goods Market Outlook by Application, 2021 to 2030

9.2.3 Europe Oil Country Tubular Goods Market Outlook by Country, 2021 to 2030

9.3 Germany Oil Country Tubular Goods Market Outlook, 2021 to 2030

9.4 France Oil Country Tubular Goods Market Outlook, 2021 to 2030

9.5 United Kingdom Oil Country Tubular Goods Market Outlook, 2021 to 2030

9.6 Spain Oil Country Tubular Goods Market Outlook, 2021 to 2030

9.7 Italy Oil Country Tubular Goods Market Outlook, 2021 to 2030

9.8 Other Europe Oil Country Tubular Goods Market Outlook, 2021 to 2030

10. Asia Pacific Oil Country Tubular Goods Market Outlook and Opportunities to 2030

10.1 Market Snapshot, 2023

10.2 Asia Pacific Oil Country Tubular Goods Market Growth Opportunities

10.2.1 Asia Pacific Oil Country Tubular Goods Market Outlook by Type, 2021 to 2030

10.2.2 Asia Pacific Oil Country Tubular Goods Market Outlook by Application, 2021 to 2030

10.2.3 Asia Pacific Oil Country Tubular Goods Market Outlook by Country, 2021 to 2030

10.3 China Oil Country Tubular Goods Market Outlook, 2021 to 2030

10.4 Japan Oil Country Tubular Goods Market Outlook, 2021 to 2030

10.5 India Oil Country Tubular Goods Market Outlook, 2021 to 2030

10.6 South Korea Oil Country Tubular Goods Market Outlook, 2021 to 2030

10.7 Indonesia Oil Country Tubular Goods Market Outlook, 2021 to 2030

10.8 Other Asia Pacific Oil Country Tubular Goods Market Outlook, 2021 to 2030

11. South and Central America Oil Country Tubular Goods Market Outlook and Opportunities to 2030

11.1 Market Snapshot, 2023

11.2 South and Central America Oil Country Tubular Goods Market Growth Opportunities

11.2.1 South and Central America Oil Country Tubular Goods Market Outlook by Type, 2021 to 2030

11.2.2 South and Central America Oil Country Tubular Goods Market Outlook by Application, 2021 to 2030

11.2.3 South and Central America Oil Country Tubular Goods Market Outlook by Country, 2021 to 2030

11.3 Brazil Oil Country Tubular Goods Market Outlook, 2021 to 2030

11.4 Argentina Oil Country Tubular Goods Market Outlook, 2021 to 2030

11.5 Other Latin America Oil Country Tubular Goods Market Outlook, 2021 to 2030

12. Middle East and Africa Oil Country Tubular Goods Market Outlook and Opportunities to 2030

12.1 Market Snapshot, 2023

12.2 Middle East and Africa Oil Country Tubular Goods Market Growth Opportunities

12.2.1 Middle East and Africa Oil Country Tubular Goods Market Outlook by Type, 2021 to 2030

12.2.2 Middle East and Africa Oil Country Tubular Goods Market Outlook by Application, 2021 to 2030

12.2.3 Middle East and Africa Oil Country Tubular Goods Market Outlook by Country, 2021 to 2030

12.3 Saudi Arabia Oil Country Tubular Goods Market Outlook, 2021 to 2030

12.4 United Arab Emirates (the UAE) Oil Country Tubular Goods Market Outlook, 2021 to 2030

12.5 Other Middle East Oil Country Tubular Goods Market Outlook, 2021 to 2030

12.6 Egypt Oil Country Tubular Goods Market Outlook, 2021 to 2030

12.7 South Africa Oil Country Tubular Goods Market Outlook, 2021 to 2030

12.8 Other Africa Oil Country Tubular Goods Market Outlook, 2021 to 2030

13. Profiles of major world Oil Country Tubular Goods Companies

13.1 Tenaris

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

13.2 TMK Group

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

13.3 Vallourec

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

13.4 Oil Country Tubular Ltd

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

13.5 United States Steel Corp

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

13.6 ArcelorMittal SA

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

13.7 EVRAZ

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

13.8 ILJIN Steel Corporation

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

- Financial Profile

13.9 JFE Steel Corporation

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

- Financial Profile

13.10 Sumitomo Corporation

- Key Statistics

- Business Operations

- Products and Services Offered

- SWOT Analysis

- Financial Profile

- Financial Profile

14. Appendix

14.1 Publisher’s Expertise

14.2 List of Tables and Charts

14.3 List of Exhibits

14.4 Legal Disclaimer

An increase in Oil and Gas Exploration Activities, Increased Investment in Unconventional Oil and Gas Resources, technological advancements, Steady Growth in International Oil Rig Count, and an optimistic oil and gas market outlook are set to shape the market outlook.

The global Oil Country Tubular Goods Market Size stood at $28.3 billion in 2022

The global Oil Country Tubular Goods Market Size is poised to register 6.4% growth over the forecast period from 2023 to 2030

Tenaris, TMK, Vallourec, Oil Country Tubular Ltd, United States Steel Corp, ArcelorMittal SA, EVRAZ, ILJIN Steel Corporation, JFE Steel Corporation, Sumitomo Corporation, and Ipsco Enterprises Inc

Casings account for the dominant share in the OCTG industry. Driven by technological advancements, the segment is poised to register robust market growth over the forecast period.